DEF 14A: Definitive proxy statements

Published on August 18, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

|

Filed by the Registrant x

|

||

|

Filed by a Party other than the Registrant ¨

|

||

|

Check the appropriate box:

|

||

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

x

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

Marathon Patent Group, Inc.

|

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

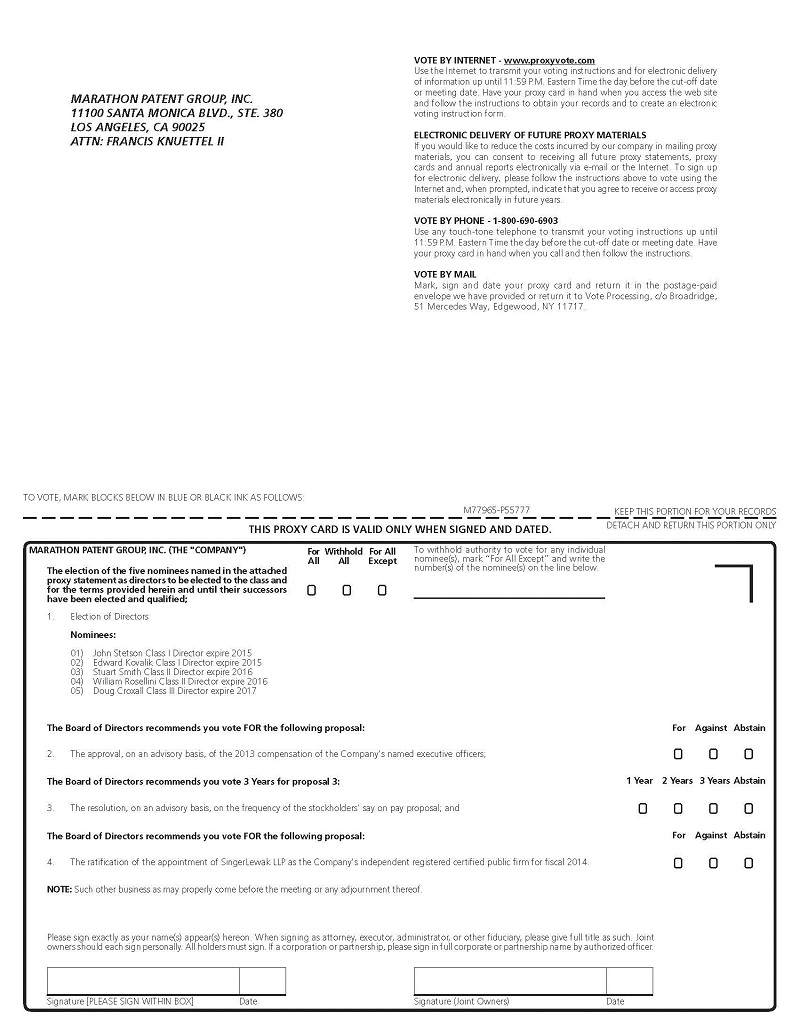

The 2014 annual meeting of stockholders of Marathon Patent Group, Inc. (the “Company”) will be held at 11111 Santa Monica Blvd., Suite 210, Los Angeles, CA 90025, on Tuesday, September 16, 2014, beginning at 2:00 P.M. local time. At the meeting, the holders of the Company’s outstanding common stock will act on the following matters:

|

(1)

|

The election of the five nominees named in the attached proxy statement as directors to be elected to the class and for the terms provided herein and until their successors have been elected and qualified;

|

|

(2)

|

The approval, on an advisory basis, of the 2013 compensation of the Company’s named executive officers;

|

|

(3)

|

The resolution, on an advisory basis, on the frequency of the stockholders’ say on pay proposal;

|

|

(4)

|

The ratification of the appointment of SingerLewak LLP as the Company’s independent registered certified public firm for fiscal 2014; and

|

|

(5)

|

The transaction of any other business as may properly come before the meeting or any adjournment or postponement thereof.

|

Stockholders of record at the close of business on August 15, 2014 are entitled to notice of and to vote at the annual meeting and any postponements or adjournments thereof.

It is hoped you will be able to attend the meeting, but in any event, please vote according to the instructions on the enclosed proxy as promptly as possible. If you are able to be present at the meeting, you may revoke your proxy and vote in person.

|

By Order of the Board of Directors,

|

|

|

/s/ Doug Croxall

|

|

|

Doug Croxall

|

|

|

Chief Executive Officer and Chairman

|

Dated: August 18, 2014

TABLE OF CONTENTS

|

1

|

|

|

4

|

|

|

8

|

|

|

10

|

|

|

14

|

|

|

15

|

|

|

20

|

|

|

23

|

|

| 24 | |

|

25

|

|

|

27

|

|

|

29

|

|

|

29

|

Marathon Patent Group, Inc.

11111 Santa Monica Blvd., Suite 210

Los Angeles, CA 90025

ANNUAL MEETING OF STOCKHOLDERS

To Be Held September 16, 2014

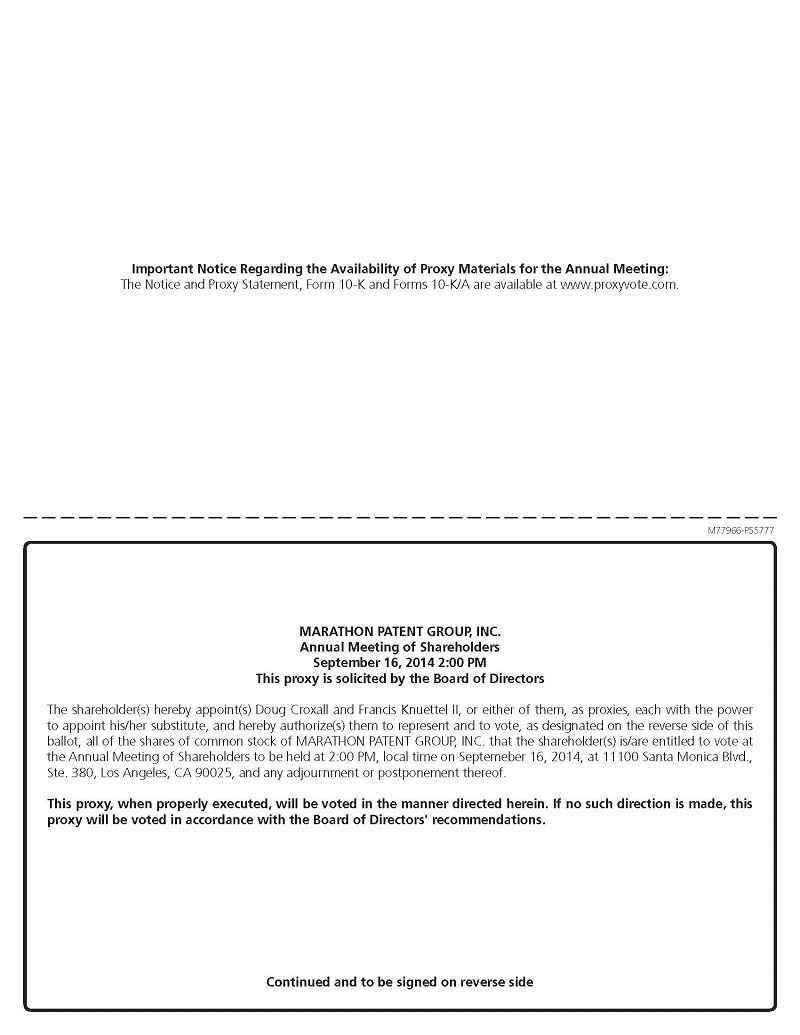

PROXY STATEMENT

The Board of Directors of Marathon Patent Group, Inc. (the “Company”) is soliciting proxies from its stockholders to be used at the annual meeting of stockholders to be held at 11111 Santa Monica Blvd., Suite 210, Los Angeles, CA 90025, on Tuesday, September 16, 2014, beginning at 2:00 P.M. local time, and at any postponements or adjournments thereof. This proxy statement contains information related to the annual meeting. This proxy statement and the accompanying form of proxy are first being sent to stockholders on or about August 18, 2014.

Why did I receive these materials?

