DEF 14A: Definitive proxy statements

Published on January 18, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant [X] | |

| Filed by a Party other than the Registrant [ ] | |

| Check the appropriate box: | |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under §240.14a-12 |

| Marathon Patent Group, Inc. | ||

(Name of Registrant as Specified In Its Charter) |

||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Marathon

Patent Group, Inc.

11601 Wilshire Blvd., Ste. 500

Los Angeles, CA 90025

January 18, 2018

To the Shareholders of Marathon Patent Group, Inc.:

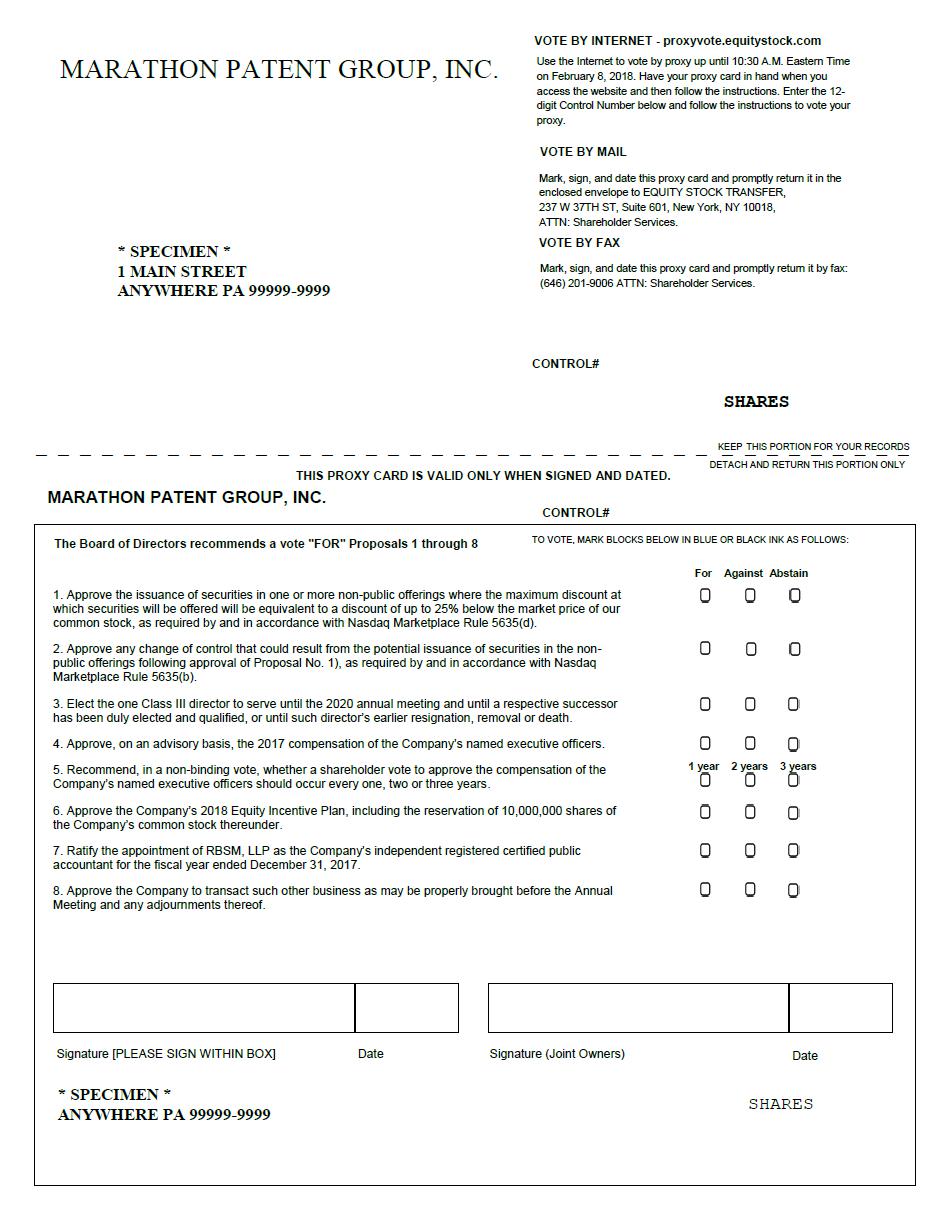

You are cordially invited to attend the 2017 Annual Meeting of Shareholders (the “Annual Meeting”) of Marathon Patent Group, Inc., a Nevada corporation (the “Company”), to be held at 10:30 a.m. Eastern Time on February 8, 2018, at the law offices of Sichenzia Ross Ference Kesner LLP, 1185 Avenue of the Americas, 37th Floor, New York, NY 10036, to consider and vote upon the following proposals:

| 1. | The approval of the issuance of securities in one or more non-public offerings where the maximum discount at which securities will be offered will be equivalent to a discount of 25% below the market price of our common stock, as required by and in accordance with Nasdaq Marketplace Rule 5635(d); | |

| 2. |

The approval of any change of control that could result from the potential issuance of securities in the non-public offerings following approval of Proposal No. 1, as required by and in accordance with Nasdaq Marketplace Rule 5635(b); |

|

| 3. |

The election of the one Class III director to serve until the 2020 annual meeting and until a respective successor has been duly elected and qualified, or until such director’s earlier resignation, removal or death; |

|

| 4. | The approval, on an advisory basis, of the 2017 compensation of the Company’s named executive officers; | |

| 5. | To recommend, in a non-binding vote, whether a shareholder vote to approve the compensation of the Company’s named executive officers should occur every one, two or three years; | |

| 6. |

The approval of the Company’s 2018 Equity Incentive Plan, including the reservation of 10,000,000 shares of the Company’s common stock thereunder; |

|

| 7. | The ratification of the appointment of RBSM, LLP, as the Company’s independent registered certified public accountant for the fiscal year ended December 31, 2017; and | |

| 8. | The approval of the Company to transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. |

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE ABOVE EIGHT PROPOSALS.

Pursuant to the provisions of the Company’s bylaws, the board of directors of the Company (the “Board”) has fixed the close of business on January 11, 2018 as the record date for determining the shareholders of the Company entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. Accordingly, only shareholders of record at the close of business on the January 11, 2018 are entitled to notice of, and shall be entitled to vote at, the Annual Meeting or any postponement or adjournment thereof.

Please review in detail the attached notice and proxy statement for a more complete statement of matters to be considered at the Annual Meeting.

Your vote is very important to us regardless of the number of shares you own. Whether or not you are able to attend the Annual Meeting in person, please read the proxy statement and promptly vote your proxy via the internet, by telephone or, if you received a printed form of proxy in the mail, by completing, dating, signing and returning the enclosed proxy in order to assure representation of your shares at the Annual Meeting. Granting a proxy will not limit your right to vote in person if you wish to attend the Annual Meeting and vote in person.

| By Order of the Board of Directors: | |

| /s/ Merrick D. Okamoto | |

| Merrick D. Okamoto, | |

| Chairman of the Board of Directors |

| 2 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The 2017 annual meeting of shareholders (the “Annual Meeting”) of Marathon Patent Group, Inc. (the “Company”) will be held at the law offices of Sichenzia Ross Ference Kesner LLP, 1185 Avenue of the Americas, 37th Floor, New York, NY 10036, on February 8, 2018, beginning at 10:30 a.m. EST. At the Annual Meeting, the holders of the Company’s outstanding common stock will act on the following matters:

| 1. | The approval of the issuance of securities in one or more non-public offerings where the maximum discount at which securities will be offered will be equivalent to a discount of 25% below the market price of our common stock, as required by and in accordance with Nasdaq Marketplace Rule 5635(d); | |

| 2. |

The approval of any change of control that could result from the potential issuance of securities in the non-public offerings following approval of Proposal No. 1, as required by and in accordance with Nasdaq Marketplace Rule 5635(b); |

|

| 3. |

The election of the one Class III director to serve until the 2020 annual meeting and until a respective successor has been duly elected and qualified, or until such director’s earlier resignation, removal or death; |

|

| 4. | The approval, on an advisory basis, of the 2017 compensation of the Company’s named executive officers; | |

| 5. |

To recommend, in a non-binding vote, whether a shareholder vote to approve the compensation of the Company’s named executive officers should occur every one, two or three years (“Say-on-Pay Frequency Vote”); |

|

| 6. |

The approval of the Company’s 2018 Equity Incentive Plan, including the reservation of 10,000,000 shares of the Company’s common stock thereunder; |

|

| 7. | The ratification of the appointment of RBSM, LLP, as the Company’s independent registered certified public accountant for the fiscal year ended December 31, 2017; and | |

| 8. | The approval of the Company to transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. |

Shareholders of record at the close of business on January 11, 2018 are entitled to notice of and to vote at the Annual Meeting and any postponements or adjournments thereof.

