DEF 14A: Definitive proxy statements

Published on June 16, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant [X] | |

| Filed by a Party other than the Registrant [ ] | |

| Check the appropriate box: | |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under §240.14a-12 |

Marathon Digital Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Marathon Digital Holdings, Inc.

1180 N. Town Center Drive, Suite 100

Las Vegas, NV 89144

June 16, 2021

To the Shareholders of Marathon Digital Holdings, Inc.:

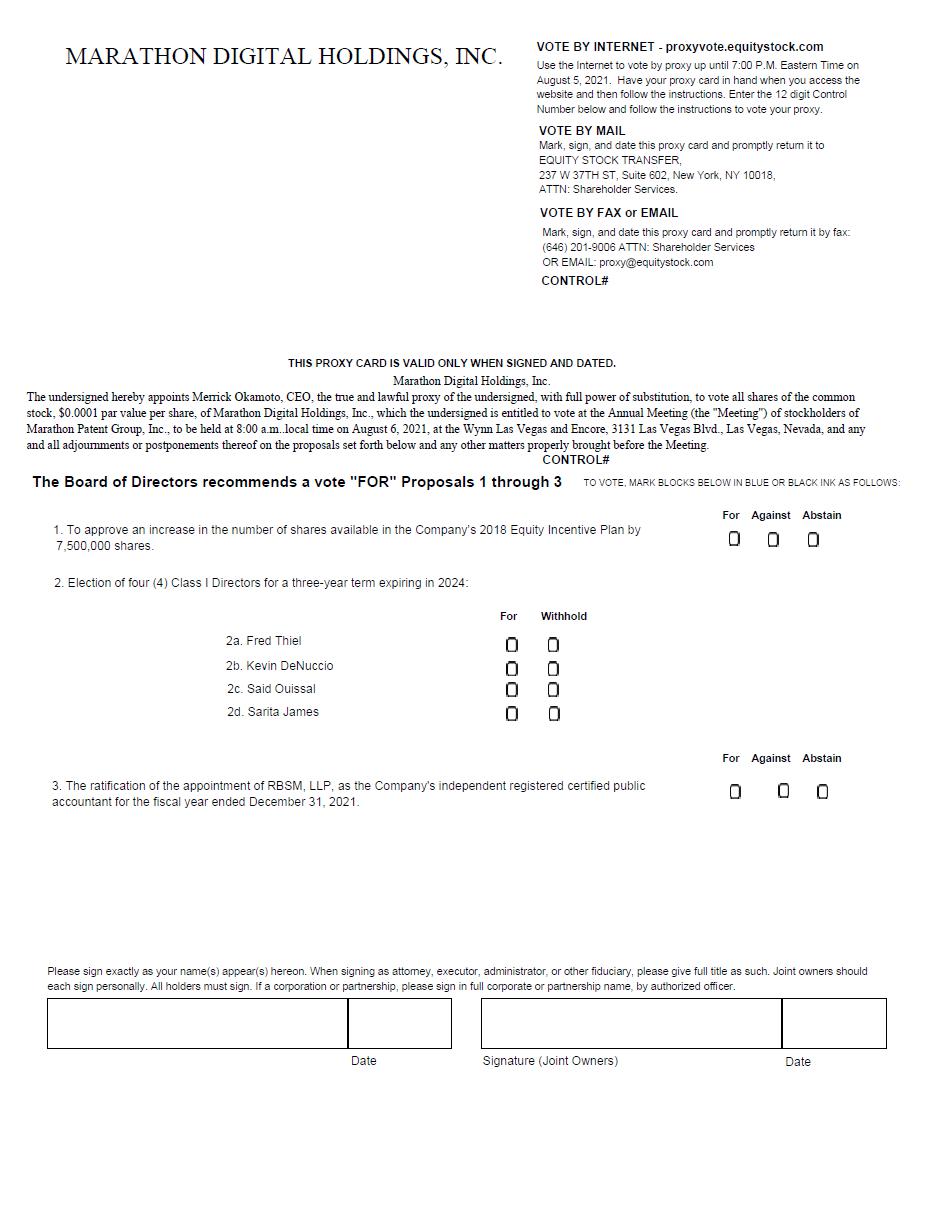

You are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Marathon Digital Holdings, Inc., a Nevada corporation (the “Company”), to be held at 8:00 AM local time on Friday, August 6, 2021, at Wynn Las Vegas and Encore, 3131 Las Vegas Blvd, Las Vegas, NV 89109, to consider and vote upon the following proposals:

| 1. | To approve an increase in the number of shares available in the Company’s 2018 Equity Incentive Plan by 7,500,000 shares; |

| 2. | Approve the election of four Class I directors for a three-year term expiring in 2024. |

| 3. | The ratification of the appointment of RBSM, LLP, as the Company’s independent registered certified public accountant for the fiscal year ended December 31, 2021. |

| 4. | To transact such other business as may be properly brought before the 2021 Annual Meeting and any adjournments thereof. |

THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE ABOVE FIVE PROPOSALS.

Pursuant to the provisions of the Company’s bylaws, the board of directors of the Company (the “Board”) has fixed the close of business on June 14, 2021 as the record date for determining the shareholders of the Company entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. Accordingly, only shareholders of record at the close of business on June 14, 2021 are entitled to notice of, and shall be entitled to vote at, the Annual Meeting or any postponement or adjournment thereof.

Please review in detail the attached notice and proxy statement for a more complete statement of matters to be considered at the Annual Meeting.

Your vote is very important to us regardless of the number of shares you own. Whether or not you are able to attend the Annual Meeting in person, please read the proxy statement and promptly vote your proxy via the internet, by telephone or, if you received a printed form of proxy in the mail, by completing, dating, signing and returning the enclosed proxy in order to assure representation of your shares at the Annual Meeting. Granting a proxy will not limit your right to vote in person if you wish to attend the Annual Meeting and vote in person.

| By Order of the Board of Directors: | |

| /s/ Merrick D. Okamoto | |

| Merrick D. Okamoto, | |

| Chairman of the Board of Directors |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The 2021 Annual Meeting of shareholders (the “Annual Meeting”) of Marathon Digital Holdings, Inc. (the “Company”) will be held at the Company’s offices at 1180 N. Town Center Drive, Suite 100, Las Vegas, Nevada 89144, on 8:00 AM local time on Friday, August 6, 2021, at Wynn Las Vegas and Encore, 3131 Las Vegas Blvd, Las Vegas, NV 89109. At the Annual Meeting, the holders of the Company’s outstanding common stock will act on the following matters:

| 1. | To approve an increase in the number of shares available in the Company’s 2018 Equity Incentive Plan by 7,500,000 shares; |

| 2. | Approve the election of four Class I Directors for a three-year term expiring in 2024. |

| 3. | The ratification of the appointment of RBSM, LLP, as the Company’s independent registered certified public accountant for the fiscal year ended December 31, 2021. |

| 4. | To transact such other business as may be properly brought before the 2021 Annual Meeting and any adjournments thereof. |

Shareholders of record at the close of business on June 14, 2021 are entitled to notice of and to vote at the 2021 Annual Meeting and any postponements or adjournments thereof.

It is hoped you will be able to attend the 2021 Annual Meeting, but in any event, please vote according to the instructions on the enclosed proxy as promptly as possible. If you are able to be present at the 2021 Annual Meeting, you may revoke your proxy and vote in person.

| Dated: June 16, 2021 | By Order of the Board of Directors: |

| /s/ Merrick D. Okamoto | |

| Merrick D. Okamoto, | |

| Chairman of the Board of Directors |

MARATHON DIGITAL HOLDINGS, INC.