Our Board of Directors is soliciting proxies for the 2014 annual meeting of stockholders. You are receiving a proxy statement because you owned shares of our common stock on August 15, 2014 (the “Record Date”) and that entitles you to vote at the meeting. By use of a proxy, you can vote whether or not you attend the meeting. This proxy statement describes the matters on which we would like you to vote and provides information on those matters so that you can make an informed decision.

What information is contained in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, our Board, the compensation of Directors and Executive Officers and other information that the Securities and Exchange Commission requires us to provide annually to our stockholders.

Who is entitled to vote at the meeting?

Holders of common stock as of the close of business on the Record Date will receive notice of, and be eligible to vote at, the annual meeting and at any adjournment or postponement of the annual meeting. At the close of business on the Record Date, we had outstanding and entitled to vote 5,745,409 shares of common stock.

How many votes do I have?

Each outstanding share of our common stock you owned as of the Record Date will be entitled to one vote for each matter considered at the meeting. There is no cumulative voting.

Who can attend the meeting?

Only persons with evidence of stock ownership as of the Record Date or who are invited guests of the Company may attend and be admitted to the annual meeting of the stockholders. Stockholders with evidence of stock ownership as of the record date may be accompanied by one guest. Photo identification may be required (a valid driver’s license, state identification or passport). If a stockholder’s shares are registered in the name of a broker, trust, bank or other nominee, the stockholder must bring a proxy or a letter from that broker, trust, bank or other nominee or their most recent brokerage account statement that confirms that the stockholder was a beneficial owner of shares of stock of the Company as of the Record Date. Since seating is limited, admission to the meeting will be on a first-come, first-served basis.

Cameras (including cell phones with photographic capabilities), recording devices and other electronic devices will not be permitted at the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of one-third (33.33%) of the voting power of common stock issued and outstanding on the Record Date will constitute a quorum, permitting the conduct of business at the meeting. Proxies received but marked as abstentions or broker non-votes, if any, will be included in the calculation of the number of votes considered to be present at the meeting for purposes of a quorum.

How do I vote?

If you are a holder of record (that is, your shares are registered in your own name with our transfer agent), you can vote either in person at the annual meeting or by proxy without attending the annual meeting. We urge you to vote by proxy even if you plan to attend the annual meeting so that we will know as soon as possible that enough votes will be present for us to hold the meeting.

Each stockholder receiving proxy materials by mail may vote by proxy by using the accompanying proxy card. When you return a proxy card that is properly signed and completed, the shares represented by your proxy will be voted as you specify on the proxy card.

If you hold your shares in “street name,” you must either direct the bank, broker or other record holder of your shares as to how to vote your shares, or obtain a proxy from the bank, broker or other record holder to vote at the meeting. Please refer to the voter instruction cards used by your bank, broker or other record holder for specific instructions on methods of voting, including by telephone or by using the Internet.

Your shares will be voted as you indicate. If you return the proxy card but you do not indicate your voting preferences, then your shares will not be voted with respect to any proposal. The Board and management do not intend to present any matters at this time at the annual meeting other than those outlined in the notice of the annual meeting. Should any other matter requiring a vote of stockholders arise, stockholders returning the proxy card confer upon the individuals designated as proxy’s discretionary authority to vote the shares represented by such proxy on any such other matter in accordance with their best judgment.

Can I change my vote?

Yes. If you are a stockholder of record, you may revoke or change your vote at any time before the proxy is exercised by filing a notice of revocation with our Secretary or by mailing a proxy bearing a later date or by attending the annual meeting and voting in person. For shares you hold beneficially in “street name,” you may change your vote by submitting new voting instructions to your bank, broker, other record holder of your shares or other nominee or, if you have obtained a legal proxy from your bank, broker, other record holder of your shares or other nominee giving you the right to vote your shares, by attending the meeting and voting in person. In either case, the powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

Who is soliciting this proxy?

We are soliciting this proxy on behalf of our Board of Directors and will pay all expenses associated with this solicitation. In addition to mailing these proxy materials, certain of our officers and other employees may, without compensation other than their regular compensation, solicit proxies through further mailing or personal conversations, or by telephone, facsimile or other electronic means. We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of our stock and to obtain proxies.

Will stockholders be asked to vote on any other matters?

To the knowledge of the Company and its management, stockholders will vote only on the matters described in this proxy statement. However, if any other matters properly come before the meeting, the persons named as proxies for stockholders will vote on those matters in the manner they consider appropriate.

What vote is required to approve each item?

The five nominees receiving the highest vote totals of the eligible shares of our common stock will be elected as our directors. The approval of the advisory resolution on executive compensation, the advisory resolution on the frequency of the stockholders’ say-on-pay proposal and the ratification of the appointment of SingerLewak LLP (“SingerLewak”) require the affirmative vote of the majority of the votes present, in person or by proxy, and entitled to vote at the meeting.

How are votes counted?

With regard to the election of directors, votes may be cast in favor or withheld and votes that are withheld will be excluded entirely from the vote and will have no effect. You may not cumulate your votes for the election of directors.

For the other proposals, you may vote “FOR,” “AGAINST” or “ABSTAIN.” Abstentions are considered to be present and entitled to vote at the meeting and, therefore, will have the effect of a vote against each of the proposals.

If you hold your shares in “street name,” the Company has supplied copies of its proxy materials for its 2014 annual meeting of stockholders to the broker, bank or other nominee holding your shares of record and they have the responsibility to send these proxy materials to you. Your broker, bank or other nominee that have not received voting instructions from their clients may not vote on any proposal other than the appointment of SingerLewak. These so-called “broker non-votes” will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining a quorum, but will not be considered in determining the number of votes necessary for approval of any of the proposals and will have no effect on the outcome of any of the proposals other than the approval of the amendment to our articles of incorporation to provide for a classified board of directors. Your broker, bank or other nominee is permitted to vote your shares on the appointment of SingerLewak as our independent auditor without receiving voting instructions from you.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please vote your shares applicable to each proxy card and voting instruction card that you receive.

How can I find out the Results of the Voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K, which we will file within four business days of the meeting.

Do I Have Dissenters’ Rights of Appraisal?

Under the Nevada Revised Statues and our charter documents, holders of our common stock will not be entitled to statutory rights of appraisal, commonly referred to as dissenters’ rights or appraisal rights (i.e., the right to seek a judicial determination of the “fair value” of their shares and to compel the purchase of their shares for cash in that amount) with respect to the proposals contained herein.

What Interest Do Officers and Directors Have in Matters to Be Acted Upon?

No person who has been a director or executive officer of the Company at any time since the beginning of our fiscal year, and no associate of any of the foregoing persons, has any substantial interest, direct or indirect, in any matter to be acted upon, other than Proposal 1, the election to our board of the five nominees set forth herein and Proposals 2 and 3, to the extent such proposals are on a non-binding advisory basis.

The following table sets forth certain information regarding beneficial ownership of our common stock as of July 30, 2014: (i) by each of our directors, (ii) by each of the Named Executive Officers, (iii) by all of our executive officers and directors as a group, and (iv) by each person or entity known by us to beneficially own more than five percent (5%) of any class of our outstanding shares. The percentage ownership of each beneficial owner is calculated after giving effect to the Reverse Split. As of July 30, 2014, there were 5,721,370 shares of our common stock outstanding, after giving effect to the Reverse Split.

