10-K: Annual report pursuant to Section 13 and 15(d)

Published on March 10, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For

the fiscal year ended

or

For the transition period from _______to______

(Exact Name of Registrant as Specified in Charter)

| (State or other jurisdiction of incorporation) | (Commission

File Number) |

(IRS

Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. ☒

| ☒ | Accelerated Filer | ☐ | ||

| Non-accelerated Filer | ☐ | Smaller Reporting Company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes

The

aggregate market value of the common stock, no par value, held by non-affiliates of the registrant, based on the closing sale price of

registrant’s common stock as quoted on the Nasdaq Capital Market on June 30, 2021 (the last business day of the registrant’s

most recently completed second fiscal quarter), was approximately $

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. shares of common stock are issued and outstanding as of March 9, 2022.

| 2 |

TABLE OF CONTENTS

| 3 |

MARATHON DIGITAL HOLDINGS, INC.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K and other written and oral statements made from time to time by us may contain so-called “forward-looking statements,” all of which are subject to risks and uncertainties. Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “forecasts,” “projects,” “intends,” “estimates,” and other words of similar meaning. One can identify them by the fact that they do not relate strictly to historical or current facts. These statements are likely to address our growth strategy, financial results and product and development programs. One must carefully consider any such statement and should understand that many factors could cause actual results to differ from our forward-looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed, and actual future results may vary materially.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

| ● | The uncertainty of profitability; | |

| ● | Risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; and | |

| ● | The potential economic fallout resulting from the COVID-19 outbreak and related circumstances. | |

| ● | Other risks and uncertainties related to our business plan and business strategy. |

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on our forward-looking statements. Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made, and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Information regarding market and industry statistics contained in this Annual Report on Form 10-K is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. As a result, investors should not place undue reliance on these forward-looking statements.

As used in this annual report, the terms “we”, “us”, “our”, the “Company”, “Marathon Digital Holdings, Inc.”, “Marathon”) and “MARA” mean Marathon Digital Holdings, Inc. and its subsidiaries, unless otherwise indicated.

| 4 |

PART I

ITEM 1. BUSINESS

Marathon is a digital asset technology company that mines cryptocurrencies with a focus on the blockchain ecosystem and the generation of digital assets. Marathon also acquires bitcoin when our cash, cash equivalents and short-term investments exceed current working capital requirements, and we may from time to time, subject to favorable market conditions, issue debt or equity securities to raise capital to use the proceeds to purchase bitcoin. To Marathon, the strategy is to hold bitcoin as a long term investment rather than engaging in regular trading of bitcoin or to hedge or otherwise enter into derivative contracts with respect to our bitcoin holdings, though we may sell bitcoin in future periods as needed to generate cash for treasury management and other general corporate purposes. Holding bitcoin is a strategy to act as a store of value, supported by a robust and public open source architecture, that is not linked to any country’s monetary policy and can therefore serve as a hedge against inflation. We are of the firm belief that bitcoin offers additional opportunity for appreciation in value with increasing adoption due to its limited supply. We may also explore opportunities to become involved in businesses ancillary to our bitcoin mining business as favorable market conditions and opportunities arise.

We were incorporated in the State of Nevada on February 23, 2010 under the name Verve Ventures, Inc. On December 7, 2011, we changed our name to American Strategic Minerals Corporation and were engaged in exploration and potential development of uranium and vanadium minerals business. In June 2012, we discontinued our minerals business and began to invest in real estate properties in Southern California. In October 2012, we commenced our IP licensing operations, at which time the Company’s name was changed to Marathon Patent Group, Inc. On November 1, 2017, we entered into a merger agreement with Global Bit Ventures, Inc. (“GBV”), which is focused on mining digital assets. We purchased cryptocurrency mining machines and established a data center in Canada to mine digital assets. We are expanding our activities in the mining of new digital assets, while at the same time harvesting the value of our remaining IP assets.

On June 28, 2018, our Board has determined that it is in the best interests of the Company and our shareholders to allow the Amended Merger Agreement with GBV to expire on its current termination date of June 28, 2018 without further negotiation or extension. The Board approved to issue 3,000,000 shares of our common stock to GBV as a termination fee for us cancelling the proposed merger between the two companies.