It is hoped you will be able to attend the Annual Meeting, but in any event, please vote according to the instructions on the enclosed proxy as promptly as possible. If you are able to be present at the Annual Meeting, you may revoke your proxy and vote in person.

|

Dated: January 18, 2018 |

By Order of the Board of Directors: |

| /s/ Merrick D. Okamoto | |

| Merrick D. Okamoto, | |

| Chairman of the Board of Directors |

| 3 |

TABLE OF CONTENTS

| 4 |

MARATHON

PATENT GROUP, INC.

11601 Wilshire Blvd., Ste. 500

Los Angeles, California 90025

ANNUAL

MEETING OF SHAREHOLDERS

To Be Held February 8, 2018

PROXY STATEMENT

The Board of Directors of Marathon Patent Group, Inc. (the “Company”) is soliciting proxies from its shareholders to be used at the annual meeting of shareholders (the “Annual Meeting”) to be held at the law offices of Sichenzia Ross Ference Kesner LLP, 1185 Avenue of the Americas, 37th Floor, New York, NY 10036, on February 8, 2018, beginning at 10:30 a.m. EST, and at any postponements or adjournments thereof. This proxy statement contains information related to the Annual Meeting. This proxy statement and the accompanying form of proxy are first being sent to shareholders on or about January 19, 2018.

Why did I receive these materials?

Our Board of Directors (the “Board”) is soliciting proxies for the 2017 Annual Meeting. You are receiving a proxy statement because you owned shares of our common stock on January 11, 2018 (the “Record Date”) and that entitles you to vote at the meeting. By use of a proxy, you can vote whether or not you attend the meeting. This proxy statement describes the matters on which we would like you to vote and provides information on those matters so that you can make an informed decision.

What information is contained in this proxy statement?

The information in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, our Board, the compensation of Directors and Executive Officers and other information that the Securities and Exchange Commission requires us to provide annually to our shareholders.

Who is entitled to vote at the meeting?

Holders of our voting capital stock as of the close of business on the Record Date will receive notice of, and be eligible to vote at, the Annual Meeting and at any adjournment or postponement of the Annual Meeting. At the close of business on the Record Date, we had outstanding and entitled to vote 14,277,781 shares of the Company’s common stock (“Common Stock”); one share of Series B Convertible Preferred Stock, convertible into 1 share of Common Stock (“Series B Preferred Stock”); and 5,480.65 shares of Series E Convertible Preferred Stock, convertible into 5,067,435 shares of Common Stock (“Series E Preferred Stock”), which vote is subject to the 4.99% beneficial ownership limitation.

How many votes do I have?

Each outstanding share of our common stock you owned as of the Record Date will be entitled to one vote for each matter considered at the meeting. There is no cumulative voting.

Who can attend the meeting?

Only persons with evidence of stock ownership as of the Record Date or who are invited guests of the Company may attend and be admitted to the Annual Meeting of the shareholders. Shareholders with evidence of stock ownership as of the record date may be accompanied by one guest. Photo identification may be required (a valid driver’s license, state identification or passport). If a shareholder’s shares are registered in the name of a broker, trust, bank or other nominee, the shareholder must bring a proxy or a letter from that broker, trust, bank or other nominee or their most recent brokerage account statement that confirms that the shareholder was a beneficial owner of shares of stock of the Company as of the Record Date. Since seating is limited, admission to the meeting will be on a first-come, first-served basis.

| 5 |

Cameras (including cell phones with photographic capabilities), recording devices and other electronic devices will not be permitted at the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the voting power of our capital stock issued and outstanding on the Record Date will constitute a quorum, permitting the conduct of business at the meeting. Proxies received but marked as abstentions or broker non-votes, if any, will be included in the calculation of the number of votes considered to be present at the meeting for purposes of a quorum.

How do I vote?

If you are a holder of record (that is, your shares are registered in your own name with our transfer agent), you can vote either in person at the Annual Meeting or by proxy without attending the Annual Meeting. We urge you to vote by proxy even if you plan to attend the Annual Meeting so that we will know as soon as possible that enough votes will be present for us to hold the meeting.

Each shareholder receiving proxy materials by mail may vote by proxy by using the accompanying proxy card. When you return a proxy card that is properly signed and completed, the shares represented by your proxy will be voted as you specify on the proxy card.

If you hold your shares in “street name,” you must either direct the bank, broker or other record holder of your shares as to how to vote your shares, or obtain a proxy from the bank, broker or other record holder to vote at the meeting. Please refer to the voter instruction cards used by your bank, broker or other record holder for specific instructions on methods of voting, including by telephone or by using the Internet.

Your shares will be voted as you indicate. If you return the proxy card but you do not indicate your voting preferences, then your shares will not be voted with respect to any proposal. The Board and management do not intend to present any matters at this time at the Annual Meeting other than those outlined in the notice of the Annual Meeting. Should any other matter requiring a vote of shareholders arise, shareholders returning the proxy card confer upon the individuals designated as proxy’s discretionary authority to vote the shares represented by such proxy on any such other matter in accordance with their best judgment.

Can I change my vote?

Yes. If you are a shareholder of record, you may revoke or change your vote at any time before the proxy is exercised by filing a notice of revocation with our Secretary or by mailing a proxy bearing a later date or by attending the Annual Meeting and voting in person. For shares you hold beneficially in “street name,” you may change your vote by submitting new voting instructions to your bank, broker, other record holder of your shares or other nominee or, if you have obtained a legal proxy from your bank, broker, other record holder of your shares or other nominee giving you the right to vote your shares, by attending the meeting and voting in person. In either case, the powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

Who is soliciting this proxy?

We are soliciting this proxy on behalf of our Board of Directors and will pay all expenses associated with this solicitation. In addition to mailing these proxy materials, certain of our officers and other employees may, without compensation other than their regular compensation, solicit proxies through further mailing or personal conversations, or by telephone, facsimile or other electronic means. We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of our stock and to obtain proxies.

| 6 |

Will shareholders be asked to vote on any other matters?

To the knowledge of the Company and its management, shareholders will vote only on the matters described in this proxy statement. However, if any other matters properly come before the meeting, the persons named as proxies for shareholders will vote on those matters in the manner they consider appropriate.

What vote is required to approve each item?

Election of the Class III director requires a plurality of the votes cast at the Annual Meeting. The approval of (i) the issuance of securities in one or more non-public offerings where the maximum discount at which securities will be offered will be equivalent to a discount of 25% below the market price of our common stock, as required by and in accordance with Nasdaq Marketplace Rule 5635(d), (ii) any change of control that could result from the potential issuance of securities in the non-public offerings following approval of Proposal 1, as required by and in accordance with Nasdaq Marketplace Rule 5635(b), (iii) the advisory resolution on executive compensation, (iv) the Say-on-Pay Frequency Vote, (v) the adoption of the Company’s 2018 Equity Incentive Plan, including the reservation of 10,000,000 shares of our common stock thereunder, and (vi) the ratification of the appointment of RBSM, LLP (“RBSM”) requires the affirmative vote of a majority of the votes cast for these proposals.

How are votes counted?

With regard to the election of directors, votes may be cast in favor or withheld and votes that are withheld will be excluded entirely from the vote and will have no effect. You may not cumulate your votes for the election of directors.