Amount and Nature of Beneficial Ownership (1)

|

Name and Address of Beneficial Owner

|

Common

Stock

|

Preferred

|

Options

|

Warrants

|

Total

|

Percentage

of

Common

Stock (%)

|

|||||||||||||

|

Officers and Directors

|

|||||||||||||||||||

|

Doug Croxall (Chairman and CEO)

|

307,692

|

|

278,830

|

(3)

|

0

|

586,522

|

9.78

|

% | |||||||||||

|

John Stetson (EVP, Secretary and Director)

|

180,824

|

(4)

|

30,769

|

12,820

|

(5)

|

10,893

|

(6)

|

235,306

|

4.07

|

% | |||||||||

|

Francis Knuettel II (CFO)

|

0

|

16,111

|

(17)

|

0

|

16,111

|

*

|

|||||||||||||

|

James Crawford (COO)

|

0

|

24,030

|

(7)

|

0

|

24,030

|

*

|

|||||||||||||

|

Stuart Smith (Director)

|

105,770

|

5,000

|

0

|

25,289

|

(8)

|

136,059

|

2.37

|

% | |||||||||||

|

William Rosellini (Director)

|

0

|

9,764

|

(10)

|

0

|

9,764

|

*

|

|||||||||||||

|

Edward Kovalik (Director)

|

0

|

4,998

|

(21) |

0

|

4,998

|

*

|

|||||||||||||

|

All Directors and Executive Officers

( seven persons )

|

594,286

|

35,769

|

346,554

|

36,182

|

1,012,791

|

16.05

|

% | ||||||||||||

|

Persons owning more than 5% of voting securities

|

|||||||||||||||||||

|

Erich and Audrey Spangenberg (19)

|

813,462

|

(12)

|

0

|

0

|

24,039

|

837,501

|

14. 58

|

% | |||||||||||

|

Jeff Feinberg

|

116,102

|

270,366

|

0

|

185,096

|

(11)

|

571,564

|

9.99

|

% | |||||||||||

|

Barry Honig

|

393,156

|

(15)

|

102,482

|

0

|

75,926

|

(16)

|

571,564

|

9.99

|

% | ||||||||||

* Less than 1%

(1) Amounts set forth in the table and footnotes gives effect to the Reverse Split that we effectuated on July 18, 2013. In determining beneficial ownership of our common stock as of a given date, the number of shares shown includes shares of common stock which may be acquired on exercise of warrants or options or conversion of convertible securities within 60 days of that date. In determining the percent of common stock owned by a person or entity on July 30, 2014, (a) the numerator is the number of shares of the class beneficially owned by such person or entity, including shares which may be acquired within 60 days on exercise of warrants or options and conversion of convertible securities, and (b) the denominator is the sum of (i) the total shares of common stock outstanding on July 30, 2014 (5,721,370), and (ii) the total number of shares that the beneficial owner may acquire upon conversion of the preferred and on exercise of the warrants and options, subject to limitations on conversion and exercise as more fully described in note 10 below. Unless otherwise stated, each beneficial owner has sole power to vote and dispose of its shares.

(2) Held by LVL Patent Group LLC, over which Mr. Croxall holds voting and dispositive power.

(3) Represents (i) options to purchase 141,020 shares of common stock at an exercise price of $6.50 per share, (ii) options to purchase 96,150 shares of common stock at an exercise price of $5.265 per share and (iii) options to purchase 41,660 shares of common stock at an exercise price of $5.93 per share and excludes (i) options to purchase 12,826 shares of common stock at an exercise price of $6.50 per share, (ii) options to purchase 57,696 shares of common stock at an exercise price of $5.265 per share and (iii) options to purchase 58,340 shares of common stock at an exercise price of $5.93 per share that are not exercisable within 60 days of July 30, 2014.

(4) Represents 121,786 shares held by Mr. Stetson individually, 5,769 shares held by HS Contrarian Investments LLC and 53,269 shares held by Stetson Capital Investments, Inc. Mr. Stetson is the President of Stetson Capital Investments, Inc. and the manager of HS Contrarian Investments LLC and in such capacities is deemed to have voting and dispositive power over shares held by such entities.

(5) Represents options to purchase 12,820 shares of common stock at an exercise price of $6.50 per share and excludes options to purchase 25,642 shares of common stock at an exercise price of $6.50 per share that do not vest and are not exercisable within 60 days of July 30, 2014.

(6) Represents (i) a warrant to purchase 3,201 shares of common stock at an exercise price of $7.80 per share and (ii) a warrant to purchase 7,692 shares of common stock at an exercise price of $7.50 per share.

(7) Represents options to purchase 24,030 shares of common stock at an exercise price of $4.94 per share and excludes options to purchase 14,432 shares of common stock that do not vest and are not exercisable within 60 days of July 30, 2014.

(8) Represents (i) a warrant to purchase 14,423 shares of common stock at an exercise price of $6.50 per share and (ii) a warrant to purchase 5,769 shares of common stock held by Stetson Capital Investments, Inc. and (iii) a warrant to purchase 1,923 shares of common stock held by Stetson Capital Investments, Inc. Retirement Plan. John Stetson is the President of Stetson Capital Investments, Inc. and the trustee of Stetson Capital Investments, Inc. Retirement Plan and is deemed to hold voting and dispositive power of the shares held by such entities.

(9) Represents 5,000 shares of common stock underlying Series A Preferred Stock.

(10) Represents (i) options to purchase 2,564 shares of common stock at an exercise price of $6.50 per share and (ii) options to purchase 7,200 shares of common stock at an exercise price of $5.265 per share and excludes (i) options to purchase 5,128 shares of common stock at an exercise price of $6.50 per share and (ii) options to purchase 4,338shares of common stock at an exercise price of $5.265 per share that do not vest and are not exercisable within 60 days of July 30, 2014.

(11) Represents (i) 50% of a warrant to purchase 216,346 shares of common stock at an exercise price of $6.50 per share held by The Feinberg Family Trust and (ii) a warrant to purchase 76,923 shares of common stock held by Jeffrey. Jeffrey Feinberg is one of two trustees of The Feinberg Family Trust and holds shared voting and dispositive power over shares held by The Feinberg Family Trust with his wife. Jeffrey Feinberg disclaims beneficial ownership as to 50% of such amount held by The Feinberg Family Trust due to pending divorce.

(12) Includes (i) 153,846 shares of Common Stock owned directly by Erich Spangenberg, (ii) 150,000 shares of Common Stock held directly by TT IP, LLC, of which Erich Spangenberg is the beneficial owner; (iii) 48,077 shares of Common Stock held directly by IPNav Capital, LLC (“IPNav Capital”), of which Erich Spangenberg is the beneficial owner; and (iv) 461,539 shares directly owned by TechDev, of which Audrey Spangenberg is the beneficial owner.

(13) Excludes (i) 195,500 shares of common stock issuable upon conversion of shares of Series B Convertible Preferred Stock held directly by TechDev, of which Audrey Spangenberg is the beneficial owner, and (ii) 195,500 shares of common stock issuable upon conversion of shares of Series B Convertible Preferred Stock held directly by Granicus, of which Erich Spangenberg is the beneficial owner, because pursuant to the terms of the Series B Convertible Preferred Stock, the holders cannot convert any of the Series B Convertible Preferred Stock if such holders would beneficially own, after any such conversion, more than 9.99% of the outstanding shares of common stock (the “9.99% Blocker”). The number of shares and percentage set forth in the table give effect to the 9.99% Blocker.

(14) Represents 232,204 shares of common stock held by The Feinberg Family Trust. Jeffrey Feinberg is one of two trustees of the Trust and holds shared voting and dispositive power over shares held by the Trust with his wife. Jeffrey Feinberg disclaims beneficial ownership as to 50% of such amount due to pending divorce. Excludes 100,000 shares of common stock, 50% of which shall vest on November 18, 2014 and the remaining 50% of which shall vest on November 18, 2015.

(15) Represents 90,527 shares of common stock directly, 39,700shares of common stock held by GRQ Consultants, Inc. (“GRQ”), 92,515 shares of common stock held by GRQ Consultants, Inc. 401k Plan (“GRQ 401k Plan”), 57,408 shares of common stock held by GRQ Consultants, Inc. Defined Benefit Plan (“GRQ Defined Plan”), 102,217 shares of common stock held by GRQ Consultants, Inc. Roth 401k Plan (“GRQ Roth 401k Plan”) and 10,789 shares of common stock held by Barry and Renee Honig Charitable Foundation, Inc. (“Honig Foundation”). Mr. Honig is the President of GRQ and the Honig Foundation and the trustee of GRQ 401k Plan, GRQ Defined Plan and GRQ Roth 401k Plan and is deemed to hold voting and dispositive power over shares held by such entities.

(16) Represents 9,616 shares of common stock underlying warrants with an exercise price of $6.50 per share held directly, 14,423 shares of common stock underlying warrants with an exercise price of $6.50 per share and 31,731 shares of common stock underlying warrants with an exercise price of $7.50 per share held by GRQ 401k Plan, 11,502 shares of common stock underlying warrants with an exercise price of $7.80 per share, held by GRQ Roth 401k Plan, 962 shares of common stock underlying warrants with an exercise price of $7.50 per share held by GRQ and 7,692 shares of common stock underlying warrants with an exercise price of $7.50 per share.