All share and per share values for all periods presented in the accompanying consolidated financial statements have been retroactively adjusted to reflect the 1:4 Reverse Split which occurred on April 8, 2019.

On September 30, 2019, the Company consummated the purchase of 6000 S-9 Bitmain 13.5 TH/s Bitcoin Antminers (“Miners”) from SelectGreen Blockchain Ltd. (the “Seller”), a British Columbia corporation, for which the purchase price was $4,086,250 or 2,335,000 shares of its common stock at a price of $1.75 per share. As a result of an exchange cap requirement imposed in conjunction with the Company’s Listing of Additional Shares application filed with Nasdaq to the transaction, the Company issued 1,276,442 shares of its common stock which represented $2,233,773 of the $4,086,250 (constituting 19.9% of the issued and outstanding shares on the date of the Asset Purchase Agreement) and upon the receipt of shareholder approval, at the Annual Shareholders Meeting to be held on November 15, 2019, the Company can issue the balance of the 1,058,558 unregistered common stock shares. The shareholders did approve the issuance of the additional shares at the Annual Shareholders Meeting. The Company has issued an additional 474,808 at $0.90 per share on December 27, 2019. On March 30, 2020, the Seller agreed to amend the total of number of shares to be issued was reduced to 2,101,500 shares and the rest of 350,250 shares was issued at $0.49 per share. There was no mining payable outstanding as of September 30, 2020.

On May 11, 2020, the Company announced the purchase of 700 M30S+ (80 TH) miners. On May 12, 2020, the Company announced the purchase 660 Bitmain S19 Pro Miners. On June 11, 2020, the Company announced the purchase of an additional 500 of the latest generation Bitmain S19 Pro Miners, bringing the Company’s total Hashrate to approximately 240 PH/s when fully deployed.

On May 20, 2020, the Company amended its note, originally dated August 31, 2017, with Bi-Coastal Consulting Defined Benefit Plan to reduce the conversion price to $0.60 per share. The current principal balance of the Note was $999,105.60 and accrued the interest was $215,411.30. The Company agreed to the reduction in the conversion price from $0.80 to $0.60 to incentivize the Note holder to convert the Note to common stock. As the Note has been fully converted to common stock, the Company has no Long-Term debt.

On July 28, 2020, the Company closed a public offering of 7,666,666 shares of common stock, including the exercise in full by the underwriter of the option to purchase an additional 999,999 shares of common stock, at a public offering price of $0.90 per share. The gross proceeds of this offering, before deducting underwriting discounts and commissions and other offering expenses payable by Marathon, were approximately $6.9 million.

On July 29, 2020, the Company announced the purchase of 700 next generation M31S+ ASIC Miners from MicroBT. in the miners arrived mid-August.

On August 13, 2020, the Company entered into a Long Term Purchase Contract with Bitmaintech PTE., LTD (“Bitmain”) for the purchase of 10,500 next generation Antminer S-19 Pro ASIC Miners. The purchase price per unit is $2,362 ($2,206 with a 6.62% discount) for a total gross purchase price of $24,801,000 (with a 6.62% discount for a discounted price of $23,159,174). The parties confirm that the total hashrate of the Antminers under this agreement shall not be less than 1,155,000 TH/s.

| 5 |

Subject to the timely payment of the purchase price, Bitmain delivered products according to the following schedule: 1,500 units on or before January 31, 2021; and 1,800 units on or before each of February 28, 2021; March 31, 2021; April 30, 2021, May 31, 2021 and June 30, 2021. As of December 31, 2021, the Company has paid the entire purchase price under this agreement and has received 10,500 units from Bitmain.

On October 23, 2020, the Company executed a contract with Bitmain to purchase an additional 10,000 next generation Antminer S-19 Pro ASIC Miners. The 2021 delivery schedule was for 2,500 units to be delivered in January, 4,500 units delivered in February and the final 3,000 units delivered in March 2021. The gross purchase price was $23,620,000.00 with 30% due upon the execution of the contract and the balance paid over the next 4 months. Subsequent to executing this agreement, due to the additional executed contracts, Bitmain applied a discount of 8.63% to the purchase price adjusting the amount due to $21,581,594.00. As of December 31, 2021, the Company has paid the entire purchase price under this agreement and has received 10,000 units from Bitmain.