For the other proposals that are deemed non-routine, you may vote “FOR,” “AGAINST” or “ABSTAIN.” Abstentions and broker non-votes will not be counted as votes cast either for or against any of the non-routine proposals being presented to shareholders and will have no impact on the result of the vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name, as defined below, on these non-routine proposals only if the brokerage firm has received voting instructions from their clients. Such broker non-votes will not be considered in determining the number of votes necessary for approval of these non-routine proposals and will have no effect on the outcome, although they will be counted towards determining whether a quorum exists.

If you hold your shares in “street name,” the Company has supplied copies of its proxy materials for its 2017 Annual Meeting to the broker, bank or other nominee holding your shares of record and they have the responsibility to send these proxy materials to you. Your broker, bank or other nominee that have not received voting instructions from their clients may not vote on any proposal other than the appointment of RBSM. These so-called “broker non-votes” will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining a quorum, but will not be considered in determining the number of votes necessary for approval of any of the proposals and will have no effect on the outcome of any of the proposals. Your broker, bank or other nominee is permitted to vote your shares on the appointment of RBSM as our independent auditor without receiving voting instructions from you.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please vote your shares applicable to each proxy card and voting instruction card that you receive.

How can I find out the Results of the Voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K, which we will file within four business days of the Annual Meeting.

| 7 |

Do I Have Dissenters’ Rights of Appraisal?

Under the Nevada Revised Statutes and our charter documents, holders of our common stock will not be entitled to statutory rights of appraisal, commonly referred to as dissenters’ rights or appraisal rights (i.e., the right to seek a judicial determination of the “fair value” of their shares and to compel the purchase of their shares for cash in that amount) with respect to the proposals contained herein.

What Interest Do Officers and Directors Have in Matters to Be Acted Upon?

No person who has been a director or executive officer of the Company at any time since the beginning of our fiscal year, and no associate of any of the foregoing persons, has any substantial interest, direct or indirect, in any matter to be acted upon, other than Proposal No. 3, the election of the nominee as a Class III director set forth herein.

Householding of Annual Disclosure Documents

The SEC previously adopted a rule concerning the delivery of annual disclosure documents. The rule allows us or brokers holding our shares on your behalf to send a single set of our annual report and proxy statement to any household at which two or more of our shareholders reside, if either we or the brokers believe that the shareholders are members of the same family. This practice, referred to as “householding,” benefits both shareholders and us. It reduces the volume of duplicate information received by you and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements. Once shareholders receive notice from their brokers or from us that communications to their addresses will be “householded,” the practice will continue until shareholders are otherwise notified or until they revoke their consent to the practice. Each shareholder will continue to receive a separate proxy card or voting instruction card.

Those shareholders who either (i) do not wish to participate in “householding” and would like to receive their own sets of our annual disclosure documents in future years or (ii) who share an address with another one of our shareholders and who would like to receive only a single set of our annual disclosure documents should follow the instructions described below:

| ● | shareholders whose shares are registered in their own name should contact our transfer agent, Equity Stock Transfer LLC, and inform them of their request by calling them at (212) 575-5757 or writing them at 237 W. 37th Street, Suite 601, New York, NY 10018. | |

| ● | shareholders whose shares are held by a broker or other nominee should contact such broker or other nominee directly and inform them of their request, shareholders should be sure to include their name, the name of their brokerage firm and their account number. |

| 8 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our common stock as of January 11, 2018: (i) by each of our directors, (ii) by each of the Named Executive Officers, (iii) by all of our executive officers and directors as a group, and (iv) by each person or entity known by us to beneficially own more than five percent (5%) of any class of our outstanding shares. As of January 11, 2018, there were 14,277,781 shares of our common stock outstanding.

| Amount and Nature of Beneficial Ownership as of January 11, 2018 (1) | ||||||||||||||||||||

| Name and Address of Beneficial Owner(1) | Common Stock |

Options | Warrants | Total | Percentage of Common Stock (%) |

|||||||||||||||

| Officers and Directors | ||||||||||||||||||||

| Doug Croxall (CEO)(2) | 853,846 | — | — | 853,846 | 6.0 | % | ||||||||||||||

| Francis Knuettel II (Chief Financial Officer)(3) | 50,000 | 122,500 | — | 172,500 | 1.2 | % | ||||||||||||||

| James Crawford (Chief Operating Officer)(4) | — | 45,866 | — | 45,866 | * | |||||||||||||||

| Edward Kovalik (Director)(5) | 5,209 | 20,000 | — | 80,000 | * | |||||||||||||||

| Christopher Robichaud (Director)(6) | 5,209 | 5,000 | — | 20,000 | * | |||||||||||||||

| David P. Lieberman (7) | 5,209 | — | — | — | * | |||||||||||||||

| Merrick D. Okamoto (8) | 12,153 | — | — | — | * | |||||||||||||||

| All Directors and Executive Officers (seven persons) | 931,626 | 193,366 | — | 1,124,992 | 7.8 | % | ||||||||||||||

* Less than 1%

| (1) |

In determining beneficial ownership of our common stock as of a given date, the number of shares shown includes shares of Common Stock which may be acquired on exercise of warrants or options or conversion of convertible securities within 60 days of January 11, 2018. In determining the percent of Common Stock owned by a person or entity on January 11, 2018, (a) the numerator is the number of shares of the class beneficially owned by such person or entity, including shares which may be acquired within 60 days on exercise of warrants or options and conversion of convertible securities, and (b) the denominator is the sum of (i) the total shares of Common Stock outstanding on January 11, 2018 and (ii) the total number of shares that the beneficial owner may acquire upon conversion of securities and upon exercise of the warrants and options, subject to limitations on conversion and exercise as more fully described below. Unless otherwise stated, each beneficial owner has sole power to vote and dispose of its shares and such person’s address is c/o Marathon Patent Group, Inc., 11601 Wilshire Blvd., Ste. 500, Los Angeles, CA 90025. |

| (2) | Shares of Common Stock are held by Croxall Family Revocable Trust, over which Mr. Croxall holds voting and dispositive power. |

| (3) | Represents options to purchase (i) 72,500 shares of Common Stock at an exercise price of $16.66 per share, (ii) 25,000 shares of Common Stock at an exercise price of $25.60 per share and (iii) 25,000 shares of Common Stock at an exercise price of $7.44 per share. |

| (4) | Represents options to purchase (i) 9,616 shares of Common Stock at an exercise price of $9.88 per share, (ii) 7,500 shares of Common Stock at an exercise price of $16.66 per share, (iii) 20,000 shares of Common Stock at an exercise price of $25.60 per share and (iv) 8,750 shares of Common Stock at an exercise price of $7.44 per share. |

| (5) | Represents vested shares of restricted Common Stock and options to purchase (i) 5,000 shares of Common Stock at an exercise price of $13.18 per share, (ii) 5,000 shares of Common Stock at an exercise price of $29.78 per share, (iii) 5,000 shares of Common Stock at an exercise price of $8.12 per share and (iv) 5,000 shares of Common Stock at an exercise price of $9.64 per share. |

| 9 |

| (6) | Represents vested shares of restricted Common Stock and an option to purchase 5,000 shares of Common Stock at an exercise price of $9.64 per share. |

(7) |

Represents vested shares of restricted Common Stock. |

| (8) | Represents vested shares of restricted Common Stock. |

Set forth below is certain information regarding our directors and executive officers. Our Board is comprised of four directors, and is divided among three classes, Class I, Class II and Class III. Class I directors will serve until the 2018 annual meeting of shareholders and until their respective successors have been duly elected and qualified, or until such director’s earlier resignation, removal or death. The Class II director will serve until the 2019 annual meeting of shareholders and until his respective successor has been duly elected and qualified, or until such director’s earlier resignation, removal or death. The Class III director will serve until the 2020 annual meeting of shareholders and until his respective successor has been duly elected and qualified, or until such director’s earlier resignation, removal or death. All officers serve at the pleasure of the Board.