(17) Represents options to purchase 16,111 shares of common stock at an exercise p rice of $8.33 per share and excludes options to purchase 128,889 shares of common stock that do not vest and are not exercisable within 60 days of July 30, 2014.

(18) Represents 24,039 shares of common stock issuable upon exercise of a warrant held by IPNav Capital, of which Erich Spangenberg is the beneficial owner.

(19) Erich Spangenberg is the sole member of TT IP, LLC. Accordingly, Erich Spangenberg may be deemed to beneficially own all of the shares that are owned by TT IP, LLC. IP Navigation Group, LLC is the sole member of IPNav Capital. Erich Spangenberg is the managing member and owner of 90% of the membership interests in IP Navigation Group, LLC. Accordingly, Erich Spangenberg may be deemed to beneficially own all of the shares that are owned by IPNav Capital. Acclaim Financial Group, LLC (“AFG”) is the sole member of TechDev. Accordingly, AFG may be deemed to beneficially own all of the shares of Common Stock that are owned by TechDev. Audrey Spangenberg is the sole managing member of AFG, and accordingly may be deemed to beneficially own all of the shares that are owned by TechDev. Erich Spangenberg owns 99% of the membership interests of Granicus. Accordingly, Erich Spangenberg may be deemed to beneficially own all of the shares that are owned by Granicus.

Erich Spangenberg, the spouse of Audrey Spangenberg, may be deemed to beneficially own all of the shares of Common Stock that are owned by Audrey Spangenberg and Audrey Spangenberg may be deemed to beneficially own all of the shares of Common Stock that are owned by Erich Spangenberg.

(20) Represents (i) 23,077 shares of common stock underlying shares of Series A Preferred Stock held by Stetson Capital Investments, Inc. and (ii) 7,692 shares of common stock underlying Series A Preferred Stock held by Stetson Capital Investments, Inc. Retirement Plan. John Stetson is the President of Stetson Capital Investments, Inc. and the trustee of Stetson Capital Investments, Inc. Retirement Plan and is deemed to hold voting and dispositive power of the shares held by such entities.

(21) Represents options to purchase 4,998 shares of common stock at an exercise price of $6.59 per share and excludes options to purchase 5,002 shares of common stock that do not vest and are not exercisable within 60 days of July 30, 2014.

(22) Represents 307,692 shares of common stock underlying Series A Preferred Stock of which 37,326 shares of common stock underlying Series A Preferred Stock are excluded due to a 9.99% blocker that limits conversion in excess of 9.99% of our issued and outstanding common stock.

(23) Excludes options to purchase 100,000 shares of common stock that do not vest and are not exercisable within 60 days of July 30, 2014.

(24) Represents 3,846 shares of common stock underlying Series A Preferred Stock held by GRQ, 126,923 shares of common stock underlying Series A Preferred Stock held by GRQ 401K and 30,769 shares of common stock underlying Series A Preferred Stock held by Honig Foundation of which 59,056 shares of common stock underlying Series A Preferred Stock are excluded due to a 9.99% blocker that limits conversion in excess of 9.99% of our issued and outstanding common stock.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires our executive officers and directors and persons who own more than 10% of a registered class of our equity securities to file with the Securities and Exchange Commission initial statements of beneficial ownership, reports of changes in ownership and annual reports concerning their ownership of the our common stock and other equity securities, on Form 3, 4 and 5 respectively. Executive officers, directors and greater than 10% shareholders are required by the Securities and Exchange Commission regulations to furnish our company with copies of all Section 16(a) reports they file.

Based solely on our review of the copies of such reports received by us, and on written representations by our officers and directors regarding their compliance with the applicable reporting requirements under Section 16(a) of the Exchange Act, we believe that, with respect to the fiscal year ended December 31, 2013, our officers and directors, and all of the persons known to us to own more than 10% of our common stock, filed all required reports on a timely basis, except as follows:

|

·

|

Erich Spangenberg is late in filing a Form 4 to report 1 transaction,

|

|

·

|

James Crawford is late in filing a Form 3 and a Form 4 to report 1 transaction,

|

|

·

|

Craig Nard is late in filing a Form 4 to report 1 transaction, and

|

|

·

|

Stuart Smith is late in filing a Form 3.

|

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

The number of authorized directors as of the date of this proxy statement is five (5). All of the nominees have indicated to the Company that they will be available to continue to serve as directors. If any nominee named herein for election as a director should for any reason become unavailable to serve prior to the annual meeting, the Board may, prior to the annual meeting, (i) reduce the size of the Board to eliminate the position for which that person was nominated, (ii) nominate a new candidate in place of such person or (iii) leave the position vacant to be filled at a later time. The Board of Directors has nominated the following persons to serve in each of the following classes of directors: (i) John Stetson and Edward Kovalik for election as Class I directors, and, if elected, their initial term will expire at the 2015 annual meeting of stockholders; (ii) Stuart Smith and William Rosellini for election as Class II directors, and, if elected, their initial term will expire at the 2016 annual meeting of stockholders; and (iii) Doug Croxall for election as a Class III director, and, if elected, his initial term will expire at the 2017 annual meeting of stockholders.

Directors elected at the 2014 annual meeting will hold office until their respective successors are elected and qualified, or until their earlier death, resignation or removal. All of the nominees are currently directors of the Company. The experience, qualifications, attributes and skills that led to the conclusion that the persons should serve as a director of our Company are described below in each director nominee’s biography.

Director Nominees:

Doug Croxall - Chief Executive Officer and Chairman

Mr. Croxall, 45, has served as the Chief Executive Officer and Founder of LVL Patent Group LLC, a privately owned patent licensing company since 2009. From 2003 to 2008, Mr. Croxall served as the Chief Executive Officer and Chairman of FirePond, a software company that licensed configuration pricing and quotation software to Fortune 1000 companies. Mr. Croxall earned a Bachelor of Arts degree in Political Science from Purdue University in 1991 and a Master of Business Administration from Pepperdine University in 1995. Mr. Croxall was chosen as a director of the Company based on his knowledge of and relationships in the patent acquisition and monetization business.

John Stetson - Executive Vice President, Secretary and Director

Mr. Stetson, 29, has been Executive Vice President since December 2013. Prior to that time, Mr. Stetson was the Chief Financial Officer and Secretary of the Company since June 2012. Mr. Stetson has been the Managing Member of HS Contrarian Investments LLC since 2011 and the President of Stetson Capital Investments, Inc. since 2010. Mr. Stetson was an Investment Analyst from 2008 to 2009 for Heritage Investment Group and worked in the division of Corporate Finance of Toll Brothers from 2007 to 2008. The Board believes his knowledge of business makes him a valuable member of the Board.

Stuart Smith - Director

Stuart H. Smith, 52, is a practicing plaintiff attorney licensed in Louisiana. He is a founding partner of the New Orleans-based law firm SmithStag, LLC. Smith has practiced law for nearly 25 years, litigating against oil companies and other energy-related corporations for damages associated with radioactive oilfield waste, referred to within the oil and gas industry as technologically enhanced radioactive material (TERM). In 2001, Smith was lead counsel in an oilfield radiation case that resulted in a verdict of $1.056 billion against ExxonMobil. Smith has been interviewed and his cases have been covered by a variety of media outlets, including CNN’s Andersen Cooper 360, BBC World News, Fox News, The New York Times, The Washington Post, USA Today, Lawyers Weekly USA, The Times-Picayune, The Baton Rouge Advocate, The Hill, The Associated Press, Bloomberg, National Public Radio, Radio America, and Washington Post Radio. Mr. Smith was chosen to be a member of our Board of Directors based on knowledge of complex litigation.

Edward Kovalik - Director

Edward Kovalik, 39, is the Chief Executive Officer and Managing Partner of KLR Group, which he co-founded in the spring of 2012. KLR Group is an investment bank specializing in the Energy sector. Ed manages the firm and focuses on structuring customized financing solutions for the firm’s clients. He has over 16 years of experience in the financial services industry. Prior to founding KLR, Ed was Head of Capital Markets at Rodman & Renshaw, and headed Rodman’s Energy Investment Banking team. Prior to Rodman, from 1999 to 2002, Ed was a Vice President at Ladenburg Thalmann & Co, where he focused on private placement transactions for public companies. Ed serves as a director on the board of River Bend Oil and Gas.