1180 N. Town Center Drive, Suite 100

Las Vegas, NV 89144

ANNUAL MEETING OF SHAREHOLDERS

To Be Held August 6, 2021

PROXY STATEMENT

The Board of Directors of Marathon Digital Holdings, Inc. (the “Company”) is soliciting proxies from its shareholders to be used at the 2021 Annual Meeting of shareholders (the “Annual Meeting”) to be held at the Company’s offices at 1180 N. Town Center Drive, Suite 100, Las Vegas, Nevada 89144, on August 6, 2021, beginning at 8:00 AM local time, and at any postponements or adjournments thereof. This proxy statement contains information related to the Annual Meeting. This proxy statement and the accompanying form of proxy are first being sent to shareholders on or about June 23, 2021.

ABOUT THE ANNUAL MEETING

Why am I receiving this proxy statement?

You are receiving this proxy statement because you have been identified as a shareholder of the Company as of the record date which our Board has determined to be June 14, 2021, and thus you are entitled to vote at the Company’s 2021 Annual Meeting. This document serves as a proxy statement used to solicit proxies for the 2021 Annual Meeting. This document and the Appendixes hereto contain important information about the 2021 Annual Meeting and the Company, and you should read it carefully.

Who is entitled to vote at the 2021 Annual Meeting?

Only shareholders of record as of the close of business on the record date will be entitled to vote at the 2021 Annual Meeting. As of the close of business on the record date, there were 99,634,123 shares of our common stock issued and outstanding and entitled to vote. Each common stock shareholder is entitled to one vote for each share of our common stock held by such shareholder on the record date on each of the proposals presented in this proxy statement.

May I vote in person?

If you are a shareholder of the Company and your shares are registered directly in your name with the Company’s transfer agent, Equity Stock Transfer, you are considered, with respect to those shares, the shareholder of record, and the proxy materials and proxy card, attached hereto as Appendix A, are being sent directly to you by the Company. If you are a shareholder of record, you may attend the 2021 Annual Meeting to be held on August 6, 2021, and vote your shares in person, rather than signing and returning your proxy.

If your shares of common stock are held by a bank, broker or other nominee, you are considered the beneficial owner of shares held in “street name,” and the proxy materials are being forwarded to you together with a voting instruction card by such bank, broker or other nominee. As the beneficial owner, you are also invited to attend the 2021 Annual Meeting. Since a beneficial owner is not the shareholder of record, you may not vote these shares in person at the 2021 Annual Meeting unless you obtain a proxy from your broker issued in your name giving you the right to vote the shares at the 2021 Annual Meeting.

Photo identification may be required (a valid driver’s license, state identification or passport). If a shareholder’s shares are registered in the name of a broker, trust, bank or other nominee, the shareholder must bring a proxy or a letter from that broker, trust, bank or other nominee or their most recent brokerage account statement that confirms that the shareholder was a beneficial owner of shares of stock of the Company as of the Record Date. Since seating is limited, admission to the meeting will be on a first-come, first-served basis.

Cameras (including cell phones with photographic capabilities), recording devices and other electronic devices will not be permitted at the meeting.

If my Company shares are held in “street name” by my broker, will my broker vote my shares for me?

Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters, as discussed further below. Your broker will not be able to vote your shares of common stock without specific instructions from you for “non-routine” matters.

If your shares are held by your broker or other agent as your nominee, you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker or other agent to vote your shares.

What are “broker non-votes”?

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” “Broker non-votes” occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. These matters are referred to as “non-routine” matters. Since brokers are permitted to vote on “routine” matters without instructions from the beneficial owner, “broker non-votes” do not occur with respect to “routine” matters.

All matters other than Proposal 2 are “routine” matters.

The determination of “routine” and “non-routine” matters is determined by brokers and those firms responsible to tabulate votes cast by beneficial owners of shares held in street name and other nominees. Firms casting such votes have generally been guided by rules of the New York Stock Exchange when determining if proposals are considered “routine” or “non-routine”. When a matter to be voted on is the subject of a contested solicitation, banks, brokers and other nominees do not have discretion to vote your shares with respect to any proposal to be voted on.

How do I cast my vote if I am a shareholder of record?

The link for the material will be posted on our transfer agent’s website: https://www.equitystock.com/shareholders/proxy-voting/marathon-patent-group. If you are a shareholder with shares registered in your name with the Company’s transfer agent, Equity Stock Transfer, on the record date, you may vote in person at the 2021 Annual Meeting or vote by proxy by fax at (646) 201-9006 ATTN: Shareholder Services OR EMAIL: proxy@equitystock.com or internet at proxyvote.equitystock.com or by mail. Whether or not you plan to attend the 2021 Annual Meeting, please vote as soon as possible to ensure your vote is counted. You may still attend the 2021 Annual Meeting and vote in person even if you have already voted by proxy. For more detailed instructions on how to vote using one of these methods, please see the form of proxy card attached to this Schedule 14A and the information below.

| ● | To vote in person. You may attend the 2021 Annual Meeting and the Company will give you a ballot when you arrive. | |

| ● | To vote by proxy by fax or internet. If you have fax or internet access, you may submit your proxy by following the instructions provided in this proxy statement, or by following the instructions provided with your proxy materials and on the enclosed proxy card or voting instruction card. | |

| ● | To vote by proxy by mail. You may submit your proxy by mail by completing and signing the enclosed proxy card and mailing it in the enclosed envelope. Your shares will be voted as you have instructed. |

How do I cast my vote if I am a beneficial owner of shares registered in the name of any broker or bank?

If you are a beneficial owner of shares registered in the name of your broker, bank, dealer or other similar organization, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from the Company. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or other agent. To vote in person at the 2021 Annual Meeting, you must obtain a valid proxy from your broker or other agent. Follow the instructions from your broker or other agent included with these proxy materials or contact your broker or bank to request a proxy form.

What constitutes a quorum for purposes of the 2021 Annual Meeting?

The presence at the meeting, in person or by proxy, of the holders of at least a majority of the issued and outstanding shares entitled to vote are present or represented by proxy at the Annual Meeting permitting the conduct of business at the meeting. On the record date, there were 99,634,123 shares of Common Stock and 0 shares of preferred stock issued and outstanding and entitled to vote. Accordingly, the holders of 49,817,062 shares eligible to vote must be present at the 2021 Annual Meeting to have a quorum. Proxies received but marked as abstentions or broker non-votes, if any, will be included in the calculation of the number of votes considered to be present at the meeting for purposes of a quorum. Your shares will be counted toward the quorum at the 2021 Annual Meeting only if you vote in person at the meeting, you submit a valid proxy or your broker, bank, dealer or similar organization submits a valid proxy.

Can I change my vote?

Yes. Any shareholder of record voting by proxy has the right to revoke their proxy at any time before the polls close at the 2021 Annual Meeting by sending a written notice stating that they would like to revoke his, her or its proxy to the Corporate Secretary of the Company; by providing a duly executed proxy card bearing a later date than the proxy being revoked; or by attending the 2021 Annual Meeting and voting in person. Attendance alone at the 2021 Annual Meeting will not revoke a proxy. If a shareholder of the Company has instructed a broker to vote its shares of common stock that are held in “street name,” the shareholder must follow directions received from its broker to change those instructions.

Who is soliciting this proxy – Who is paying for this proxy solicitation?

We are soliciting this proxy on behalf of our Board of Directors. The Company will bear the costs of and will pay all expenses associated with this solicitation, including the printing, mailing and filing of this proxy statement, the proxy card and any additional information furnished to shareholders. In addition to mailing these proxy materials, certain of our officers and other employees may, without compensation other than their regular compensation, solicit proxies through further mailing or personal conversations, or by telephone, facsimile or other electronic means. We will also, upon request, reimburse banks, brokers, nominees, custodians and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of our stock and to obtain proxies.

What vote is required to approve each item?