The following table presents information with respect to our current senior officers and directors:

| Name and Address | Age | Date

First Elected or Appointed |

Position(s) | |||

| Francis Knuettel II | 51 | May 15, 2014 | Chief Financial Officer | |||

| James Crawford | 42 | March 1, 2013 | Chief Operating Officer | |||

| Edward Kovalik | 43 | April 15, 2014 | Class I Director | |||

| David P. Lieberman | 73 | August 13, 2017 | Class I Director | |||

| Merrick D. Okamoto | 57 | August 13, 2017 |

Interim Chief Executive Officer and Chairman of the Board of Directors (Class I) |

|||

| Christopher Robichaud | 50 | September 28, 2016 | Class II Director |

Background of officers and directors

The following is a brief account of the education and business experience during at least the past five years of our officers and directors, indicating each person’s principal occupation during that period, and the name and principal business of the organization in which such occupation and employment were carried out.

| 10 |

Francis Knuettel II—Chief Financial Officer

Prior to joining the Company, Mr. Francis Knuettel, II, age 51, was Managing Director and CFO for Greyhound IP LLC, an investor in patent litigation expenses for patents enforced by small firms and individual inventors. From 2007 through 2013, Mr. Knuettel served as the Chief Financial Officer of IP Commerce, Inc., a cloud-based operator of an electronic payment platform and from 2005 through 2007, Mr. Knuettel served as the CFO of InfoSearch Media, Inc., a publicly traded company in the internet marketing space. From 2000 through 2004, Mr. Knuettel was at Internet Machines Corporation, a fables semiconductor company located in Los Angeles, where he served on the Board of Directors and held several positions, including Chief Executive Officer and Chief Financial Officer. Additionally, from 2008 through 2011, Mr. Knuettel was a member of the Board of Directors and Chairman of the Audit Committee for Firepond, Inc., a publicly traded producer of CPQ software systems and from 2015 through 2017, Mr. Knuettel was on the Board of Directors of Spindle Inc., a publicly traded provider of unified commerce solutions for electronic payments. Mr. Knuettel received his BA with honors in Economics from Tufts University and holds an MBA in Finance and Entrepreneurial Management from The Wharton School at the University of Pennsylvania.

James Crawford—Chief Operating Officer

Mr. James Crawford, age 42, was a founding member of Kino Interactive, LLC, and of AudioEye, Inc. Mr. Crawford’s experience as an entrepreneur spans the entire life cycle of companies from start-up capital to compliance officer and director of reporting public companies. Prior to his involvement as Chief Operating Officer of the Company, Mr. Crawford served as a director and officer of Augme Technologies, Inc. beginning March 2006, and assisted the company in maneuvering through the initial challenges of acquisitions executed by the company through 2011 that established the company as a leading mobile marketing company in the United States. Mr. Crawford is experienced in public company finance and compliance functions. He has extensive experience in the area of intellectual property creation, management and licensing. Mr. Crawford also served on the board of directors Modavox and Augme Technologies, and as founder and managing member of Kino Digital, Kino Communications, and Kino Interactive.

Edward Kovalik—Director

Mr. Edward Kovalik, age 43, is the Chief Executive Officer and Managing Partner of KLR Group, which he co-founded in 2012. KLR Group is an investment bank specializing in the Energy sector. Mr. Kovalik manages the firm and focuses on structuring customized financing solutions for the firm’s clients. He has over 16 years of experience in the financial services industry. Prior to founding KLR, Mr. Kovalik was Head of Capital Markets at Rodman & Renshaw, and headed Rodman’s Energy Investment Banking team. Prior to Rodman, from 1999 to 2002, Mr. Kovalik was a Vice President at Ladenburg Thalmann & Co, where he focused on private placement transactions for public companies. Mr. Kovalik serves as a director on the board of River Bend Oil and Gas.

David P. Lieberman – Director

Mr. David Lieberman, age 73, is a seasoned business executive with over 40 years of financial experience beginning with five years as an accountant with Price Waterhouse. He has extensive experience as a senior operational and financial executive serving both multiple public and non-public companies. Mr. Lieberman currently serves as the President of Cobra International and Lieberman Financial Consulting where he acts as administrator for several investment groups. Previously he served as CFO and Director for MEDL Mobile Holdings, Inc., and CFO and Director of Datascension, Inc., a telephone market research company that provides both outbound and inbound services to corporate customers, since January 2008 and a director of that company since 2006. From 2006 to 2007, he served as Chief Financial Officer of Dalrada Financial Corporation, a publicly traded payroll processing company based in San Diego. From 2003 to 2006, he was the Chief Financial Officer for John Goyak & Associates, Inc., a Las Vegas-based aerospace consulting firm. Mr. Lieberman attended the University of Cincinnati, where he received his B.A. in Business, and is a licensed CPA in the State of California.

Merrick D. Okamoto - Interim Chief Executive Officer and Chairman of the Board of Directors

Mr. Merrick D. Okamoto, age 57, serves as acting Chairman of the Board and as a director of the Company since August 2017. Mr. Okamoto also serves as the President at Viking Asset Management, LLC (“Viking”) which he co-founded in 2002. He is responsible for research, due diligence and structuring potential investment opportunities for the Longview Family of Funds. Mr. Okamoto has been instrumental in providing capital to over 200 private and public companies and he is responsible for Viking’s trading operations. He served as the Chairman of Optex Systems Holdings, Inc., from January 2013 to November 2014, and as its director from March 2009 to November 2014. He currently serves as an Executive Director at Embark Corporation. Prior to Viking, Mr. Okamoto co-founded TradePortal.com, Inc., in 1999 (“TradePortal”) and served as its President until 2001. He was instrumental in developing the proprietary Trade Matrix software platform offered by TradePortal Securities. Mr. Okamoto’s negotiations were key in selling a minority stake in TradePortal to Thomson Financial. Prior to TradePortal, Mr. Okamoto had been employed in the securities industry since 1983. He served as Vice President at Shearson Lehman Brothers, Prudential Securities and Paine Webber. Mr. Okamoto founded First Stage Capital, Inc. in 1996, which advises Public and Private Companies on business matters. Mr. Okamoto is widely recognized as an advanced securities trader specializing in short-term trading with sector momentum and has extensive experience in technical market analysis techniques. From 1987 to 1990, Mr. Okamoto hosted the television program, The Income Report. He has been featured as a guest speaker on CNN and the McNeil/Lehrer Report.

| 11 |

Christopher Robichaud — Director

Mr. Christopher Robichaud, age 50, has served as Chief Executive Officer of PMK•BNC, a communications, marketing and consulting agency since January 2010. In addition to managing teams in Los Angeles, New York and London, he advises clients across the globe on how to apply the “Science of Popular Culture” to build audiences, create fans, and ultimately engage with consumers in today’s ever-changing world and recently created and leads the agency’s global consulting unit, which helps companies better understand today’s changing landscape worldwide branding landscape. Prior to serving as CEO of PMK•BNC, Mr. Robichaud was the President and COO of BNC from September 1990 through December 2009.

Board Composition

Directors currently are elected to the class and for the terms as provided in Proposal No. 1 or until the earlier of their death, resignation, removal or until their successors have been duly elected and qualified. There are no family relationships among our Directors. Our bylaws provide that the number of members of our Board may be changed from time to time by resolutions adopted by the Board and/or the shareholders. Our Board currently consists of four members.

Term of Office

Our Board is comprised of four directors, and is divided among three classes, Class I, Class II and Class III. Class I directors will serve until the 2018 annual meeting of shareholders and until their respective successors have been duly elected and qualified, or until such director’s earlier resignation, removal or death. The Class II director will serve until the 2019 annual meeting of shareholders and until his respective successor has been duly elected and qualified, or until such director’s earlier resignation, removal or death. The Class III director, once elected at this Annual Meeting, will serve until the 2020 annual meeting of shareholders and until his respective successor has been duly elected and qualified, or until such director’s earlier resignation, removal or death. All officers serve at the pleasure of the Board.

Directorships

Except as otherwise reported above, none of our directors held directorships in other reporting companies and registered investment companies at any time during the past five years.