William Rosellini - Director

William Rosellini, 33, is Founder and Chairman of Microtransponder Inc. and Rosellini Scientific, LLC. Mr. Rosellini previously served as the founding CEO of Microtransponder from 2006 to 2012 and Lexington Technology Group in 2012. During his tenures as CEO he has raised nearly $30M in venture funding and $10M in NIH grants. Mr. Rosellini has been named a MTBC Tech Titan and a GSEA Entrepreneur of the Year and has testified to Congress on the importance of non-dilutive funding for inventors and researchers. Mr. Rosellini holds a BA in economics from the University of Dallas, a JD from Hofstra Law, an MBA and MS of Accounting from the University of Texas, a MS of Computational Biology from Rutgers, a MS of Regulatory Science from USC and a MS of Neuroscience from University of Texas. Previously, Mr. Rosellini was a right-handed pitcher who played in Arizona Diamondbacks system. The Board has determined that Mr. Rosellini’s medical technology expertise and industry knowledge and experience will make him a valuable member of the Board.

Our Board of Directors recommends a vote FOR each of the Director nominees listed above.

Board Composition

Directors currently hold are elected to the class and for the terms as provided in Proposal No. 1 or until the earlier of their death, resignation, removal or until their successors have been duly elected and qualified. There are no family relationships among our Directors. Our bylaws provide that the number of members of our Board of Directors may be changed from time to time by resolutions adopted by the Board of Directors and/or the stockholders. Our Board of Directors currently consists of five members.

Directorships

Except as otherwise reported above, none of our directors held directorships in other reporting companies and registered investment companies at any time during the past five years.

Involvement in Certain Legal Proceedings

During the past ten years, none of our officers, directors, promoters or control persons have been involved in any legal proceedings as described in Item 401(f) of Regulation S-K.

Board Leadership Structure

Our Board does not have a policy on whether the same person should serve as both the Chief Executive Officer and Chairman of the Board or, if the roles are separate, whether the Chairman should be selected from the non-employee directors or should be an employee. Our Board believes that it should have the flexibility to periodically determine the leadership structure that it believes is best for the Company. The Board believes that its current leadership structure, with Mr. Croxall serving as both Chief Executive Officer and Board Chairman, is appropriate given the efficiencies of having the Chief Executive Officer also serve in the role of Chairman.

Board Role in Risk Oversight

Risk is inherent with every business and we face a number of risks. Management is responsible for the day-to-day management of risks we face, while our Board of Directors is responsible for overseeing our management and operations, including overseeing its risk assessment and risk management functions.

Number of Meetings of the Board of Directors and Committees

The Board held 5 meetings during 2013, the Audit Committee held 1 meeting. The Compensation Committee and the Nominating and Governance Committee were not established until 2014. Directors are expected to attend Board and Committee meetings and to spend time needed to meet as frequently as necessary to properly discharge their responsibilities. Each active director attended at least 75% of the aggregate number of meetings of the Board during 2013, except for Edward Kovalik, who was elected in 2014.

Attendance at Annual Meetings of the Stockholders

The Company has no policy requiring Directors and Director Nominees to attend its annual meeting of stockholders; however, all Directors and Director Nominees are encouraged to attend.

Director Independence

Mr. Stuart Smith, Mr. Edward Kovalik, and Mr. William Rosellini are determined to be “independent” Directors under the applicable definition of the listing standards of the NASDAQ Capital Market (“NASDAQ”).

Stockholder Communications

Stockholders may send communications to the Company’s directors as a group or individually, by writing to those individuals or the group: c/o the Chief Executive Officer c/o Marathon Patent Group, Inc., 11100 Santa Monica Blvd., Ste. 380, Los Angeles, CA 90025. The Chief Executive Officer will review all correspondence received and will forward all correspondence that is relevant to the duties and responsibilities of the Board or the business of the Company to the intended director(s). Examples of inappropriate communication include business solicitations, advertising and communication that is frivolous in nature, relates to routine business matters (such as product inquiries, complaints or suggestions), or raises grievances that are personal to the person submitting the communication. Upon request, any director may review communication that is not forwarded to the directors pursuant to this policy.

Committees of the Board of Directors

Our Board of Directors has established three standing committees: an audit committee, a nominating and corporate governance committee and a compensation committee, which are described below. Members of these committees are elected annually at the regular board meeting held in conjunction with the annual stockholders’ meeting. The charter of each committee is available on our website at www.marathonpg.com.

Audit Committee

The Audit Committee members are Mr. Stuart Smith, Mr. Edward Kovalik and Dr. William Rosellini. The Committee has authority to review our financial records, deal with our independent auditors, recommend to the Board policies with respect to financial reporting, and investigate all aspects of the our business. All three members of the Audit Committee, Mr. Smith, Mr. Kovalik and Mr. Rosellini, currently satisfy the independence requirements and other established criteria of NASDAQ.

The Audit Committee Charter is available on the Company’s website at http://www.marathonpg.com/. The Audit Committee has sole authority for the appointment, compensation and oversight of the work of our independent registered public accounting firm, and responsibility for reviewing and discussing with management and our independent registered public accounting firm our audited consolidated financial statements included in our Annual Report on Form 10-K, our interim financial statements and our earnings press releases. The Audit Committee also reviews the independence and quality control procedures of our independent registered public accounting firm, reviews management’s assessment of the effectiveness of internal controls, discusses with management the Company’s policies with respect to risk assessment and risk management and will review the adequacy of the Audit Committee charter on an annual basis.

The Board of Directors has determined that Mr. Rosellini meet the requirements of an audit committee financial expert as defined in the SEC rules.

Nominating and Governance Committee

The Nominating and Corporate Governance Committee members are Stuart Smith, William Rosellini and Edward Kovalik. The Nominating and Corporate Governance Committee has the following responsibilities: (a) setting qualification standards for director nominees; (b) identifying, considering and nominating candidates for membership on the Board; (c) developing, recommending and evaluating corporate governance standards and a code of business conduct and ethics applicable to the Company; (d) implementing and overseeing a process for evaluating the Board, Board committees (including the Committee) and overseeing the Board’s evaluation of the Chairman and Chief Executive Officer of the Company; I making recommendations regarding the structure and composition of the Board and Board committees; (f) advising the Board on corporate governance matters and any related matters required by the federal securities laws; and (g) assisting the Board in identifying individuals qualified to become Board members; recommending to the Board the director nominees for the next annual meeting of shareholders; and recommending to the Board director nominees to fill vacancies on the Board.

The Nominating and Governance Committee Charter is available on the Company’s website at http://www.marathonpg.com/. The Nominating and Governance Committee determines the qualifications, qualities, skills, and other expertise required to be a director and to develop, and recommend to the Board for its approval, criteria to be considered in selecting nominees for director (the “Director Criteria”); identifies and screens individuals qualified to become members of the Board, consistent with the Director Criteria. The Nominating and Governance Committee considers any director candidates recommended by the Company's stockholders pursuant to the procedures described in the Company's proxy statement, and any nominations of director candidates validly made by stockholders in accordance with applicable laws, rules and regulations and the provisions of the Company's charter documents. The Nominating and Governance Committee makes recommendations to the Board regarding the selection and approval of the nominees for director to be submitted to a stockholder vote at the annual meeting of stockholders, subject to approval by the Board.

Compensation Committee

The Compensation Committee oversees our executive compensation and recommends various incentives for key employees to encourage and reward increased corporate financial performance, productivity and innovation. Its members are Mr. Stuart Smith, Mr. Edward Kovalik and Mr. William Rosellini. All three members of the Compensation Committee, Mr. Smith, Mr. Kovalik and Mr. Rosellini, currently satisfy the independence requirements and other established criteria of NASDAQ.