On December 8, 2020, the Company executed a contract with Bitmain to purchase an additional 10,000 next generation Antminer S-19j Pro ASIC Miners, with 6,000 units delivered in August 2021, and the remaining 4,000 units delivered in September 2021. The gross purchase price is $23,770,000 with 10% of the purchase price due within 48 hours of execution of the contract, 30% due on January 14, 2021, 10% due on February 15, 2021, 30% due on June 15, 2021 and 20% due on July 15, 2021. Subsequent to executing this agreement, due to the additional executed contracts, Bitmain applied a discount of 8.63% to the purchase price adjusting the amount due to $21,718,649. As of December 31, 2021, the Company paid the entire purchase price under this agreement and has received 10,000 units from Bitmain.

On December 23, 2020, the Company executed a contract with Bitmain to purchase an additional 70,000 next generation Antminer S-19 ASIC Miners, with 7,000 units to be delivered by August 2021, 2,100 units to be delivered by September 2021, 6,500 units to be delivered by October 31, 2021, 14,700 units to be delivered by November 30, 2021, 24,500 units to be delivered by December 31, 2021 and 15,200 units to be delivered by January 31, 2022. The purchase price is $167,763,451. The purchase price for the miners shall be paid as follows: 20% within 48 hours of signing of contract; 30% on or before March 1, 2021; 4.75% on June 15, 2021; 1.76% on July 15, 2021; 4.58% on August 15, 2021; 10.19% on September 15, 2021; 17.63% on October 15, 2021 and 11.55% on November 15, 2021. As of December 31, 2021, the Company has paid the entire purchase price under this agreement and received over 40,000 units from Bitmain.

Effective December 31, 2020, The Board of Directors of Marathon Digital Holdings, Inc. (the “Company”) ratified the following arrangements approved by its Compensation Committee:

Merrick Okamoto, CEO was awarded a cash bonus of $2,000,000 which was paid before year end 2020. He was also awarded a special bonus of 1,000,000 RSUs with immediate vesting. He was given a new three-year employment agreement effective January 1, 2021 with the same salary and bonus as the prior agreement. He was also granted the following: award of 1,000,000 RSUs when the company’s market capitalization reaches and sustains a market capitalization for 30 consecutive days above $500,000,000; award of 1,000,000 RSUs priced when the company’s market capitalization reaches and sustains a market capitalization for 30 consecutive days above $750,000,000; award of 2,000,000 RSUs priced at lowest closing stock price in past 30 trading days when the company’s market capitalization reaches and sustains a market capitalization for 30 consecutive days above $1,000,000,000; and award of 2,000,000 RSUs when the company’s market capitalization reaches and sustains a market capitalization for 30 consecutive days above $2,000,000,000.

Sim Salzman, CFO, was granted a bonus payment of $40,000 in cash; and a bonus of 91,324 RSUs with immediate vesting. James Crawford, COO, was granted a bonus payment of $127,308 in cash and a stock bonus of 57,990 RSUs with immediate vesting. Furthermore, per his employment agreement, his base salary for the 2021 was increased by 3%.

Compensation for directors of the board for 2021 as follows: (i) cash compensation of $60,000 per year for each director, plus an additional $15,000 per year for each committee chair, paid 25% at the end of each calendar quarter; (ii) for existing directors, the equivalent of 54,795 RSUs; and (iii) for newly elected directors, a one-time grant of 91,324 RSUs, vesting 25% each calendar quarter during 2021. For clarification, new directors will also receive the same annual compensation as existing directors in addition to their one time grant.