Involvement in Certain Legal Proceedings

During the past ten years, none of our officers, directors, promoters or control persons has been:

| (a) | convicted in a criminal proceeding or is subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); | |

| (b) | subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or any Federal or State authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; | |

| (c) | found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law; |

| 12 |

| (d) | the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of (a) any Federal or State securities or commodities law or regulation; (b) any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or (c) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or | |

| (e) |

the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Board Leadership Structure

Our Board does not have a policy on whether the same person should serve as both the Chief Executive Officer and Chairman of the Board or, if the roles are separate, whether the Chairman should be selected from the non-employee directors or should be an employee. Our Board believes that it should have the flexibility to periodically determine the leadership structure that it believes is best for the Company.

Board Role in Risk Oversight

Risk is inherent with every business and we face a number of risks. Management is responsible for the day-to-day management of risks we face, while our Board is responsible for overseeing our management and operations, including overseeing its risk assessment and risk management functions.

Number of Meetings of the Board of Directors and Committees

During 2016, the Board held three meetings, the Audit Committee held four meetings, the Compensation Committee held three meetings and the Nominating and Corporate Governance Committee held two meetings. Directors are expected to attend Board and Committee meetings and to spend time needed to meet as frequently as necessary to properly discharge their responsibilities. Each active director attended at least 75% of the aggregate number of meetings of the Board during 2016.

Attendance at Annual Meetings of the Shareholders

The Company has no policy requiring Directors and Director Nominees to attend its Annual Meeting of shareholders; however, all Directors and Director Nominees are encouraged to attend.

Director Independence

Mr. Edward Kovalik, Mr. Christopher Robichaud and Mr. David P. Lieberman are “independent” directors based on the definition of independence in the listing standards of The NASDAQ Stock Market LLC (“NASDAQ”).

Shareholder Communications

Shareholders may send communications to the Company’s directors as a group or individually, by writing to those individuals or the group: c/o the Chief Executive Officer c/o Marathon Patent Group, Inc., 11601 Wilshire Blvd., Ste. 500, Los Angeles, California 90025. The Chief Executive Officer will review all correspondence received and will forward all correspondence that is relevant to the duties and responsibilities of the Board or the business of the Company to the intended director(s). Examples of inappropriate communication include business solicitations, advertising and communication that is frivolous in nature, relates to routine business matters (such as product inquiries, complaints or suggestions), or raises grievances that are personal to the person submitting the communication. Upon request, any director may review communication that is not forwarded to the directors pursuant to this policy.

| 13 |

Committees of the Board of Directors

Our Board of Directors has established three standing committees: an audit committee, a nominating and corporate governance committee and a compensation committee, which are described below. Members of these committees are elected annually at the regular board meeting held in conjunction with the annual shareholders’ meeting. The charter of each committee is available on our website at http://www.marathonpg.com/.

Audit Committee

The Audit Committee members are currently Mr. David P. Lieberman, Mr. Edward Kovalik and Mr. Christopher Robichaud, with Mr. David P. Lieberman as Chairman. The Committee has authority to review our financial records, deal with our independent auditors, recommend to the Board policies with respect to financial reporting, and investigate all aspects of our business. All of the members of the Audit Committee currently satisfy the independence requirements and other established criteria of NASDAQ.

The Audit Committee Charter is available on the Company’s website at http://www.marathonpg.com/. The Audit Committee has sole authority for the appointment, compensation and oversight of the work of our independent registered public accounting firm, and responsibility for reviewing and discussing with management and our independent registered public accounting firm our audited consolidated financial statements included in our Annual Report on Form 10-K, our interim financial statements and our earnings press releases. The Audit Committee also reviews the independence and quality control procedures of our independent registered public accounting firm, reviews management’s assessment of the effectiveness of internal controls, discusses with management the Company’s policies with respect to risk assessment and risk management and will review the adequacy of the Audit Committee charter on an annual basis.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee members are currently Mr. David P. Lieberman and Mr. Christopher Robichaud, with Mr. Christopher Robichaud as Chairman. The Nominating and Corporate Governance Committee has the following responsibilities: (a) setting qualification standards for director nominees; (b) identifying, considering and nominating candidates for membership on the Board; (c) developing, recommending and evaluating corporate governance standards and a code of business conduct and ethics applicable to the Company; (d) implementing and overseeing a process for evaluating the Board, Board committees (including the Committee) and overseeing the Board’s evaluation of the Chairman and Chief Executive Officer of the Company; (e) making recommendations regarding the structure and composition of the Board and Board committees; (f) advising the Board on corporate governance matters and any related matters required by the federal securities laws; and (g) assisting the Board in identifying individuals qualified to become Board members; recommending to the Board the director nominees for the next annual meeting of shareholders; and recommending to the Board director nominees to fill vacancies on the Board.

The Nominating and Governance Committee Charter is available on the Company’s website at http://www.marathonpg.com/. The Nominating and Governance Committee determines the qualifications, qualities, skills, and other expertise required to be a director and to develop, and recommend to the Board for its approval, criteria to be considered in selecting nominees for director (the “Director Criteria”); identifies and screens individuals qualified to become members of the Board, consistent with the Director Criteria. The Nominating and Governance Committee considers any director candidates recommended by the Company’s shareholders pursuant to the procedures described in the Company’s proxy statement, and any nominations of director candidates validly made by shareholders in accordance with applicable laws, rules and regulations and the provisions of the Company’s charter documents. The Nominating and Governance Committee makes recommendations to the Board regarding the selection and approval of the nominees for director to be submitted to a shareholder vote at the Annual Meeting of shareholders, subject to approval by the Board.

| 14 |

Compensation Committee

The Compensation Committee oversees our executive compensation and recommends various incentives for key employees to encourage and reward increased corporate financial performance, productivity and innovation. Its members are currently Mr. David P. Lieberman and Mr. Edward Kovalik with Mr. Edward Kovalik as Chairman. All of the members of the Compensation Committee currently satisfy the independence requirements and other established criteria of NASDAQ.

The Compensation Committee Charter is available on the Company’s website at http://www.marathonpg.com/. The Compensation Committee is responsible for: (a) assisting our Board in fulfilling its fiduciary duties with respect to the oversight of the Company’s compensation plans, policies and programs, including assessing our overall compensation structure, reviewing all executive compensation programs, incentive compensation plans and equity-based plans, and determining executive compensation; and (b) reviewing the adequacy of the Compensation Committee charter on an annual basis. The Compensation Committee, among other things, reviews and approves the Company’s goals and objectives relevant to the compensation of the Chief Executive Officer, evaluate the Chief Executive Officer’s performance with respect to such goals, and set the Chief Executive Officer’s compensation level based on such evaluation. The Compensation Committee also considers the Chief Executive Officer’s recommendations with respect to other executive officers and evaluates the Company’s performance both in terms of current achievements and significant initiatives with long-term implications. It assesses the contributions of individual executives and recommend to the Board levels of salary and incentive compensation payable to executive officers of the Company; compares compensation levels with those of other leading companies in similar or related industries; reviews financial, human resources and succession planning within the Company; recommend to the Board the establishment and administration of incentive compensation plans and programs and employee benefit plans and programs; recommends to the Board the payment of additional year-end contributions by the Company under certain of its retirement plans; grants stock incentives to key employees of the Company and administer the Company’s stock incentive plans; and reviews and recommends for Board approval compensation packages for new corporate officers and termination packages for corporate officers as requested by management.