The following votes are required to approve each proposal:

| ● | Proposal 1 - To approve the increase in shares available under the 2018 Equity Incentive Plan, “FOR” votes from the holders of a majority of the shares of the Company’s common stock present in person or represented by proxy and entitled to vote on the matter at the 2021 Annual Meeting are required to approve this proposal. |

| ● | Proposal 2 - Election of the four Class I directors requires a plurality (the four nominees receiving the most “FOR” votes) of the votes cast at the 2021 Annual Meeting. |

| ● | Proposal 3 - The ratification of the appointment of RBSM, LLP, as the Company’s independent registered certified public accountant for the fiscal year ended December 31, 2021. “FOR” votes from the holders of a majority of the shares of the Company’s common stock present in person or represented by proxy and entitled to vote on the matter at the 2021 Annual Meeting are required to approve this proposal. |

| ● | Proposal 4 – To transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. “FOR” votes from the holders of a majority of the shares of the Company’s common stock present in person or represented by proxy and entitled to vote on the matter at the 2021 Annual Meeting are required to approve this proposal. |

Will My Shares Be Voted If I Do Not Return My Proxy Card?

If your shares are registered in your name or if you have stock certificates, they will not be voted if you do not return your proxy card by mail or vote at the Annual Meeting. If your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter, or because your broker chooses not to vote on a matter for which it does have discretionary voting authority, this is referred to as a “broker non-vote.” The New York Stock Exchange (“NYSE”) has rules that govern brokers who have record ownership of listed company stock (including stock such as ours that is listed on The Nasdaq Capital Market) held in brokerage accounts for their clients who beneficially own the shares. Under these rules, brokers who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters (“routine matters”), but do not have the discretion to vote uninstructed shares as to certain other matters (“non-routine matters”). Neither proposal herein is a routine matter.

If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares the bank, broker or other nominee does not have authority to vote your unvoted shares on any of the other proposals submitted to shareholders for a vote at the Annual Meeting. We encourage you to provide voting instructions. This ensures your shares will be voted at the Annual Meeting in the manner you desire.

Can I access these proxy materials on the Internet?

Yes. The Notice of Annual Meeting, and this proxy statement and the Appendix hereto are available for viewing, printing, and downloading at https://ir.marathonpg.com/sec-filings. All materials will remain posted on https://ir.marathonpg.com/sec-filings at least until the conclusion of the meeting.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please vote your shares applicable to each proxy card and voting instruction card that you receive.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K filed with the Securities and Exchange Commission within four business days of the 2021 Annual Meeting.

What interest do officers and directors have in matters to be acted upon?

No person who has been a director or executive officer of the Company at any time since the beginning of our fiscal year, and no associate of any of the foregoing persons, has any substantial interest, direct or indirect, in any matter to be acted upon, other than the fact that our officers and directors may become the recipients of further grants under our 2018 Equity Incentive Plan which is the subject of Proposal No. 1 to be voted upon in this proxy statement.

Who can provide me with additional information and help answer my questions?

If you would like additional copies, without charge, of this proxy statement or if you have questions about the proposals being considered at the 2021 Annual Meeting, including the procedures for voting your shares, you should contact Simeon Salzman, the Company’s CFO, by telephone at 1 702 945-2773.

Householding of Annual Disclosure Documents

The SEC previously adopted a rule concerning the delivery of annual disclosure documents. The rule allows us or brokers holding our shares on your behalf to send a single set of our annual report and proxy statement to any household at which two or more of our shareholders reside, if either we or the brokers believe that the shareholders are members of the same family. This practice, referred to as “householding,” benefits both shareholders and us. It reduces the volume of duplicate information received by you and helps to reduce our expenses. The rule applies to our annual reports, proxy statements and information statements. Once shareholders receive notice from their brokers or from us that communications to their addresses will be “householded,” the practice will continue until shareholders are otherwise notified or until they revoke their consent to the practice. Each shareholder will continue to receive a separate proxy card or voting instruction card.

Those shareholders who either (i) do not wish to participate in “householding” and would like to receive their own sets of our annual disclosure documents in future years or (ii) who share an address with another one of our shareholders and who would like to receive only a single set of our annual disclosure documents should follow the instructions described below:

| ● |

shareholders whose shares are registered in their own name should contact our transfer agent, Equity Stock Transfer LLC, and inform them of their request by calling them at (212) 575-5757 or writing them at 237 W. 37thStreet, Suite 601, New York, NY 10018. |

| ● | shareholders whose shares are held by a broker or other nominee should contact such broker or other nominee directly and inform them of their request, shareholders should be sure to include their name, the name of their brokerage firm and their account number. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

SECURITY OWNERSHIP OF CERTAIN OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding beneficial ownership of our Common Stock and other securities exercisable in the next 60 days as of June 14, 2021: (i) by each of our directors, (ii) by each of the named executive officers, (iii) by all of our executive officers and directors as a group, and (iv) by each person or entity known by us to beneficially own more than five percent (5%) of any class of our outstanding shares. As of June 14, 2021, there were 99,484,123 shares of our common stock outstanding.

| Name and Address of Beneficial Owner | Common Stock | RSUs | Warrants | Total | Percentage of Common Stock (%) | |||||||||||||||

| Officers and Directors | ||||||||||||||||||||

| Merrick

Okamoto (Executive Chairman) (1) |

4,163,859 | - | - | 4,163,859 | 4.19 | % | ||||||||||||||

| Fred Thiel (CEO) (2) | 76,436 | 39,897 | - | 116,333 | * | % | ||||||||||||||

| James Crawford (COO) | 200,036 | - | - | 200,036 | * | |||||||||||||||

| Simeon Salzman (CFO) | 74,366 | - | - | 74,366 | * | |||||||||||||||

| Kevin DeNuccio (3) | 38,259 | 33,684 | - | 71,943 | * | |||||||||||||||

| Peter Benz (4) | 43,060 | 73,059 | - | 116,119 | * | |||||||||||||||

| Georges Antoun | 0 | - | - | 0 | * | |||||||||||||||

| Jay Leupp | 0 | - | - | 0 | * | |||||||||||||||

| All Directors and Executive Officers (eight persons) | 4,596,016 | 146,640 | - | 4,742,656 | 4.62 | % | ||||||||||||||

| * Less than 1% | ||||||||||||||||||||

| As of June 14, 2021, there were 99,484,123 shares of our common stock outstanding. |

| (1) Mr. Okamoto is owed 2,547,392 restricted stock units which would vesting immediately upon issuance due to the 2020 Compensation Awards. |

| (2) Mr. Thiel also owned 39,897 restricted stock units which started vesting in equal quarterly amounts commencing on January 1, 2021. |

| (3) Mr. DeNuccio also owned 33,684 restricted stock units which started vesting in equal quarterly amounts commencing on January 1, 2021. |

| (4) Mr. Benz also owned 73,059 restricted stock units which started vesting in equal quarterly amounts commencing on January 1, 2021. Due to Mr. Benz resignation from the Board, the RSUs due vested immediately. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table presents information with respect to our officers, directors and significant employees as of the date of this 14A:

| Name and Address | Age | Date

First Elected or Appointed |

Position(s) | |||

| Merrick Okamoto | 60 | August 13, 2017 | Executive Chairman and Director | |||

| Simeon Salzman | 40 | October 19, 2020 | Chief Financial Officer | |||

| James Crawford | 46 | March 1, 2013 | Chief Operating Officer | |||

| Fred Thiel | 60 | April 24, 2018 | Chief Executive Officer and Director | |||

| Georges Antoun | 58 | May 20, 2021 | Director | |||

| Jay Leupp | 57 | May 20, 2021 | Director | |||

| Kevin DeNuccio | 62 | January 19, 2021 | Director |

Background of officers and directors

The following is a brief account of the education and business experience during at least the past five years of our officers and directors, indicating each person’s principal occupation during that period, and the name and principal business of the organization in which such occupation and employment were carried out.