On January 12, 2021, the Company also announced that it had successfully completed its previously announced $200 million shelf offering by utilizing its at-the-market (ATM) facility. As a result, the Company ended the 2020 fiscal year with $217.6 million in cash and 74,656,549 shares outstanding.

| 6 |

On January 15, 2021, Marathon Digital Holdings, Inc., a Nevada corporation (the “Company”), held an annual meeting of stockholders (the “Meeting”). As of the record date for the Meeting, 51,403,280 shares of common stock were issued and outstanding. A total of 33,981,556 shares of common stock, constituting a quorum, were present and accounted for at the Meeting. At the Meeting, the Company’s stockholders approved the following proposals:

VOTES CAST

| Common shares |

PROPOSAL #1 Increase

in Shares |

PROPOSAL #2a Election

of Merrick |

PROPOSAL #2b Election

of |

PROPOSAL #3 Ratification

of |

PROPOSAL #4 Nonbinding |

|||||||||||||||

| Yes | 10,112,531 | 12,184,952 | 12,216,945 | 32,948,526 | 11,146,174 | |||||||||||||||

| No | 2,278,676 | 464,134 | 1,093,170 | |||||||||||||||||

| Abstain | 163,325 | 369,187 | 337,194 | 567,470 | 315,663 | |||||||||||||||

| Broker Non-Vote | 21,427,024 | 21,427,417 | 21,427,417 | 1,426 | 21,426,549 | |||||||||||||||

Effective January 19, 2021, David Lieberman resigned as a director of Marathon Digital Holdings, Inc. (the “Company”). On the same date, the Company’s Board appointed Kevin DeNuccio as a director to fill the vacancy created by Mr. Lieberman’s resignation.

Mr. DeNuccio is the Founder and General Partner of Wild West Capital LLC since 2012 where he focused on angel investments, primarily in SAAS software start-ups. He brings to Marathon more than 25 years of experience as a chief executive, global sales leader, public and private board member, and more than a dozen angel investments, managing and growing leading technology businesses. He served in senior executive positions with Verizon, Cisco Systems, Ericsson, Redback Networks, Wang Laboratories and Unisys Corporation.

On January 25, 2021, the Company announced that it has purchased 4,812.66 BTC in an aggregate purchase price of $150 million.

Effective March 1, 2021, the Company changed its name to Marathon Digital Holdings, Inc.

On April 26, 2021, the Company appointed Fred Thiel as its new chief executive officer. Mr. Thiel has succeeded Merrick Okamoto, who has served as the Company’s chief executive officer since 2018, and who served as executive chairman of the board of directors following the transition until his retirement at the end of 2021.

On March 25, 2021, Marathon Digital Holdings, Inc. (the “Company”) entered into a licensing agreement with DMG Blockchain Solutions, Inc. to license DMG’s proprietary Blockseer pool technology for use in its new Marathon OFAC Pool . Pursuant to the terms and conditions of the Agreement, the Company will be granted an exclusive and irrevocable license to use the technology in the U.S., and DMG will receive: $500,000 in restricted common stock of the Company (stock to be issued in a transaction exempt from registration under Section 4(a)(2) under the Securities Act of 1933, as amended); a monthly license fee with a sliding scale based on the MARAPool’s block rewards and transaction fees received by the pool; and technical support services to be provided on an as-needed basis with payment in US dollars. As of December 31, 2021, DMG has received shares equivalent to $500,000 in restricted common stock of the Company.

On May 20, 2021, the Company appointed Georges Antoun and Jay Leupp to its board of directors, effective immediately, as Peter Benz transitions to become the company’s vice president of corporate development and Michael Berg stepped down from his position of director to pursue other projects. As a result, Marathon’s board of directors now consists of five directors, including three independent directors and two inside directors.

On May 21, 2021, Marathon Digital Holdings, Inc. (the “Company”) entered into a binding letter of intent with Compute North, LLC to host 73,000 Bitcoin Miners over a staged in implementation between October 2021 and March 2022. The hosting cost is $0.50 per machine per month and the hosting rate will be $0.044 per kWh. In order to build out the infrastructure without paying for the capital expenditure, the Company will provide an 18 month bridge loan to Compute North of up to $67 million dollars, in tranches, based upon specified requirements being met. The terms of the contract are limited to three years with increases thereafter capped at three percent per year thereafter. The Company has also agreed to pay up to $14 million in expedite fees for construction/electrical and supply chain expediting activities. As of December 31, 2021, the Company paid $8 million of the $14 million in expedite fees recorded as a deposit on the balance sheet . On September 3, 2021, the Company entered into a master agreement with Compute North, LLC whereas the Company will pay an initial deposit of $14.6 million in aggregate over five instalments. As of December 31, 2021, the Company paid the full $14.6 million initial deposit recorded as a deposit on the balance sheet.