COMPENSATION COMMITTEE REPORT OF EXECUTIVE COMPENSATION

The Compensation Committee has reviewed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K and discussed that analysis with management. Based on its review and discussions with management, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference into the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2016. This report is provided by the following independent directors, who currently comprise the Compensation Committee:

Edward

Kovalik (Chair)

David P. Lieberman

| 15 |

The following summary compensation table sets forth information concerning compensation for services rendered in all capacities during 2016 and 2015 awarded to, earned by or paid to our executive officers. The value attributable to any Option Awards and Stock Awards reflects the grant date fair values of stock awards calculated in accordance with FASB Accounting Standards Codification Topic 718.

| Name and Principal Position | Year | Salary | Bonus Awards |

Stock Awards |

Option Awards |

Non-Equity Plan Compensation |

Nonqualified Deferred Earnings |

All

Other Compensation |

Total | ||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||

| Doug Croxall (1) | 2016 | 511,210 | 509,000 | — | — | — | — | — | 1,020,210 | ||||||||||

| CEO and Chairman | 2015 | 496,200 | 575,000 | — | 137,095 | — | — | — | 1,208,295 | ||||||||||

| Francis Knuettel II | 2016 | 250,000 | 185,000 | — | — | — | — | — | 435,000 | ||||||||||

| CFO & Secretary | 2015 | 250,000 | 215,000 | — | 91,396 | — | — | — | 556,396 | ||||||||||

| James Crawford | 2016 | 184,290 | 50,000 | — | — | — | — | — | 234,290 | ||||||||||

| COO | 2015 | 185,002 | 18,700 | — | 31,989 | — | — | — | 235,691 | ||||||||||

| Enrique Sanchez (2) | 2016 | 183,196 | — | — | — | — | — | — | 183,196 | ||||||||||

| IP Counsel & SVP of Licensing | 2015 | 220,833 | 25,000 | — | 45,698 | — | — | — | 291,531 | ||||||||||

| Umesh Jani (3) | 2016 | 225,000 | — | — | — | — | — | — | 225,000 | ||||||||||

| CTO, SVP of Licensing | 2015 | 225,000 | 43,500 | — | 45,698 | — | — | — | 314,198 | ||||||||||

| David Liu (4) | 2016 | 114,583 | — | — | 198,105 | — | — | — | 312,688 | ||||||||||

| CTO | 2015 | — | — | — | — | — | — | — | — | ||||||||||

| Erich Spangenberg (5) | 2016 | 150,000 | 200,000 | — | 357,264 | — | — | — | 707,264 | ||||||||||

| Dir. of Acquisitions & Licensing | 2015 | — | — | — | — | — | — | — | — | ||||||||||

| Richard Chernicoff (6) | 2016 | 120,000 | — | — | — | — | — | — | 120,000 | ||||||||||

| Interim General Counsel | 2015 | 255,500 | 12,500 | — | 709,492 | — | — | — | 977,492 |

(1) Doug Croxall was appointed as the Chief Executive Officer of the Company on November 14, 2012 and his employment with the Company terminated on December 31, 2017.

(2) Enrique Sanchez was appointed as the Senior Vice President of Licensing of the Company on November 3, 2014 and his employment with the Company terminated on September 22, 2016.

(3) Umesh Jani was appointed as the Chief Technology Officer and SVP of Licensing of the Company on October 31, 2014 and his employment with the Company terminated on January 31, 2017.

(4) David Liu was appointed as the Chief Technology Officer of the Company on July 18, 2016 and his employment with the Company was terminated on March 15, 2017.

(5) Erich Spangenberg was appointed as the Director of Acquisitions and Licensing on May 11, 2016. On August 3, 2017, the Company and Mr. Spangenberg terminated the employment agreement and as a result, Mr. Spangenberg is no longer an officer of the Company.

(6) Richard Chernicoff was appointed as the Interim General Counsel on April 7, 2015, in addition to his responsibilities as a Director, and his appointment as Interim General Counsel was terminated on July 31, 2016.

Employment Agreements

On November 1, 2017, the Company entered into certain agreements with Doug Croxall amending the prior Retention Agreement dated August 22, 2017 as amended September 29, 2017 that may result in the receipt of cash severance payments and other benefits with a total value of approximately $565,000 (excluding the value of any accelerated vesting of stock options and stock issuances) following the effective time of the merger (the “Merger”) with Global Bit Ventures, Inc., a Nevada company (“GBV”), of which payments $347,500 has been paid and $217,500 is payable at the effective time of the Merger, ongoing salary in the amount of $30,000 per month through December 31, 2017, the date on which his resignation becomes effective, and to not sell any shares of Common Stock until 10 days following a change of control of the Company. In addition, Mr. Croxall has the right to vesting of 700,000 shares, after giving effect to the transfer of 50,000 shares of Common Stock to Francis Knuettel II.

On August 30, 2017, the Company entered into a Retention Agreement with Francis Knuettel II, the Company’s Chief Financial Officer (the “Knuettel Retention Agreement”), pursuant to which the existing employment agreement between Mr. Knuettel and the Company was terminated. Pursuant to the Knuettel Retention Agreement, Mr. Knuettel shall continue to serve as Chief Financial Officer through March 31, 2017 or as otherwise determined in accordance with the Knuettel Retention Agreement. Pursuant to the Knuettel Retention Agreement, Mr. Knuettel shall be entitled to receive: (i) a monthly consulting fee in the amount of $15,000 for a period of six (6) months commencing on October 1, 2017, (ii) 50,000 shares of restricted Common Stock, which was subject to shareholder approval of the Company’s 2017 Equity Incentive Plan, and (iii) medical and other insurance benefits through the end of March 2018. Mr. Knuettel also received 50,000 shares of restricted Common Stock from Mr. Croxall pursuant to the grant he was provided upon entering into the Knuettel Retention Agreement.

On August 30, 2017, the Company entered into a revised employment Agreement with James Crawford, the Company’s Chief Operating Officer (the “Crawford Agreement”), pursuant to which (a) the employment agreements between Mr. Crawford and the Company were terminated and of no further force and effect, and Mr. Crawford is no longer entitled to any payment relating to severance, change of control of the Company or termination pay from the Company, and (b) Mr. Crawford shall continue to serve as the Chief Operating Officer until such time as provided in the Crawford Agreement. In consideration for the foregoing, pursuant to the Crawford Agreement, Mr. Crawford shall receive from the Company monthly compensation in the amount of $7,500.

| 16 |

On August 31, 2017, the Company and Erich Spangenberg entered into a Consulting Termination and Release Agreement (the “Termination Agreement”), pursuant to which the consulting agreement dated as of August 3, 2017, by and between Mr. Spangenberg and the Company was terminated and of no further force and effect, and Mr. Spangenberg is no longer entitled to any compensation from the Company. In consideration for the foregoing, the Company entered into a new Consulting Agreement on August 31, 2017, with Page Innovations, LLC (“Page”), an entity designated by Mr. Spangenberg, whereby Mr. Spangenberg shall provide advice and consulting services to the Company, as an independent contractor, with respect to the business of the Company as may be requested by the Company from time to time, not to exceed one (1) hour per day or ten (10) hours in any calendar month, for which, Page will be granted 25,000 shares of restricted Common Stock.

Directors’ Compensation

The following summary compensation table sets forth information concerning compensation for services rendered in all capacities during 2016 and 2015 awarded to, earned by or paid to our directors. The value attributable to any Warrant Awards reflects the grant date fair values of stock awards calculated in accordance with FASB Accounting Standards Codification Topic 718.

| Fees

Earned or paid in cash |

Stock awards |

Option awards |

Non-equity incentive plan compensation |

Non-qualified deferred compensation earnings |

All

other compensation |

Total | |||||||||

| Name | ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||

| Richard Chernicoff (1) | |||||||||||||||

| 2016 | 40,250 | — | 20,864 | — | — | — | 61,114 | ||||||||

| 2015 | 20,923 | — | 60,742 | — | — | — | 81,665 | ||||||||

| Edward Kovalik | |||||||||||||||

| 2016 | 47,250 | — | 20,864 | — | — | — | 68,114 | ||||||||

| 2015 | — | — | 18,060 | — | — | — | 18,060 | ||||||||

| William Rosellini (2) | |||||||||||||||

| 2016 | 38,205 | — | — | — | — | — | 38,205 | ||||||||

| 2015 | 53,125 | — | 18,060 | — | — | — | 71,185 | ||||||||

| Richard Tyler (1) | |||||||||||||||

| 2016 | 44,125 | — | 20,864 | — | — | — | 64,989 | ||||||||

| 2015 | 23,270 | — | 55,868 | — | — | — | 79,138 | ||||||||

| Christopher Robichaud (3) | |||||||||||||||

| 2016 | 10,250 | — | 20,864 | — | — | — | 31,114 | ||||||||

| 2015 | — | — | — | — | — | — | — |

| (1) | The Board accepted the resignations of Mr. Richard Tyler and Mr. Richard Chernicoff, effective August 13, 2017. On such date, Mr. Merrick D. Okamoto and Mr. David P. Lieberman were appointed to the Board to fill in the two vacancies as a result of Mr. Chernicoff’s and Mr. Tyler’s resignations. |

| (2) | Mr. William Rosellini elected not to continue serving on the Board and his term ended with the annual shareholders meeting held on September 28, 2016. |

| (3) | Mr. Christopher Robichaud was elected to the Board at the annual shareholders meeting held on September 28, 2016, filling the seat vacated by Mr. Rosellini. |