The Compensation Committee Charter is available on the Company’s website at http://www.marathonpg.com/. The Compensation Committee is responsible for: (a) assisting our Board in fulfilling its fiduciary duties with respect to the oversight of the Company’s compensation plans, policies and programs, including assessing our overall compensation structure, reviewing all executive compensation programs, incentive compensation plans and equity-based plans, and determining executive compensation; and (b) reviewing the adequacy of the Compensation Committee charter on an annual basis. The Compensation Committee, among other things, reviews and approves the Company's goals and objectives relevant to the compensation of the Chief Executive Officer, evaluate the Chief Executive Officer's performance with respect to such goals, and set the Chief Executive Officer's compensation level based on such evaluation. The Compensation Committee also considers the Chief Executive Officer's recommendations with respect to other executive officers and evaluates the Company's performance both in terms of current achievements and significant initiatives with long-term implications. It assesses the contributions of individual executives and recommend to the Board levels of salary and incentive compensation payable to executive officers of the Company; compares compensation levels with those of other leading companies in similar or related industries; reviews financial, human resources and succession planning within the Company; recommend to the Board the establishment and administration of incentive compensation plans and programs and employee benefit plans and programs; recommends to the Board the payment of additional year-end contributions by the Company under certain of its retirement plans; grants stock incentives to key employees of the Company and administer the Company's stock incentive plans; and reviews and recommends for Board approval compensation packages for new corporate officers and termination packages for corporate officers as requested by management.

Director Compensation

The following summary compensation table sets forth information concerning compensation for services rendered in all capacities during 2013 and 2012 awarded to, earned by or paid to our directors. The value attributable to any Warrant Awards reflects the grant date fair values of stock awards calculated in accordance with FASB Accounting Standards Codification Topic 718. As described further in Note 6 – Stockholders’ Equity (Deficit) – Common Stock Warrants to our consolidated year-end financial statements, a discussion of the assumptions made in the valuation of these warrant awards.

|

Name

|

Fees earned or paid in cash

($)

|

Stock awards

($)

|

Warrant awards

($)

|

Non-equity incentive plan

compensation

($)

|

Nonqualified deferred

compensation earnings

($)

|

All other compensation

($)

|

Total

($)

|

|||||||||||||||||||||

|

Stuart Smith

2013

2012

|

-

-

|

101,250

-

|

-

124,725

|

-

-

|

-

-

|

-

-

|

101,250

124,725

|

|||||||||||||||||||||

|

Craig Nard (1)

2013

2012

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

62,863

-

|

62,863

-

|

|||||||||||||||||||||

|

William Rosellini

2013

2012

|

-

-

|

-

-

|

-

-

|

-

-

|

-

-

|

62,863

-

|

62,863

-

|

|||||||||||||||||||||

|

David Rector (2)

2013

2012

|

-

-

|

-

-

|

-

124,725

|

-

-

|

-

-

|

-

-

|

-

124,725

|

|||||||||||||||||||||

|

Joshua Bleak (3)

2013

2012

|

-

-

|

-

-

|

-

349,230

|

-

-

|

-

-

|

-

-

|

-

349,230

|

|||||||||||||||||||||

(1) Craig Nard resigned from his position as Director on April 14, 2014.

(2) David Rector resigned from his position as Director on March 8, 2013.

(3) Joshua Bleak resigned from his position as Director on March 8, 2013.

Certain information regarding our Executive Officers is provided below:

|

Name and Address

|

Age

|

Date First Elected or Appointed

|

Position(s)

|

|||

|

Doug Croxall

|

45

|

November 14, 2012

|

Chief Executive Officer and Chairman

|

|||

|

Francis Knuettel II

|

48

|

May 15, 2014

|

Chief Financial Officer

|

|||

|

John Stetson

|

29

|

June 26, 2012

|

Executive Vice President, Secretary and Director

|

|||

|

James Crawford

|

39

|

March 1, 2013

|

Chief Operating Officer

|

For information with respect to Doug Croxall and John Stetson, please see the information about the members of our Board of Directors on the preceding pages. There are no family relationships among our Directors or Executive Officers. For James Crawford and Francis Knuettel II, please see the following:

James Crawford - Chief Operating Officer

Mr. Crawford, 39, was a founding member of Kino Interactive, LLC, and of AudioEye, Inc. Mr. Crawford’s experience as an entrepreneur spans the entire life cycle of companies from start-up capital to compliance officer and director of reporting public companies. Prior to his involvement as Chief Operating Officer of Marathon, Mr. Crawford served as a director and officer of Augme Technologies, Inc. beginning March 2006, and assisted the company in maneuvering through the initial challenges of acquisitions executed by the company through 2011 that established the company as a leading mobile marketing company in the United States. Mr. Crawford is experienced in public company finance and compliance functions. He has extensive experience in the area of intellectual property creation, management and licensing. Mr. Crawford also served on the board of directors Modavox® and Augme Technologies, and as founder and managing member of Kino Digital, Kino Communications, and Kino Interactive.

Francis Knuettel II - Chief Financial Officer

Mr. Knuettel, 48, has served as the Company’s Chief Financial Officer since May 2014. From 2013 through his appointment as CFO of Marathon Patent Group, Mr. Knuettel was Managing Director and CFO for Greyhound IP LLC, an investor in patent litigation expenses for patents enforced by small firms and individual inventors. Since 2007, Mr. Knuettel has been the Managing Member of Camden Capital LLC, which is focused on the monetization of patents Mr. Knuettel acquired in 2007. From 2007 through 2013, Mr. Knuettel served as the Chief Financial Officer of IP Commerce, Inc. IP Commerce is the creator of an open commerce network, delivering on-demand access to the next generation of commerce services in the payments industry. From 2005 through 2007, Mr. Knuettel served as the CFO of InfoSearch Media, Inc., a publicly traded company, at which he managed the acquisition of numerous private companies, multiple PIPE transactions and the filing of numerous registration statements. Prior to InfoSearch, from 2000 through 2004, Mr. Knuettel was at Internet Machines Corporation, a fables semiconductor company located in Los Angeles, where he served on the Board of Directors and held several positions, including Chief Executive Officer and Chief Financial Officer. At Internet Machines, Mr. Knuettel raised almost $90 million in equity and debt and managed the sale of the business in 2004. During 1999, he was Chief Financial and Operating Officer for Viking Systems, Inc., a Boston-based producer of enterprise software systems for non-profit fundraising institutions. From 1996 through 1999, he was Director of Finance and then Vice President of Operations and Chief Financial Officer for Fightertown Entertainment, Inc. in Irvine, California. Mr. Knuettel was a member of the Board of Directors and Chairman of the Audit Committee for Firepond, Inc., a publicly traded producer of CPQ software systems. Mr. Knuettel received his BA with honors in Economics from Tufts University and holds an MBA in Finance and Entrepreneurial Management from The Wharton School at the University of Pennsylvania.

Summary Compensation Table

The following summary compensation table sets forth information concerning compensation for services rendered in all capacities during 2013 and 2012 awarded to, earned by or paid to our executive officers. The value attributable to any Option Awards and Stock Awards reflects the grant date fair values of stock awards calculated in accordance with FASB Accounting Standards Codification Topic 718. As described further in Note 6 – Stockholders’ Equity (Deficit) – Common Stock Option to our consolidated year-end financial statements, a discussion of the assumptions made in the valuation of these option awards and stock awards.

|

Name and Principal

Position

|

Year

|

Salary

|

Bonus

Awards

|

Stock

Awards

|

Other Incentive

Compensation

|

Non-Equity

Plan

Compensation

|

Nonqualified

Deferred

Earnings

|

All

Other

Compensation

|

Total

|

|||||||||||||

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

|||||||||||||||

|

Doug Croxall

CEO and Chairman

|

2013

|

363,333

|

350,000

|

-

|

902,692

|

-

|

-

|

-

|

1,616,025

|

|||||||||||||

|

2012

|

40,385

|

-

|

-

|

968,600

|

-

|

-

|

-

|

1,008,985

|

||||||||||||||

|

Francis

Knuettel II

CFO

|

2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||

|

Richard

Raisig

Former CFO (1)

|

2013

|

19,791

|

-

|

-

|

511,036

|

-

|

-

|

-

|

530,827

|

|||||||||||||

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||

|

James

Crawford

COO

|

2013

|

221,408

|

-

|

-

|

366,677

|

-

|

-

|

-

|

588,085

|

|||||||||||||

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||

|

John Stetson (2)

Executive Vice President, Secretary and Former CFO

|

2013

|

79,583

|

-

|

405,000

|

284,750

|

(5)

|

-

|

-

|

-

|

769,333

|

||||||||||||

|

2012

|

8,654

|

-

|

33,287

|

-

|

-

|

-

|

-

|

41,941

|

||||||||||||||

|

Nathaniel Bradley (3)

Former CTO

|

2013

|

148,125

|

-

|

-

|

517,200

|

-

|

-

|

-

|

665,325

|

|||||||||||||

|

2012

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||

|

Mark Groussman (4)

Former CEO

|

2013

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||

|

2012

|

44,384

|

-

|

-

|

-

|

(6)

|

-

|

-

|

-

|

44,384

|

|||||||||||||

(1) Richard Raisig resigned from his position as our Chief Financial Officer on April 25, 2014.