On July 30, 2021, Marathon Digital Holdings, Inc. (the “Company”) entered into a fully executed contract with Bitmain to purchase an additional 30,000 S-19j Pro ASIC Miners, with 5,000 units scheduled to be delivered in each of January 2022, February 2022, March 2022, April 2022, May 2022, and June 2022. The purchase price is $126,000,000 with (i) 25% of the purchase price due paid within one day of execution of the contract, (ii) 35% of the purchase price of each batch due in consecutive months with 35% of the January 2022 batch due immediately, and then 35% of each of the remaining five batches due on the 15th of each consecutive month starting August 15, 2021, through December 15, 2021 and (iii) the remaining 40% of the purchase price of each batch due on the 15th of each consecutive month starting November 15, 2021 and then 40% of each of the remaining five batches due on the 15th of each consecutive month through April 2022.

| 7 |

On August 9, 2021, the Company appointed Sarita James and Said Ouissal to its board of directors, effective immediately as independent directors.

On August 23, 2021 , the Company issued 2,722,435 shares of common stock pursuant to the 2018 Equity Incentive Plan.

On August 27, 2021, Marathon Digital Holdings, Inc. (the “Company”) entered into a Master Securities Loan Agreement (the “Agreement”) with NYDIG Funding, LLC (“NYDIG”). Pursuant to the Agreement, the Company will loan its bitcoin (“BTC”) to NYDIG with an interest rate of three percent (3%) per annum. Interest accrues daily and is payable on a monthly basis. The Agreement provides that the Company may recall its BTC at any time. NYDIG shall, prior to or concurrently with the transfer of the BTC to NYDIG, but in no case later than the close of business on the day of such transfer, transfer to the Company collateral with a market value at least equal to 100% of the market value of the loaned BTC, and the Company is granted a first priority lien on such collateral. As of August 27, 2021, the Company loaned 300 BTC to NYDIG.

As previously disclosed in the Company’s monthly production updates, there have been multiple instances of the power generating station in Hardin, MT operating below peak capacity and thus limiting the Company’s ability to mine bitcoin during 2021. To mitigate these issues in the future, system upgrades will be performed on the power generating station beginning in November 2021 and continuing into 2022. Each phase of this maintenance will require the plant, and therefore the Company’s mining operations in Hardin, MT, to be offline for approximately three to five days. The upgrades are intended to improve the power generating station’s efficacy and efficiency, increase safety, mitigate the potential for unexpected downtime in the future, and ultimately improve the Company’s ability to effectively mine bitcoin. The Company believes that the impact of these upgrades on its mining operations will minimize future downtime and thus counterbalance any maintenance downtime experienced as a result of these repairs.

On October 1, 2021, Marathon Digital Holdings, Inc. (the “Company”) entered into a Revolving Credit and Security Agreement (the “Agreement”) with Silvergate Bank (the “Bank”) pursuant to which Silvergate has agreed to loan the Company up to $100,000,000 on a revolving basis pursuant to the terms of the Agreement and the $100,000,000 principal amount revolving credit note issued by the Company in favor of the Bank under the Agreement (“Note”). The terms of the facility (“RLOC”) set forth in the Agreement and Note are as follows:

| Initial Term: | One (1) Year | |

| Availability: | The RLOC shall be made available from time to time to the Company for periodic draws (provided no event of default then exists) from its closing date up to and including the one- year anniversary of the loan date. |

| Origination Fee: | 0.25% of the Loan Commitment to the Bank (or $250,000); due at RLOC closing. | |

| Unused Commitment Fee: | 0.25% per annum of the portion of the unused Loan Commitment, payable monthly in arrears. | |

| Renewal: |

The RLOC may be renewed annually by agreement between the Bank and the Company, subject to (without limitation): (i) Company makes a request for renewal, in writing, no less than sixty (60) days prior to the then current maturity date, (ii) no event of default then exists, (iii) Company provides all necessary documentation to extend the RLOC, (iv) Company has paid all applicable fees related to the loan renewal, and (v) the Bank has approved such extension request according to its internal credit policies as determined by the Bank in its sole and absolute discretion.