Grants of Plan Based Awards and Outstanding Equity Awards at Fiscal Year-End

On August 1, 2012, our Board of Directors and shareholders adopted the 2012 Equity Incentive Plan, pursuant to which 1,538,462 shares of our common stock are reserved for issuance as awards to employees, directors, consultants, advisors and other service providers, after giving effect to the 4-for-1 reverse stock split on October 31, 2017.

| 17 |

On September 16, 2014, our Board of Directors adopted the 2014 Equity Incentive Plan (the “2014 Plan”), and on July 31, 2015, the shareholders approved the 2014 Plan at the Company’s annual meeting. The 2014 Plan authorizes the Company to grant stock options, restricted stock, preferred stock, other stock based awards, and performance awards to purchase up to 500,000 shares of Common Stock. Awards may be granted to the Company’s directors, officers, consultants, advisors and employees. Unless earlier terminated by the Board, the 2014 Plan will terminate, and no further awards may be granted, after September 16, 2024. As of January 11, 2018, the following sets forth the option and stock awards to officers of the Company.

| Option Awards | Stock awards | ||||||||||||||||||||||||||||||||||

|

Number of securities underlying unexercised options (1) (#) |

Number of securities underlying unexercised options (#) |

Equity incentive plan awards: Number of securities underlying unexercised unearned options (#) |

Option exercise price | Option expiration | Number of shares of units of stock that have not vested | Market value of shares of units of stock that have not vested | Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested | Equity incentive plan awards: Market or payout value of unearned shares, units or other rights that have not vested | |||||||||||||||||||||||||||

| exercisable | unexercisable | unexercisable | ($) | date | (#) | ($) | (#) | ($) | |||||||||||||||||||||||||||

| James Crawford | 9,616 | - | - | $ | 9.88 | 06/19/18 | - | - | - | - | |||||||||||||||||||||||||

| James Crawford | 7,500 | - | - | $ | 16.66 | 05/14/24 | - | - | - | - | |||||||||||||||||||||||||

| James Crawford | 20,000 | - | - | $ | 25.60 | 10/31/24 | - | - | - | - | |||||||||||||||||||||||||

| James Crawford | 8,750 | - | - | $ | 7.44 | 10/14/25 | - | - | - | - | |||||||||||||||||||||||||

| Francis Knuettel II | 72,500 | - | - | $ | 16.66 | 05/14/24 | - | - | - | - | |||||||||||||||||||||||||

| Francis Knuettel II | 25,000 | - | - | $ | 25.60 | 10/31/24 | - | - | - | - | |||||||||||||||||||||||||

| Francis Knuettel II | 25,000 | - | - | $ | 7.44 | 10/14/25 | - | - | - | - | |||||||||||||||||||||||||

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the Board or compensation committee of any other entity that has one or more of its executive officers serving as a member of our Board.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. These persons are required by regulation to furnish us with copies of all Section 16(a) reports that they file. Based on our review of the copies of these reports received by us, or written representations from the reporting persons that no other reports were required, we believe that, during fiscal year 2016, all filing requirements applicable to our current officers, directors and greater than 10% beneficial owners were complied with.

| 18 |

The current members of the Audit Committee are Mr. Edward Kovalik, Mr. David P. Lieberman and Mr. Christopher Robichaud, with Mr. David P. Lieberman as Chairman.

The Audit Committee of the Board, which consists entirely of directors who meet the required independence and experience requirements of Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended, and the rules of the Nasdaq Stock Market, has furnished the following report:

The Audit Committee assists the Board in overseeing and monitoring the integrity of the Company’s financial reporting process, its compliance with legal and regulatory requirements and the quality of its internal and external audit processes. The role and responsibilities of the Audit Committee are set forth in a written charter adopted by the Board, which is available on our website at www.marathonpg.com. The Audit Committee is responsible for the appointment, oversight and compensation of our independent public accountant. The Audit Committee reviews with management and our independent public accountant our annual financial statements on Form 10-K and our quarterly financial statements on Forms 10-Q. In fulfilling its responsibilities for the financial statements for fiscal year 2016, the Audit Committee took the following actions:

| ● | reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2016 with management and our independent public accountant; | |

| ● | discussed with our independent public accountant the matters required to be discussed in accordance with the rules set forth by the Public Company Accounting Oversight Board (“PCAOB”), relating to the conduct of the audit; and | |

| ● | received written disclosures and the letter from our independent public accountant regarding its independence as required by applicable requirements of the PCAOB regarding the accountant’s communications with the Audit Committee and the Audit Committee further discussed with the accountant its independence. The Audit Committee also considered the status of pending litigation, taxation matters and other areas of oversight relating to the financial reporting and audit process that the Audit Committee determined appropriate. |

Based on the Audit Committee’s review of the audited financial statements and discussions with management and our independent public accountant, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 for filing with the SEC.

THE AUDIT COMMITTEE:

David P. Lieberman (Chair)

Edward Kovalik

Christopher Robichaud

The foregoing Audit Committee Report does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other filing of our company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent we specifically incorporate this Audit Committee Report by reference therein.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On December 29, 2017, the Board appointed Merrick D. Okamoto to serve as interim Chief Executive Officer of the Company, effective January 1, 2018, which term shall not exceed one-year, until the Company engages a replacement Chief Executive Officer. In consideration of his services, Mr. Okamoto shall receive a monthly base salary in the amount of $17,500.

On November 1, 2017, the Company and Doug Croxall entered into an amendment (“Retention Amendment”) to Retention Agreement dated August 22, 2017, as amended and restated on August 30, 2017 (the “Retention Agreement”), whereby his tenure as Chief Executive Officer of the Company would be extended through and until December 31, 2017. Pursuant to the Retention Amendment, Mr. Croxall’s monthly base compensation was adjusted to $30,000 per month through December 31, 2017 and upon execution of an Agreement and Plan of Merger by and between the Company and Global Bit Ventures, Inc. (“GBV”) dated as of November 1, 2017 (the “Merger”), fifty (50%) percent of the remaining retention bonus, in the amount of $187,500, would be immediately paid to Mr. Croxall, with the remainder to be paid upon close of the Merger. In addition, the Company and Mr. Croxall entered into a Voting and Standstill Agreement on November 1, 2017 whereby Mr. Croxall agreed to vote all of the shares he either directly or beneficially owns at the recommendation of the Board and to not sell any shares until ten (10) days after a change of control as defined in the Retention Agreement.

| 19 |

On September 29, 2017, pursuant to the Retention Agreement with Mr. Croxall, the Company executed an Irrevocable Stock Power to transfer and assign one hundred (100%) percent of its beneficial ownership of the shares of common stock of 3D Nanocolor Corp. to Mr. Croxall.

On September 7, 2017, the Company entered into a Lock-up Agreement with Mr. Croxall (the “Lock-up Agreement”). The Lock-Up Agreement also amends the Amended and Restated Retention Agreement, dated August 30, 2017, by and between the Company and Mr. Croxall (the “Amended and Restated Agreement”, and together with the Lock-up Agreement, the “Croxall Agreements”). Under the Croxall Agreements, 700,000 restricted shares of Common Stock issuable to Mr. Croxall in connection with their respective agreements also become subject to a lock-up provision pursuant to the terms and subject to the conditions set forth in the Croxall Agreements.