Merrick D. Okamoto – Executive Chairman and Director

Mr. Merrick D. Okamoto, age 60, serves as the President at Viking Asset Management which he co-founded in 2002. Mr. Okamoto is responsible for research, due diligence, and structuring potential investment opportunities. He has been instrumental in providing capital to over 200 private and public companies. He is also responsible for the firm’s trading operations. Prior to Viking, Mr. Okamoto co-founded TradePortal.com, Inc. in 1999 and served as its President until 2001. He was instrumental in developing the proprietary Trade Matrix software platform offered by TradePortal Securities. Mr. Okamoto’s negotiations were key in selling a minority stake in TradePortal.com Inc. to Thomson Financial. Prior to that, he held Vice President positions with Shearson Lehman Brothers, Prudential Securities, and Paine Webber.

Simeon Salzman - Chief Financial Officer

Mr. Simeon Salzman, age 40, has served as the Chief Financial Officer and Senior Vice President of the Las Vegas Monorail Company, a private non-profit 501c(4) entity, since July 2018. The Las Vegas Monorail Company operates a driverless monorail transit system that carries approximately 4,600,000 passengers annually over a 3.9 mile elevated track. There Mr. Salzman was responsible for overseeing all financial functions including audit, treasury and corporate finance. In addition, he was responsible for internal control compliance and management strategy.

Prior to the Las Vegas Monorail Company and from May 2015 to July 2018, Mr. Salzman served as the Chief Financial Officer for Wendoh Media and Corner Bar Management for over three years. Wendoh Media operated a weekly publication, a video editing entity, and a digital advertising entity. Corner Bar Management operates four different bars and restaurants in Downtown Las Vegas. Using his previous experience as the Corporate Controller for various managed nightlife, lounges and restaurants at the most prestigious Resort & Casinos on the Las Vegas Strip, Mr. Salzman was able to parlay his skill set revitalizing the various food and beverage establishments operated by Corner Bar Management in Downtown Las Vegas. Through enhanced analytical reviews, budgeting, internal control implementation and reducing overhead, Mr. Salzman was able to save over $1.4 million in aggregate costs and generate EBITDA of over 25% for eight consecutive quarters.

Mr. Salzman previously served as the Vice President of Programs and Secretary on the Board of Director’s for Financial Executives International (FEI). Financial Executives International connects senior-level financial executives by defining the profession, exchanging ideas about best practices, educating members and others while working with the government to improve the general economy. He also currently serves as the Treasurer on the Board of Directors of his local neighborhood HOA. Mr. Salzman holds a Bachelor of Science in Accounting and a Bachelor of Arts in Criminal Justice & Criminology from the University of Maryland, College Park. He is a Certified Public Accountant.

James Crawford - Chief Operating Officer

Mr. Crawford, age 46, was a founding member of Kino Interactive, LLC, and of AudioEye, Inc. Mr. Crawford’s experience as an entrepreneur spans the entire life cycle of companies from start-up capital to compliance officer and director of reporting public companies. Prior to his involvement as Chief Operating Officer of the Company, Mr. Crawford served as a director and officer of Augme Technologies, Inc. beginning March 2006, and assisted the company in maneuvering through the initial challenges of acquisitions executed by the company through 2011 that established the company as a leading mobile marketing company in the United States. Mr. Crawford is experienced in public company finance and compliance functions. He has extensive experience in the area of intellectual property creation, management and licensing. Mr. Crawford also served on the board of directors Modavox and Augme Technologies, and as founder and managing member of Kino Digital, Kino Communications, and Kino Interactive.

Fred Thiel – Chief Executive Officer and Director

Mr. Thiel, age 60, was named our CEO on April 26, 2021. He was the Chairman of SPROCKET, INC. from June 2017 through 2020, a Blockchain/Cryptocurrency technology and financial services company whose mission is to reduce the risk and friction of cryptocurrency trading across marketplaces, regions and exchanges by establishing a federation of exchanges that together create a single aggregated global trading market place with large scale liquidity, rapid execution, minimal counter-party risk, and price transparency. From January 2013 until November 2015, Mr. Thiel served as a director of Local Corporation, which was a NASDAQ listed entity which was a leader in on-line local search and digital media, mobile search monetization and programmatic retargeting markets. He served as Chairman of the Board of LOCAL from January 2014 to November 2015 and as its Chief Executive Officer from May 2014 to November 2015. Mr. Thiel has been the principal of Thiel Advisors Inc. since 2013. Thiel Advisors is a boutique advisory firm providing PE and VC firms, as well as public and private company boards of director, with deep technology industry operating expertise and strategic advisory services.

Georges Antoun - Director

Mr. Antoun, age 58, brings to Marathon over 30 years of operational and technical experience, having served in various leadership positions at several global technology companies, including as a member of the board of directors of two publicly traded companies: Ruckus Wireless, Inc. and Violin Memory, Inc. He currently serves as the president of First Solar where he was chief operating officer before being appointed to president, U.S. in July 2015. Prior to joining First Solar, Mr. Antoun served as a venture partner at Technology Crossover Ventures (“TCV”), a private equity and venture firm, which he joined in July 2011. Before joining TCV, he was the head of product area IP & broadband networks for Ericsson. Mr. Antoun joined Ericsson in 2007, when Ericsson acquired Redback Networks, a telecommunications equipment company, where Mr. Antoun served as the senior vice president of worldwide sales & operations. After the acquisition, Mr. Antoun was promoted to chief executive officer of the Redback Networks subsidiary. Prior to Redback Networks, Mr. Antoun spent five years at Cisco Systems, where he served as vice president of worldwide systems engineering and field marketing, vice president of worldwide optical operations, and vice president of carrier sales. Prior to Cisco, he was the director of systems engineering at Newbridge Networks, a data and voice networking company. Mr. Antoun started his career as a member of the technical staff at NYNEX (now Verizon Communications), where he was part of the company’s science and technology division. Mr. Antoun earned a Bachelor of Science degree in engineering from the University of Louisiana at Lafayette and a master’s in information systems engineering from NYU Poly. The Company has determined he is well suited to serve as a director due to his longstanding technical and operational expertise with global technology companies.

Kevin DeNuccio - Director

Mr. DeNuccio, age 62, is the Founder and General Partner of Wild West Capital LLC since 2012 where he focused on angel investments, primarily in SAAS software start-ups. He brings to Marathon more than 25 years of experience as a chief executive, global sales leader, public and private board member, and more than a dozen angel investments, managing and growing leading technology businesses. He served in senior executive positions with Verizon, Cisco Systems, Ericsson, Redback Networks, Wang Laboratories and Unisys Corporation. The Company has determined that Mr. DeNuccio is suited to serve on the Board due to his long standing public company, finance and “high tech” experience.

Jay Leupp - Director

Mr. Leupp, age 57, is the managing partner of Terra Firma Asset Management, LLC. Prior to co-founding Terra Firma, Mr. Leupp served as a managing director in various roles at Lazard Asset Management, Grubb & Ellis Alesco Global Advisors, RBC Capital Markets and Robertson Stephens & Co. During his career, he has also held positions at The Staubach Company, Trammell Crow Company, and KPMG Peat Marwick. Mr. Leupp is also a member of the American Institute of Certified Public Accountants (AICPA) and serves on the boards of both non-profit and corporate organizations. Mr. Leupp earned a Bachelor of Science in business administration from Santa Clara University, and an MBA from Harvard Business School. The Company has determined he is well suited to serve on its Board of Directors due to his extensive audit and finance expertise.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions and also to other employees. Our Code of Business Conduct and Ethics can be found on the Company’s website at www.marathonpg.com.

Family Relationships

There are no family relationships between any of our directors, executive officers or directors.

Involvement in Certain Legal Proceedings

During the past ten years, none of our officers, directors, promoters or control persons have been involved in any legal proceedings as described in Item 401(f) of Regulation S-K.