(2) John Stetson was appointed as President, Chief Operating Officer and a director on June 26, 2012. On November 14, 2012, John Stetson resigned as the Company’s President and Chief Operating Officer and was re-appointed as the Chief Financial Officer and Secretary on January 28, 2013. Mr. Stetson ceased to serve as Chief Financial Officer, effective December 3, 2013 and we appointed Mr. Richard Raisig as our Chief Financial Officer, effective December 3, 2013. Mr. Stetson served as our Interim Chief Financial Officer from April 25, 2014 until May 15, 2014, when we appointed Francis Knuettel II to serve as our Chief Financial Officer.

(3) Nathaniel Bradley served as the Company’s Chief Technology Officer and President of IP Services from March 1, 2013 to June 19, 2013.

(4) Mark Groussman was appointed as the Chief Executive Officer of the Company on June 11, 2012 and resigned as the Company’s Chief Executive Officer on November 14, 2012.

(5) John Stetson was awarded a ten-year option award to purchase an aggregate of 115,385 shares of the Company’s common stock (after giving effect to the Reverse Split) with an exercise price of $6.50 per share and was cancelled on November 14, 2012 upon resignation.

(6) Mark Groussman was awarded a ten-year option award to purchase an aggregate of 115,385 shares of the Company’s common stock (after giving effect to the Reverse Split) with an exercise price of $6.50 per share and was cancelled on November 14, 2012 upon resignation.

Outstanding Equity Awards at 2013 Fiscal Year-End

On August 1, 2012, our board of directors and stockholders adopted the 2012 Equity Incentive Plan, pursuant to which 769,231 shares of our common stock are reserved for issuance as awards to employees, directors, consultants, advisors and other service providers, after giving effect to the Reverse Split.

|

Option awards

|

Stock awards

|

|||||||||||||||||||

|

Name

|

Number of securities underlying unexercised options

(#) exercisable

|

Number of securities

underlying

unexercised

options

(#) unexercisable

|

Equity

incentive

plan awards: Number of

securities

underlying

unexercised

unearned

options

(#)

|

Option

exercise price

($)

|

Option expiration date

|

Number of shares or units of stock that have not vested

(#)

|

Market value of shares of units of stock that have not vested

($)

|

Equity

incentive

plan awards: Number of

unearned

shares, units or other rights that have not vested

(#)

|

Equity

incentive

plan awards: Market or payout value of

unearned

shares, units or other rights that have not vested

($)

|

|||||||||||

|

Doug Croxall

|

83,333

|

70,513

|

-

|

6.50

|

11/14/22

|

-

|

-

|

-

|

-

|

|||||||||||

|

Doug Croxall

|

38,462

|

115,385

|

-

|

5.27

|

06/11/18

|

-

|

-

|

-

|

-

|

|||||||||||

|

Doug Croxall

|

4,167

|

95,833

|

-

|

5.93

|

11/18/23

|

-

|

-

|

-

|

-

|

|||||||||||

|

Richard Raisig

|

-

|

115,000

|

-

|

5.70

|

12/03/23

|

-

|

-

|

-

|

-

|

|||||||||||

|

John Stetson

|

-

|

38,462

|

-

|

6.50

|

01/28/23

|

-

|

-

|

-

|

-

|

|||||||||||

|

(1)

|

On November 14, 2012, Mr. Croxall received an option to purchase an aggregate of 153,846 shares of Common Stock at $6.50 per share, after giving effect to the Reverse Split. The option shall become exercisable during the term of Mr. Croxall’s employment in twenty-four (24) equal monthly installments on each monthly anniversary of the date of the Mr. Croxall’s employment.

|

Agreements with Executive Officers

On November 14, 2012, we entered into an employment agreement with Doug Croxall (the “Croxall Employment Agreement”), whereby Mr. Croxall agreed to serve as our Chief Executive Officer for a period of two years, subject to renewal, in consideration for an annual salary of $350,000 and an Indemnification Agreement. Additionally, under the terms of the Croxall Employment Agreement, Mr. Croxall shall be eligible for an annual bonus if we meet certain criteria, as established by the Board of Directors, subject to standard “claw-back rights” in the event of any restatement of any prior period earnings or other results as from which any annual bonus shall have been determined. As further consideration for his services, Mr. Croxall received a ten year option award to purchase an aggregate of One Hundred Fifty Three Thousand Eight Hundred and Forty-Six (153,846) shares of our common stock with an exercise price of $6.50 per share, after giving effect to the Reverse Split, which shall vest in twenty-four (24) equal monthly installments on each monthly anniversary of the date of the Croxall Employment Agreement. On November 18, 2013, we entered into Amendment No. 1 to the Croxall Employment Agreement (“Amendment”). Pursuant to the Amendment, the term of the Croxall Agreement shall be extended to November 14, 2017 and (ii) Mr. Croxall’s annual base salary shall be increased to $480,000, subject to a 3% increase every year, commencing on November 14, 2014.

On January 28, 2013, we entered into an employment agreement with John Stetson, our Chief Financial Officer and Secretary (the “Stetson Employment Agreement”) whereby Mr. Stetson agreed to serve as our Chief Financial Officer for a period of one year, subject to renewal, in consideration for an annual salary of $75,000. Additionally, Mr. Stetson shall be eligible for an annual bonus if we meet certain criteria, as established by the Board of Directors, subject to standard “claw-back rights” in the event of any restatement of any prior period earnings or other results as from which any annual bonus shall have been determined. As further consideration for his services, Mr. Stetson received a ten year option award to purchase an aggregate of Thirty Eight Thousand Four Hundred Sixty Two (38,462) shares of our common stock with an exercise price of $6.50 per share, after giving effect to the Reverse Split, which shall vest in three (3) equal annual installments on the beginning on the first annual anniversary of the date of the Stetson Employment Agreement, provided Mr. Stetson is still employed by us. In the event of Mr. Stetson’s termination prior to the expiration of his employment term under his employment agreement, unless he is terminated for Cause (as defined in the Stetson Employment Agreement), or in the event Mr. Stetson resigns without Good Reason (as defined in the Stetson Employment Agreement), we shall pay to him a lump sum in an amount equal to the sum of his (i) base salary for the prior 12 months plus (ii) his annual bonus amount during the prior 12 months.

On March 1, 2013, Mr. James Crawford was appointed as our Chief Operating Officer. Pursuant to the Employment Agreement with Mr. Crawford dated March 1, 2013 (“Crawford Employment Agreement”), Mr. Crawford shall serve as our Chief Operating Officer for two (2) years. The Crawford Employment Agreement shall be automatically renewed for successive one (1) year periods thereafter. Mr. Crawford shall be entitled to a base salary at an annual rate of $185,000, with such upward adjustments as shall be determined by the Board in its sole discretion. Mr. Crawford shall also be entitled to an annual bonus if we meet or exceed criteria adopted by the Compensation Committee of the Board for earning bonuses. Mr. Crawford shall be awarded five (5) year stock options to purchase an aggregate of five hundred thousand (500,000) shares of our common stock, with a strike price based on the closing price of our common stock on March 1, 2013, vesting in twenty-four (24) equal installments on each monthly anniversary of March 1, 2013, provided Mr. Crawford is still employed by us on each such date.