On September 1, 2017, the Company entered into a Share Purchase Agreement (the “Purchase Agreement”) whereby a wholly-owned subsidiary of the Company, Marathon Group, S.A. (“Marathon SA”), sold its shares of Munitech IP S.a.r.l. (“Munitech”) to GPat Technologies, LLC (“GPat”). Pursuant to the Purchase Agreement, Marathon SA transferred the shares to GPat and the Company paid GPat $25,000, in return for which, GPat acquired all the shares of Munitech, along with all assets and liabilities of Munitech.

On August 31, 2017, the Company entered into an AP Settlement Agreement with Medtronics, Inc. pursuant to which the Company settled its outstanding invoices with Medtronics, Inc. in the aggregate amount of $600,000 in exchange for a payment of $220,000.

On August 31, 2017, the Company and Erich Spangenberg entered into a Consulting Termination and Release Agreement (the “Termination Agreement”), pursuant to which the consulting agreement dated as of August 3, 2017, by and between Mr. Spangenberg and the Company was terminated and of no further force and effect, and Mr. Spangenberg is no longer entitled to any compensation from the Company. In consideration for the foregoing, the Company entered into a new Consulting Agreement on August 31, 2017, with Page Innovations, LLC (“Page”), an entity designated by Mr. Spangenberg, whereby Mr. Spangenberg shall provide advice and consulting services to the Company, as an independent contractor, with respect to the business of the Company as may be requested by the Company from time to time, not to exceed one (1) hour per day or ten (10) hours in any calendar month, for which, Page will be granted 100,000 shares of restricted Common Stock.

On August 30, 2017, the Company entered into a revised employment Agreement with James Crawford, the Company’s Chief Operating Officer (the “Crawford Agreement”), pursuant to which (a) the employment agreements between Mr. Crawford and the Company were terminated and of no further force and effect, and Mr. Crawford is no longer entitled to any payment relating to severance, change of control of the Company or termination pay from the Company, and (b) Mr. Crawford shall continue to serve as the Chief Operating Officer until such time as provided in the Crawford Agreement. In consideration for the foregoing, pursuant to the Crawford Agreement, Mr. Crawford shall receive from the Company monthly compensation in the amount of $7,500.

On August 30, 2017, the Company entered into a Retention Agreement with Francis Knuettel II, the Company’s Chief Financial Officer (the “Knuettel Retention Agreement”), pursuant to which the existing employment agreement between Mr. Knuettel and the Company was terminated. Pursuant to the Knuettel Retention Agreement, Mr. Knuettel shall continue to serve as Chief Financial Officer until such time as provided in the Knuettel Retention Agreement through March 31, 2017, unless earlier terminated in accordance with the Knuettel Retention Agreement. Pursuant to the Knuettel Retention Agreement, Mr. Knuettel shall be entitled to receive: (i) a monthly consulting fee in the amount of $15,000 for a period of six (6) months commencing on October 1, 2017, (ii) 200,000 shares of restricted Common Stock, which was subject to shareholder approval of the Company’s 2017 Equity Incentive Plan, and (iii) medical and other insurance benefits through the end of March 2018.

Other than disclosed herein, there were no transactions during the year ended December 31, 2016 or any currently proposed transactions, in which the Company was or is to be a participant and the amount involved exceeds $120,000, and in which any related person had or will have a direct or indirect material interest.

Review, Approval or Ratification of Transactions with Related Persons

We have not adopted written policies and procedures specifically for related person transactions. Our Board is responsible for approving all related party transactions. The independent directors that are on our Board are responsible to approve all related party transactions that involve Mr. Okamoto, if any.

| 20 |

PROPOSAL

NO. 1

APPROVAL OF ISSUANCE OF SECURITIES IN ONE OR MORE NON-PUBLIC OFFERINGS WHERE THE MAXIMUM DISCOUNT AT WHICH SECURITIES WILL BE

OFFERED WILL BE EQUIVALENT TO A DISCOUNT OF 25% BELOW THE MARKET PRICE OF OUR COMMON STOCK, IN ACCORDANCE WITH NASDAQ MARKETPLACE

RULE 5635(d)

Our common stock is currently listed on the Nasdaq Capital Market and, as such, we are subject to Nasdaq Marketplace Rules. Nasdaq Marketplace Rule 5635(d) (“Rule 5635(d)”) requires us to obtain shareholder approval prior to the issuance of our common stock in connection with certain non-public offerings involving the sale, issuance or potential issuance by the Company of Common Stock (and/or securities convertible into or exercisable for Common Stock) equal to 20% or more of the Common Stock outstanding before the issuance. Shares of our common stock issuable upon the exercise or conversion of warrants, options, debt instruments, preferred stock or other equity securities issued or granted in such non-public offerings will be considered shares issued in such a transaction in determining whether the 20% limit has been reached, except in certain circumstances such as issuing warrants that are not exercisable for a minimum of six months and have an exercise price that exceeds market value. We may effectuate the approved offerings or transactions in one or more transactions, subject to the limitations herein.

We may seek to raise additional capital to implement our business strategy and enhance our overall capitalization. We have not determined the particular terms for such prospective offerings. Because we may seek additional capital that triggers the requirements of Rule 5635(d), we are seeking shareholder approval now, so that we will be able to move quickly to take full advantage of any opportunities that may develop in the equity markets.

We hereby submit this Proposal No. 1 to our shareholders for their approval of the potential issuance of shares of our common stock, or securities convertible into our common stock, in one or more non-public capital-raising transactions, or offerings, subject to the following limitations:

| ● |

The maximum discount at which securities will be offered (which may consist of a share of Common Stock and a warrant for the issuance of up to an additional share of Common Stock) will be equivalent to a discount of 25% below the market price of our common stock at the time of issuance in recognition of the limited public float of our traded common stock and historical volatility making the pricing discount of our stock required by investors at any particular time difficult, at this time, to predict. For example, as reported in our Annual Report on Form 10-K filed with the SEC on March 30, 2016, the range of high and low closing prices for our common stock as reported by the Nasdaq Capital Market, for the period December 31, 2014 through December 31, 2015 was $8.43 and $1.34, respectively; |

|

| ● |

The aggregate number of shares issued in the offerings will not exceed 50,000,000 shares of our common stock, subject to adjustment for any reverse stock split effected prior to the offerings (including pursuant to preferred stock, options, warrants, convertible debt or other securities exercisable for or convertible into Common Stock); |

|

| ● | The total aggregate consideration will not exceed $100,000,000; | |

| ● | Such offerings will occur, if at all, on or before December 15, 2018, unless a shorter time is required by Nasdaq; and | |

| ● | Such other terms as the Board of Directors shall deem to be in the best interests of the Company and its shareholders, not inconsistent with the foregoing. |

The issuance of shares of our common stock, or other securities convertible into shares of our common stock, in accordance with any offerings would dilute, and thereby reduce, each existing shareholder’s proportionate ownership in our common stock. The shareholders do not have preemptive rights to subscribe to additional shares that may be issued by the Company in order to maintain their proportionate ownership of the Common Stock.

The issuance of shares of Common Stock in one or more non-public offerings could have an anti-takeover effect. Such issuance could dilute the voting power of a person seeking control of the Company, thereby deterring or rendering more difficult a merger, tender offer, proxy contest or an extraordinary corporate transaction opposed by the Company.

| 21 |

The Board has not yet determined the terms and conditions of any offerings. As a result, the level of potential dilution cannot be determined at this time, but as discussed above, we may not issue more than 50,000,000 shares of Common Stock in the aggregate pursuant to the authority requested from shareholders under this proposal (subject to adjustment for any reverse stock split). It is possible that if we conduct a non-public stock offering, some of the shares we sell could be purchased by one or more investors who could acquire a large block of our common stock. This would concentrate voting power in the hands of a few shareholders who could exercise greater influence on our operations or the outcome of matters put to a vote of shareholders in the future.