Term of Office

Our Board of Directors is comprised of five directors, of which all five seats are currently occupied, and is divided among three classes, Class I, Class II and Class III. Class I directors will serve until the 2024 annual meeting of stockholders and until their respective successors have been duly elected and qualified, or until such director’s earlier resignation, removal or death. Class II directors, will serve until the 2022 annual meeting of stockholders and until their respective successors have been duly elected and qualified, or until such director’s earlier resignation, removal or death. All officers serve at the pleasure of the Board. Class III directors will serve until the 2023 annual meeting of stockholders and until their respective successors have been duly elected and qualified, or until such director’s earlier resignation, removal or death.

Director Independence

Messrs. Antoun, DeNuccio and Leupp are “independent” directors based on the definition of independence in the listing standards of the NASDAQ Stock Market LLC (“NASDAQ”).

Committees of the Board of Directors

Our Board has established three standing committees: an audit committee, a nominating and corporate governance committee and a compensation committee, which are described below. Members of these committees are elected annually at the regular board meeting held in conjunction with the annual stockholders’ meeting. The charter of each committee is available on our website at www.marathonpg.com.

Audit Committee

The Audit Committee members are currently Messrs. Antoun, DeNuccio and Leupp, with Mr. Leupp as Chairman. The Audit Committee has authority to review our financial records, deal with our independent auditors, recommend to the Board policies with respect to financial reporting, and investigate all aspects of our business. All of the members of the Audit Committee currently satisfy the independence requirements and other established criteria of NASDAQ.

The Audit Committee Charter is available on the Company’s website at http://www.marathondh.com/. The Audit Committee has sole authority for the appointment, compensation and oversight of the work of our independent registered public accounting firm, and responsibility for reviewing and discussing with management and our independent registered public accounting firm our audited consolidated financial statements included in our Annual Report on Form 10-K, our interim financial statements and our earnings press releases. The Audit Committee also reviews the independence and quality control procedures of our independent registered public accounting firm, reviews management’s assessment of the effectiveness of internal controls, discusses with management the Company’s policies with respect to risk assessment and risk management and will review the adequacy of the Audit Committee charter on an annual basis.

Nominating and Governance Committee

The Nominating and Corporate Governance Committee members are currently Messrs. DeNuccio, Antoun and Leupp, with Mr. Antoun as Chairman. The Nominating and Corporate Governance Committee has the following responsibilities: (a) setting qualification standards for director nominees; (b) identifying, considering and nominating candidates for membership on the Board; (c) developing, recommending and evaluating corporate governance standards and a code of business conduct and ethics applicable to the Company; (d) implementing and overseeing a process for evaluating the Board, Board committees (including the Committee) and overseeing the Board’s evaluation of the Chairman and Chief Executive Officer of the Company; (e) making recommendations regarding the structure and composition of the Board and Board committees; (f) advising the Board on corporate governance matters and any related matters required by the federal securities laws; and (g) assisting the Board in identifying individuals qualified to become Board members; recommending to the Board the director nominees for the next annual meeting of shareholders; and recommending to the Board director nominees to fill vacancies on the Board.

The Nominating and Governance Committee Charter is available on the Company’s website at http://www.marathondh.com/. The Nominating and Governance Committee determines the qualifications, qualities, skills, and other expertise required to be a director and to develop, and recommend to the Board for its approval, criteria to be considered in selecting nominees for director (the “Director Criteria”); identifies and screens individuals qualified to become members of the Board, consistent with the Director Criteria. The Nominating and Governance Committee considers any director candidates recommended by the Company’s shareholders pursuant to the procedures described in the Company’s proxy statement, and any nominations of director candidates validly made by shareholders in accordance with applicable laws, rules and regulations and the provisions of the Company’s charter documents. The Nominating and Governance Committee makes recommendations to the Board regarding the selection and approval of the nominees for director to be submitted to a shareholder vote at the Annual Meeting of shareholders, subject to approval by the Board.

Compensation Committee

The Compensation Committee oversees our executive compensation and recommends various incentives for key employees to encourage and reward increased corporate financial performance, productivity and innovation. Its members are currently Messrs. DeNuccio, Leupp and Antoun with Mr. DeNuccio as Chairman. All of the members of the Compensation Committee currently satisfy the independence requirements and other established criteria of NASDAQ.

The Compensation Committee Charter is available on the Company’s website at http://www.marathondh.com/. The Compensation Committee is responsible for: (a) assisting our Board in fulfilling its fiduciary duties with respect to the oversight of the Company’s compensation plans, policies and programs, including assessing our overall compensation structure, reviewing all executive compensation programs, incentive compensation plans and equity-based plans, and determining executive compensation; and (b) reviewing the adequacy of the Compensation Committee charter on an annual basis. The Compensation Committee, among other things, reviews and approves the Company’s goals and objectives relevant to the compensation of the Chief Executive Officer, evaluate the Chief Executive Officer’s performance with respect to such goals, and set the Chief Executive Officer’s compensation level based on such evaluation. The Compensation Committee also considers the Chief Executive Officer’s recommendations with respect to other executive officers and evaluates the Company’s performance both in terms of current achievements and significant initiatives with long-term implications. It assesses the contributions of individual executives and recommend to the Board levels of salary and incentive compensation payable to executive officers of the Company; compares compensation levels with those of other leading companies in similar or related industries; reviews financial, human resources and succession planning within the Company; recommend to the Board the establishment and administration of incentive compensation plans and programs and employee benefit plans and programs; recommends to the Board the payment of additional year-end contributions by the Company under certain of its retirement plans; grants stock incentives to key employees of the Company and administer the Company’s stock incentive plans; and reviews and recommends for Board approval compensation packages for new corporate officers and termination packages for corporate officers as requested by management.

Changes in Nominating Procedures

None.

Board Leadership Structure and Role in Risk Oversight

Although we have not adopted a formal policy on whether the Chairman and Chief Executive Officer positions should be separate or combined, we have traditionally determined that it is in the best interests of the Company and its shareholders to no longer combine these roles.

Our Board is primarily responsible for overseeing our risk management processes. The Board receives and reviews periodic reports from management, auditors, legal counsel, and others, as considered appropriate regarding the Company’s assessment of risks. The Board focuses on the most significant risks facing the Company and our general risk management strategy, and also ensures that risks undertaken by us are consistent with the Board’s risk parameters. While the Board oversees the Company, our management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing the Company and that our board leadership structure supports this approach.

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of Exchange Act requires our executive officers and directors and persons who beneficially own more than 10% of a registered class of our equity securities to file with the Commission initial statements of beneficial ownership, statements of changes in beneficial ownership and annual statement of changes in beneficial ownership with respect to their ownership of the Company’s securities, on Form 3, 4 and 5 respectively. Executive officers, directors and greater than 10% shareholders are required by the Securities and Exchange Commission regulations to furnish our Company with copies of all Section 16(a) reports they file.

Based solely on our review of the copies of such reports received by us, and on written representations by our officers and directors regarding their compliance with the applicable reporting requirements under Section 16(a) of the Exchange Act and without conducting any independent investigation of our own, we believe that with respect to the fiscal year ended December 31, 2020, our officers and directors, and all of the persons known to us to beneficially own more than 10% of our common stock filed all required reports on a timely basis.