On March 1, 2013, Mr. Nathaniel Bradley was appointed as our Chief Technology Officer and President of IP Services. Pursuant to the Employment Agreement between the Company and Mr. Bradley dated March 1, 2013 (“Bradley Employment Agreement”), Mr. Bradley shall serve as the Company’s Chief Technology Officer and President of IP Services for two (2) years. The Bradley Employment Agreement shall be automatically renewed for successive one (1) year periods thereafter. Mr. Bradley shall be entitled to a base salary at an annual rate of $195,000, with such upward adjustments as shall be determined by the Board in its sole discretion. Mr. Bradley shall also be entitled to an annual bonus if the Company meets or exceeds criteria adopted by the Compensation Committee of the Board for earning bonuses. Mr. Bradley shall be awarded five (5) year stock options to purchase an aggregate of one million (1,000,000) shares of the Company’s common stock, with a strike price based on the closing price of the Company’s common stock on March 1, 2013, vesting in twenty-four (24) equal installments on each monthly anniversary of March 1, 2013, provided Mr. Bradley is still employed by the Company on each such date. On June 19, 2013, our Board accepted resignation of Mr. Nathaniel Bradley from his position of Chief Technology Officer and President of IP Services. In connection with his resignation, Mr. Bradley entered into a Separation and Release Agreement with the Company (“Separation and Release Agreement”), pursuant to which, Mr. Bradley is entitled to a severance payment of $16,250 and 125,000 options previously granted to him under his employment agreement, which - vested but were subsequently forfeited. Pursuant to the Separation and Release Agreement, Mr. Bradley also agreed to provide periodic consultation to the Company as requested at an agreed upon hourly rate of $75.00.

On November 18, 2013, we entered into a 2-year Executive Employment Agreement with Richard Raisig (“Raisig Agreement”), pursuant to which Mr. Raisig shall serve as our Chief Financial Officer, effective December 3, 2013. Pursuant to the terms of the Raisig Agreement, Mr. Raisig shall receive a base salary at an annual rate of $250,000.00 and an annual bonus up to 100% of Mr. Raisig’s base salary as determined by the Compensation Committee of the Board. As further consideration for Mr. Raisig’s services, we agreed to issue Mr. Raisig ten (10) year stock options to purchase an aggregate of 115,000 shares of common stock, with a strike price of $5.70 per share, vesting in twenty-four (24) equal installments on each monthly anniversary of the date of the Raisig Agreement, provided Mr. Raisig is still employed by us on each such date. On April 25, 2014, Mr. Richard Raisig resigned from his position as Chief Financial Officer of the Company.

On May 15, 2014, we entered into a 3-year Executive Employment Agreement with Francis Knuettel II (the “Knuettel Agreement”), pursuant to which Mr. Knuettel will serve as the Chief Financial Officer of the Company, effective May 15, 2014. Pursuant to the terms of the Agreement, Mr. Knuettel shall receive a base salary at an annual rate of $250,000.00 and an annual bonus up to 75% of Mr. Knuettel’s base salary as determined by the Compensation Committee of the Board. As further consideration for Mr. Knuettel’s services, the Company agreed to issue Mr. Knuettel ten (10) year stock options to purchase an aggregate of 145,000 shares of Common stock, with a strike price of $8.33 per share, vesting in thirty-six (36) equal installments on each monthly anniversary of the date of the Agreement, provided Mr. Knuettel is still employed by the Company on each such date.

Equity Incentive Plan

On August 1, 2012, our board of directors and stockholders adopted the 2012 Equity Incentive Plan, pursuant to which 769,231 shares of our common stock are reserved for issuance as awards to employees, directors, consultants, advisors and other service providers, after giving effect to the Reverse Split.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Between February 2010 and March 2010, Christopher Clitheroe, our former Secretary and a Director, loaned us an aggregate of $1,375 for operating expenses. Between April 2011 and September 2011, Mr. Clitheroe loaned us an aggregate of $9,675 for operating expenses. These loans were non-interest bearing and were due on demand. On December 13, 2011, Mr. Clitheroe agreed to waive these loans.

In November 2011, we issued a promissory note for $53,500 to an affiliated company owned by the officers of American Strategic Minerals Corporation (“Amicor”). The note was payable in full without interest on or before January 15, 2012. In December 2011, we issued a promissory note for $99,474 to an affiliated company owned by the officers of Amicor. The note was payable in full without interest on or before January 15, 2012. Such note was issued in connection with the execution of a lease assignment agreement between us and the affiliated company for certain mineral rights located in San Juan County, Utah. On January 30, 2012, we paid both promissory notes above for a total of $152,974. The affiliated company agreed not to charge us a late penalty fee upon satisfaction of the notes.

On January 26, 2012, we entered into a 1 year consulting agreement with GRQ Consultants, Inc., pursuant to which such consultant will provide certain services to us in consideration for which we sold to the consultant warrants to purchase an aggregate of 134,615 shares of our common stock with an exercise price of $6.50. Barry Honig is the owner of GRQ Consultants, Inc. GRQ Consultants, Inc. 401(k), which is also owned by Mr. Honig, purchased an aggregate of $500,000 of shares of Common stock in the our private placement. In addition, we entered into an Option Agreement with Pershing and Mr. Honig is a member of Pershing’s board of directors. Additionally, we entered into consulting agreement with Melechdavid Inc. in consideration for which we sold to Melechdavid Inc. warrants to purchase an aggregate of 134,615 shares of our common stock with an exercise price of $6.50 per share. Our former Chief Executive Officer is the President of Melechdavid Inc.

On January 26, 2012, we entered into an option agreement with Pershing pursuant to which we purchased the option to acquire certain uranium properties in consideration for (i) a $1,000,000 promissory note payable in installments upon satisfaction of certain conditions, expiring six months following issuance and (ii) 769,231 shares of our common stock. Pursuant to the terms of the note, upon the closing of a private placement in which we receive gross proceeds of at least $5,000,000, we shall repay $500,000 under the note. Additionally, upon the closing of a private placement in which we receive gross proceeds of at least an additional $1,000,000, we shall pay the outstanding balance under the note. The note does not bear interest. On January 26, 2012, in conjunction with a private placement, we paid Pershing $500,000 under the terms of the note. Pershing may have been deemed to be our initial promoter. Additionally, Barry Honig was, until February 9, 2012, the Chairman of Pershing and had been a shareholder of Continental Resources Group, Inc., the then- controlling shareholder of Pershing, since 2009. Mr. Honig remains a director of Pershing. Mr. Honig is also the sole owner, officer and director of GRQ Consultants, Inc. David Rector, a then- member of our board of directors, was the President and a director of Pershing at the time of the transaction and Joshua Bleak, our former director, was the Chief Executive Officer of Continental. Mr. Rector resigned as the President of Pershing on March 6, 2012 and on such date was appointed as the Treasurer and Vice President of Administration and Finance of Pershing. In November 2012, David Rector resigned from Pershing as Treasurer, Vice President of Administration and Finance and member of the board of directors.

Additionally, we entered into consulting agreement with Melechdavid Inc. in consideration for which we issued to Melechdavid Inc. warrants to purchase an aggregate of 134,615 shares of our common stock with an exercise price of $6.50 per share. Our then-Chief Executive Officer, Mark Groussman, is the President of Melechdavid Inc.

On January 26, 2012, we issued a ten-year warrant to purchase an aggregate of 13,077 shares of common stock with an exercise price of $6.50 per share to Daniel Bleak, an outside consultant to us, which vests in three equal annual installments with the first installment vesting one year from the date of issuance. Daniel Bleak is the father of Joshua Bleak, a former member of our board of directors. Additionally, in August 2012, we paid Daniel Bleak $50,000 for research and business advisory services rendered pursuant to a Professional Service Agreement executed on August 1, 2012.

On January 26, 2012, we issued warrants to purchase an aggregate of 207,692 shares of common stock at an exercise price of $6.50 per share to Joshua Bleak, David Rector, Stuart Smith and George Glasier, our then- directors.

On March 19, 2012, we entered into an agreement with California Gold Corp., pursuant to which we agreed to provide California Gold Corp. with a geological review on or prior to March 30, 2012, of certain uranium properties in consideration for $125,000. David Rector, our former director, is a member of California Gold Corp.’s board of directors.

Our former principal place of business was located in a building owned by Silver Hawk Ltd., a Colorado corporation. George Glasier, our former Chief Executive Officer, is the President and Chief Executive Officer of Silver Hawk Ltd. We leased our office space on a month to month basis at a monthly rate of $850 pursuant to a lease effective January 1, 2012. Under the terms of a Rescission Agreement dated June 11, 2012, our lease for such office space was terminated.