EXECUTIVE COMPENSATION

The following summary compensation table sets forth information concerning compensation for services rendered in all capacities during 2020 and 2019 awarded to, earned by or paid to our executive officers or most highly paid individuals. The value attributable to any option awards and stock awards reflects the grant date fair values of stock awards calculated in accordance with FASB Accounting Standards Codification Topic 718. As described further in “Note 5 — Stockholders’ Equity - Common Stock Options” in our Notes to Consolidated Financial Statements, the assumptions made in the valuation of these option awards and stock awards is set forth therein.

| Name and Principal Position | Year | Salary | Bonus Awards | Stock Awards | Option Awards | Non-Equity Plan Compensation | Nonqualified Deferred Earnings | All Other Compensation | Total | |||||||||||||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||||||||||||

| Merrick Okamoto (1) | 2020 | 368,715 | 2,000,000 | - | 391,706 | - | - | - | 2,760,421 | |||||||||||||||||||||||||||

| CEO | 2019 | 352,406 | - | - | - | - | - | - | 352,406 | |||||||||||||||||||||||||||

| David Lieberman (2) | 2020 | 170,414 | 54,000 | 220,500 | - | - | - | 444,914 | ||||||||||||||||||||||||||||

| Former CFO & Director | 2019 | 181,238 | - | - | 29,666 | - | - | - | 210,904 | |||||||||||||||||||||||||||

| James Crawford (3) | 2020 | 127,441 | 160,788 | 52,811 | - | - | - | 341,040 | ||||||||||||||||||||||||||||

| COO | 2019 | 120,900 | - | - | 14,833 | - | - | - | 135,733 | |||||||||||||||||||||||||||

| Simeon Salzman (6) | 2020 | 200,000 | 40,000 | - | - | - | - | - | 240,000 | |||||||||||||||||||||||||||

| CFO | 2019 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

Merrick Okamoto entered into a new employment agreement on January 1, 2021 which replaced his prior employment agreement.

David Lieberman retired on October 19, 2020 terminating his employment with the Company.

James Crawford entered into a new employment agreement on January 1, 2021 which replaced his prior employment agreement.

Simeon Salzman entered into an employment agreement on October 19, 2020 as the Chief Financial Officer.

Employment Agreements

On October 11, 2018, we entered into a 2-year Employment Agreement, subject to successive one year extensions, with Merrick Okamoto, pursuant to which Mr. Okamoto will serve as the Executive Chairman and Chief Executive Officer of the Company. Pursuant to the terms of the Agreement, Mr. Okamoto shall receive a base salary at an annual base salary of $350,000 (subject to annual 3% cost of living increase) and an annual bonus up to 100% of base salary as determined by the Compensation Committee or the Board. As further consideration for Mr. Okamoto’s services, we agreed to issue Mr. Okamoto 10-year stock options to purchase 1,250,000 shares of Common Stock, with a strike price of $2.32 per share, vesting 50 % on the date of grant and 25% on each 6 months anniversary of the date of grant.

On October 19, 2020, the Company entered into an Executive Employment Agreement with Mr. Salzman (the “Agreement”). The Agreement has a term of two years and automatically renews for successive one year terms unless either party provides notice of nonrenewal at least 90 days prior to the end of the initial term or any renewal term. Mr. Salzman’s annual base salary is $200,000 with bonuses at the discretion of the Company’s Board of Directors. Mr. Salzman may also receive a grant of restricted stock units, and any such grant shall vest in four equal amounts on the date of grant and the three successive three month anniversaries thereof. In the event of a change in control, all RSUs vest immediately. Mr. Salzman received a signing bonus of $25,000 in lieu of a base pay increase during the second year of the Agreement. Mr. Salzman is entitled to 30 paid vacation days per year and is entitled to participate in all Company benefit plans per standard Company policy.

Upon any termination of the Agreement, Mr. Salzman is entitled to compensation and reimbursement of expenses through the date of termination as well as payment for any accrued and unpaid vacation days. If the termination is other than for cause, Mr. Salzman’s outstanding RSUs shall immediately vest. Upon a termination not for cause by the Company or by Mr. Salzman with good reason or within 180 days of a change in control, he shall receive the greater of his remaining base salary for the remaining term of the Agreement and 12 months base salary plus benefits. The Agreement contains customary and usual definitions of termination for cause and good reason.

The Annual Bonus, and any and all stock based compensation (such as options and equity awards) (collectively, the “Clawback Benefits”) shall be subject to “Clawback Rights” as follows: during the period that the Executive is employed by the Company and upon the termination of the Executive’s employment and for a period of three (3) years thereafter, if there is a restatement of any financial results from which any metrics were determined to be achieved which were the basis of the granting and calculation of such Clawback Benefits to the Executive, the Executive agrees to repay any amounts which were determined by reference to any Company financial results which were later restated (as defined below), to the extent the Clawback Benefits amounts paid exceed the Clawback Benefits amounts that would have been paid, based on the restatement of the Company’s financial information.

Directors’ Compensation

The following summary compensation table sets forth information concerning compensation for services rendered in all capacities during 2020 and 2019 awarded to, earned by or paid to our directors. The value attributable to any warrant awards reflects the grant date fair values of stock awards calculated in accordance with FASB Accounting Standards Codification Topic 718. As described further in “Note 5 — Stockholders’ Equity (Deficit) — Common Stock Warrants” in our Consolidated Financial Statements, a discussion of the assumptions made in the valuation of these warrant awards.

| Name | Year | Fees Earned or paid in cash | Stock awards | Option awards |

Non-equity incentive plan compensation |

Non-qualified deferred compensation earnings |

All other compensation |

Total | ||||||||||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||||||

| David Lieberman (1) | ||||||||||||||||||||||||||||||||

| 2020 | 1,667 | - | - | - | - | - | 1,667 | |||||||||||||||||||||||||

| 2019 | - | - | - | - | - | - | - | |||||||||||||||||||||||||

| Michael Rudolph (1) | ||||||||||||||||||||||||||||||||

| 2020 | 20,000 | - | - | - | - | - | 20,000 | |||||||||||||||||||||||||

| 2019 | 20,000 | - | - | - | - | - | 20,000 | |||||||||||||||||||||||||

| Michael Berg (1) | ||||||||||||||||||||||||||||||||

| 2020 | 20,000 | - | - | - | - | - | 20,000 | |||||||||||||||||||||||||

| 2019 | 20,000 | - | - | - | - | - | 20,000 | |||||||||||||||||||||||||

| Fred Thiel | ||||||||||||||||||||||||||||||||

| 2020 | 20,000 | - | - | - | - | - | 20,000 | |||||||||||||||||||||||||

| 2019 | 20,250 | - | - | - | - | - | 20,250 | |||||||||||||||||||||||||

| (1) | Resigned from all positions with the Company as a board member prior to the date of this Schedule 14A. |

Employee Grants of Plan Based Awards and Outstanding Equity Awards at Fiscal Year-End

On August 1, 2012, our Board and stockholders adopted the 2012 Equity Incentive Plan, pursuant to which 96,154 shares of our common stock are reserved for issuance as awards to employees, directors, consultants, advisors and other service providers, after giving effect to the Reverse Split.

On September 16, 2014, our Board adopted the 2014 Equity Incentive Plan (the “2014 Plan”), and only July 31, 2015, the shareholders approved the 2014 Plan at the Company’s annual meeting. The 2014 Plan authorizes the Company to grant stock options, restricted stock, preferred stock, other stock-based awards, and performance awards to purchase up to 125,000 shares of common stock. Awards may be granted to the Company’s directors, officers, consultants, advisors and employees. Unless earlier terminated by the Board, the 2014 Plan will terminate, and no further awards may be granted, after September 16, 2024.

On September 6, 2017, our Board adopted the 2017 Equity Incentive Plan, subsequently approved by the shareholders on September 29, 2017, pursuant to which up to 625,000 shares of our common stock, stock options, restricted stock, preferred stock, stock-based awards and other awards are reserved for issuance as awards to employees, directors, consultants, advisors and other service providers.

On January 1, 2018, our Board adopted the 2018 Equity Incentive Plan, subsequently approved by the shareholders on March 7, 2018, pursuant to which up to 2,500,000 shares of our common stock, stock options, restricted stock, preferred stock, stock-based awards and other awards are reserved for issuance as awards to employees, directors, consultants, advisors and other service providers. On January 15, 2021, the number of shares available under the Plan was increased by 5,000,000.

As of December 31, 2020, and within sixty (60) days thereafter, the following sets forth the option and stock awards to officers of the Company:

| Option Awards | Stock awards | |||||||||||||||||||||||||||||||||||

| Number of securities underlying unexercised options (1) |

Number of securities underlying unexercised options |

Equity incentive plan awards: Number of securities underlying unexercised unearned options |

Option exercise price |

Option expiration date |

Number of shares of units of stock that have not vested |

Market value of shares of units of stock that have not vested |

Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested |

Equity incentive plan awards: Market or payout value of unearned shares, units or other rights that have not vested |

||||||||||||||||||||||||||||

| (#) exercisable | (#) unexercisable | (#) unexercisable | ($) | (#) | ($) | (#) | ($) | |||||||||||||||||||||||||||||

| Merrick Okamoto | - | - | - | $ | - | - | 454,942 | 4,749,594 | 7,000,000 | 73,080,000 | ||||||||||||||||||||||||||

| James Crawford | - | - | - | $ | - | - | 61,337 | 640,358 | 57,990 | 605,416 | ||||||||||||||||||||||||||

| Simeon Salzman | - | - | - | $ | - | - | - | - | 91,324 | 953,423 | ||||||||||||||||||||||||||

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the Board or Compensation Committee of any other entity that has one or more of its executive officers serving as a member of our Board.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. These persons are required by regulation to furnish us with copies of all Section 16(a) reports that they file. We do not report on this compliance.

REPORT OF AUDIT COMMITTEE

The current members of the Audit Committee are Mr. Antoun, Mr. DeNuccio and Mr. Leupp, as Chairman.

The Audit Committee of the Board, which consists entirely of directors who meet the required independence and experience requirements of Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended, and the rules of the Nasdaq Stock Market, has furnished the following report:

The Audit Committee assists the Board in overseeing and monitoring the integrity of the Company’s financial reporting process, its compliance with legal and regulatory requirements and the quality of its internal and external audit processes. The role and responsibilities of the Audit Committee are set forth in a written charter adopted by the Board, which is available on our website at www.marathonpg.com. The Audit Committee is responsible for the appointment, oversight and compensation of our independent public accountant. The Audit Committee reviews with management and our independent public accountant our annual financial statements on Form 10-K and our quarterly financial statements on Forms 10-Q. In fulfilling its responsibilities for the financial statements for fiscal year 2018, the Audit Committee took the following actions:

| ● | reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2019 with management and our independent public accountant; | |

| ● | discussed with our independent public accountant the matters required to be discussed in accordance with the rules set forth by the Public Company Accounting Oversight Board (“PCAOB”), relating to the conduct of the audit; and | |

| ● | received written disclosures and the letter from our independent public accountant regarding its independence as required by applicable requirements of the PCAOB regarding the accountant’s communications with the Audit Committee and the Audit Committee further discussed with the accountant its independence. The Audit Committee also considered the status of pending litigation, taxation matters and other areas of oversight relating to the financial reporting and audit process that the Audit Committee determined appropriate. |

Based on the Audit Committee’s review of the audited financial statements and discussions with management and our independent public accountant, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 for filing with the SEC.

THE AUDIT COMMITTEE:

Jay Leupp (Chair)

The foregoing Audit Committee Report does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other filing of our company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent we specifically incorporate this Audit Committee Report by reference therein.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Other than disclosed herein, there were no transactions during the year ended December 31, 2020 or any currently proposed transactions, in which the Company was or is to be a participant and the amount involved exceeds $120,000, and in which any related person had or will have a direct or indirect material interest.

Corporate Governance Matters

We are committed to maintaining strong corporate governance practices that benefit the long-term interests of our shareholders by providing for effective oversight and management of the Company. Our governance policies, including a Code of Business Conduct and Ethics (“Code”) can be found on our website at www.marathonpg.com by following the link to “Investors” and then to “Governance Docs.”

Our Code of Business Conduct and Ethics, effective December 2017, applies to directors, executive officers and employees of the Company. This Code is intended to focus the directors, executive officers and employees on areas of ethical risk, provide guidance to directors, executive officers and employees to help them recognize and deal with ethical issues, provide mechanisms to report unethical conduct, and help foster a culture of honesty and accountability. Each director, executive officer and employee must comply with the letter and spirit of this Code.

We require that Directors and executive officers must be loyal to the Company and must act at all times in the best interest of the Company and its shareholders and subordinate self-interest to the corporate and shareholder good. Directors and executive officers should never use their position to make a personal profit. Directors and executive officers must perform their duties in good faith, with sound business judgment and with the care of a prudent person.

A “conflict of’ interest” occurs when the private interest of’ a director, executive officer or employee interferes in any way, or appears to interfere, with the interests of the Company as a whole. Conflicts of interest also arise when a director, executive officer or employee, or a member of his or her family, receives improper personal benefits as a result of his or her position as a director, executive officer or employee of the Company. Loans to, or guarantees of the obligations of a director, executive officer or employee or of a member of his or her family, may create conflicts of interest. Directors and executive officers must avoid conflicts of interest with the Company. Any situation that involves, or may reasonably be expected to involve, a conflict of interest with the Company must be disclosed immediately to the Chairman of the Board. This Code does not attempt to describe all possible conflicts of interest that could develop. Some of the more common conflicts from which directors and executive offices must refrain, however, are set out below.

● Relationship of Company with third-parties. Directors, executive officers and employees may not engage in any conduct or activities that are inconsistent with the Company’s best interests or that disrupt or impair the Company’s relationship with any person or entity with which the Company has or proposes to enter into a business or contractual relationship.

● Compensation from non-Company sources. Directors, executive officers and employees may not accept compensation, in any form, for services performed for the Company from any source other than the Company.

● Gifts. Directors, executive officers and employees and members of their families may not offer, give or receive gifts from persons or entities who deal with the Company in those cases where any such gift is being made in order to influence the actions of a director as a member of the Board or the actions of an executive officer as an officer of the Company, or where acceptance of the gifts would create the appearance of a conflict of interest

Directors, executive officers and employees must maintain the confidentiality of information entrusted to them by the Company or its customers, and any other confidential information about the Company that comes to them, from whatever source, in their capacity as a director, executive officer or employee, except when disclosure is authorized or required by laws or regulations. Confidential information includes all non-public information that might be of use to competitors, or harmful to the Company or its customers, if disclosed.

No waiver of any provisions of the Code for the benefit of a director or an executive officer (which includes without limitation, for purposes of this Code, the Company’s principal executive, financial and accounting officers) shall be effective unless (i) approved by the Board of Directors, and (ii) if applicable, such a waiver is promptly disclosed to the Company’s shareholders in accordance with applicable United States securities laws and/or the rules and regulations of the exchange or system on which the Company’s shares are traded or quoted, as the case may be.

PROPOSAL NO. 1

TO INCREASE THE NUMBER OF SHARES AVAILABLE FOR ISSUANCE UNDER OUR 2020 EQUITY INCENTIVE PLAN BY 7,500,000

On January 1, 2018, our Board adopted the 2018 Equity Incentive Plan (“2018 Plan”), subsequently approved by the shareholders on March 7, 2018, pursuant to which up to 5,000,000 shares of our common stock, stock options, restricted stock, preferred stock, stock-based awards and other awards are reserved for issuance as awards to employees, directors, consultants, advisors and other service providers (and have all been allocated). As of the date of this Schedule 14A, there are no shares of our common stock remaining to be issued thereunder. Upon approval of the amendment to the 2018 Plan, the total number of shares available to be issued shall be 7,500,000.

Reasons for the Proposed Amendment

The Company will utilize the increased equity incentives to retain management, employees and directors and also to ensure that management maintains a reasonable level of equity as the Company grows and utilizes equity to raise capital and perhaps engage in acquisitions of symbiotic businesses should the opportunity arise.

VOTE REQUIRED

Approval of this Proposal 1 requires the affirmative vote of the holders of a majority of the shares of common stock casting votes in person or by proxy on this proposal at the Annual Meeting. This proposal is a “non-routine” matter under NYSE Rule 452 on which brokers may not vote without instruction from beneficial owners. Abstentions and broker non-votes will have no effect on the vote on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE INCREASE IN SHARES AVAILABLE UNDER OUR 2018 PLAN.

Vote Required

The affirmative vote of a majority of the votes cast for this proposal is required to approve the increase in shares available under the Plan.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL NO. 1.

PROPOSAL NO. 2

THE ELECTION OF FOUR DIRECTORS

General

Four Class I directors are to be elected at this Annual Meeting to serve until the 2043 annual meeting of shareholders or until a successor has been elected and qualified for each. Unless otherwise instructed, the persons named in the accompanying proxy intend to vote the shares represented by the proxy for the election of the nominees listed below. Although it is not contemplated that the nominees will decline or be unable to serve as directors, in such event, proxies will be voted by the proxy holder for such other persons as may be designated by the Board, unless the Board reduces the number of directors to be elected. Election of the directors requires a plurality of the votes cast at the Annual Meeting. As the Company has grown, the Board has determined to add two additional directors as set forth below to have a full complement of independent directors.

The following table sets forth the nominees for the directors on the Board of Directors. It also provides certain information about the nominees as of the Record Date. Board committee assignments will be reviewed and reassigned as appropriate after the 2021 Annual Meeting.

Nominees for Director

| Name and Address | Age | Date First Elected or Appointed | Position(s) | |||

| Fred Thiel | 60 | April 24, 2018 | Class I Director | |||

| Kevin DeNuccio | 62 | January 19, 2019 | Class I Director | |||

| Said Ouissal | 44 | 2021 Annual Meeting | Class I Director | |||

| Sarita James | 44 | 2021 Annual Meeting | Class I Director |

Fred Thiel and Kevin DeNuccio – as set forth above under Management.

Mr. Ouissal, age 44, has been the Founder & Chief Executive Officer of Zededa since 2016, a next-generation edge software infrastructure start-up for which he raised $28.5M of VC funding, defined product and built company from inception. He is a seasoned business and product executive with extensive go-to-market experience in high-growth and dynamic turn-around environments, public and private; and a visionary product management and technology leader with deep technical background in various IT/technology domains and inventor of multiple patents. Prior roles include with Violin Memory, where he was the Senior Vice-President of Global Field Operations, Product Management & Business Development, Juniper Networks, where he was Vice-President of Product Management, Ericsson, where he was Vice-President of Strategy & Global Customer Engagement and Redback Networks, where he was the Vice-President of Global Systems Engineering. He is the inventor of two patents in the broadband access and IP networking technology area. He received a Bachelor of Science degree in Computer Science from Saxion Hogescholen in the Netherlands. The Company believes Mr. Ouissal is well suited to serve on its Board due to his technology background and expertise.

Sarita James, age 44, has been the Chief Executive Officer of Embark since 2014, responsible for management of the company with a focus on growth. Prior to Embark, she held executive roles at Citigroup, including Chief Operating Officer of Citi Ventures. She has experience building software at Microsoft Corporation where she received two patents and advising technology companies as a consultant at McKinsey & Company. Ms. James has a passion for education and the public sector. Under the Obama administration, she served as a White House Fellow and Acting Branch Chief of the Small Business Administration’s Microloan program. During Mayor Bloomberg’s second term, she ran the Strategy and Policy division for New York City Economic Development Corporation. She received a B.A. in Computer Science from Harvard College and her M.B.A. from Oxford University’s Said Business School. The Company believes Ms. James is well suited to serve as a director due to her deep expertise in software and technology.

Vote Required

The affirmative vote of a majority of votes cast for this proposal is required to approve the election of the Class I directors until the 2024 annual meeting of shareholders and until their respective successors have been duly elected and qualified, or until such director’s earlier resignation, removal or death.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL NO. 2.

PROPOSAL NO. 3

THE RATIFICATION OF THE APPOINTMENT OF RBSM LLP AS THE COMPANY’S INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2021

The Board of Directors has appointed RBSM LLP (“RBSM”) as our independent registered certified public accounting firm for the fiscal year 2021 and has further directed that the selection of RBSM be submitted to a vote of shareholders at the Annual Meeting for ratification.

As previously reported in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on January 17, 2017, on January 11, 2017, the Company notified SingerLewak LLP (“SingerLewak”) of its dismissal, effective January 11, 2017, as the Company’s independent registered public accounting firm. SingerLewak served as the auditors of the Company’s financial statements for the period from April 16, 2014 through the date of dismissal. With approval from the Board on January 5, 2017, the Company appointed BDO USA, LLP (“BDO”), effective January 11, 2017, as the Company’s independent registered public accounting firm for the Company’s fiscal year ending December 31, 2016. As previously reported in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on December 1, 2017, on November 27, 2017, the Company received notice from BDO that it resigned as the Company’s auditor effective immediately. On November 30, 2017, the Board appointed RBSM as the Company’s independent registered public accounting firm for the Company’s fiscal year ending December 31, 2017.

As described below, the shareholder vote is not binding on the Board. If the appointment of RBSM is not ratified, the Board will evaluate the basis for the shareholders’ vote when determining whether to continue the firm’s engagement, but may ultimately determine to continue the engagement of the firm or another audit firm without re-submitting the matter to shareholders. Even if the appointment of RBSM is ratified, the Board may in its sole discretion terminate the engagement of the firm and direct the appointment of another independent auditor at any time during the year if it determines that such an appointment would be in the best interests of our Company and our shareholders.

Representatives of RBSM are expected to attend the Annual Meeting, where they will be available to respond to appropriate questions and, if they desire, to make a statement.

For the years ended December 31, 2020 and 2019, we engaged RBSM LLP, as our independent auditor. For the years ended December 31, 2020 and 2019, we incurred fees for our current auditor, RBSM as set forth below:

| Fiscal Year Ended | ||||||||

| December 31, 2020 | December 31, 2019 | |||||||

| Audit fees | $ | 172,964 | $ | 187,500 | ||||

| Tax fees | - | 13,000 | ||||||

| All other fees | 112,500 | - | ||||||

Audit fees consist of fees related to professional services rendered in connection with the annual audit of our annual financial statements, review of our quarterly financial statements and review of the Company’s registration statements and other filings.

Tax fees consist of fees billed for professional services related to the preparation of our U.S. federal and state income tax returns and tax advice.

All other fees consist of fees for other miscellaneous items, including fees related to registrations statements.

All services provided by the Company’s independent auditor were approved by the Company’s Audit Committee.

Our policy is to pre-approve all audit and permissible non-audit services performed by the independent accountants. These services may include audit services, audit-related services, tax services and other services. Under our Audit Committee’s policy, pre-approval is generally provided for particular services or categories of services, including planned services, project-based services and routine consultations. In addition, the Audit Committee may also pre-approve particular services on a case-by-case basis. Our Audit Committee approved all services that our independent accountants provided to us in the past two fiscal years.

Vote Required

The affirmative vote of the majority of the votes cast at the Annual Meeting is required for the ratification of the appointment of RBSM as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021.

PROPOSAL NO. 4 - OTHER MATTERS

The Board knows of no matter to be brought before the Annual Meeting other than the matters identified in this proxy statement. However, if any other matter properly comes before the Annual Meeting or any adjournment of the meeting, it is the intention of the persons named in the proxy solicited by the Board to vote the shares represented by them in accordance with their best judgment.

ANNUAL REPORT

Upon written request to Secretary, Marathon Digital Holdings, Inc. at 1180 N. Town Center Drive, Suite 100, Las Vegas, NV 89144, we will provide without charge to each person requesting a copy of our 2020 Annual Report, including the financial statements filed therewith. We will furnish a requesting shareholder with any exhibit not contained therein upon specific request. In addition, this Proxy Statement, as well as our 2021 Annual Report, and Quarterly Report for the quarter ended March 31, 2021, are available on our Internet website at www.marathonpg.com.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| /s/ Merrick D. Okamoto | |