If the Bank approves a request by Company to renew the RLOC upon any maturity, then a Renewal Fee of 0.25% of the Loan Commitment (or $250,000) shall be due and payable upon extension of the Loan Commitment. |

| 8 |

| Payments: | Interest only to be paid monthly, with principal all due at maturity. | |

| Collateral: | The RLOC will be secured by a pledge of a sufficient amount of Company’s right, title and interest in and to bitcoin and/or U.S. Dollar (“USD”) stored in a custody account for the benefit of the Bank (the “Collateral Account”). the Bank will establish a Collateral Account with a regulated custodial entity (the “Custodian”) that has been approved by the Bank. the Bank and Custodian will have a custodial agreement to perfect the security interest in the pledged Collateral Account which, among other things, allows for 1) the Bank to monitor the balance of the Collateral Account and 2) allows the Bank to have exclusive control over the Collateral Account including liquidation of the collateral in the event of Company’s default under the terms of the RLOC. the Bank may also file a UCC financing statement on the pledged collateral. | |

| Minimum Advance Rate: | At origination, the Company must ensure the Collateral Account balance has sufficient bitcoin (and/or US$) to cause a Loan to Value (the “LTV”) ratio of 65% (or less) (“Minimum Advance Rate”) on the unpaid principal balance of the RLOC. | |

| Covenants: | The Company must maintain a minimum debt to equity ratio of 0.5:1. The Company must maintain a minimum liquidity of $25,000,000. |

On November 9, 2021, the Company received a waiver letter from Silvergate Bank whereas Silvergate Bank has waived its default rights with respect to noncompliance of Section VII. Negative Covenants 7.3 Indebtedness and Section VI. Affirmative Covenants 6.5. Financial Covenants. Silvergate Bank accepts and acknowledges convertible notes in the aggregate principal amount up to $650,000,000, plus an option to purchase an additional $97,500,000 principal amount of Convertible Notes shall not constitute “Indebtedness” for purpose of Section 7.3 of the Revolving Credit and Security Agreement. Further the maximum debt-to-equity ratio in Section 6.5 shall be revised to be 1.50:1.00.

During the quarter ended September 30, 2021, the Company and certain of its executives received a subpoena from the SEC to produce documents and communications concerning the Hardin, Montana data center facility described in our Form 8-K dated October 13, 2020. On October 6, 2020, the Company entered into a series of agreements with multiple parties to design and build a data center for up to 100-megawatts in Hardin, MT. In conjunction therewith, the Company filed a Current Report on Form 8-K on October 13, 2020. The 8-K discloses that, pursuant to a Data Facility Services Agreement, the Company issued 6,000,000 shares of restricted Common Stock, in transactions exempt from registration under Section 4(a)(2) of the Securities Act of 1933, as amended. We understand that the SEC may be investigating whether or not there may have been any violations of the federal securities law. We are cooperating with the SEC.

On November 18, 2021, Marathon Digital Holdings, Inc. (the “Company”) issued $650,000,000 principal amount of its 1.00% Convertible Senior Notes due 2026 (the “Notes”). The Notes were issued pursuant to, and are governed by, an indenture (the “Indenture”), dated as of November 18, 2021, between the Company and U.S. Bank National Association, as trustee (the “Trustee”). Pursuant to the purchase agreement between the Company and the initial purchasers of the Notes, the Company also granted the initial purchasers an option, for settlement within a period of 13 days from, and including, November 18, 2021 to purchase up to an additional $97,500,000 principal amount of Notes. As noted below, this option was exercised and an additional $97,500,000 principal amount of Notes was issued on November 23, 2021.

The Notes will be the Company’s senior, unsecured obligations and will be (i) equal in right of payment with the Company’s existing and future senior, unsecured indebtedness; (ii) senior in right of payment to the Company’s existing and future indebtedness that is expressly subordinated to the Notes; (iii) effectively subordinated to the Company’s existing and future secured indebtedness, to the extent of the value of the collateral securing that indebtedness; and (iv) structurally subordinated to all existing and future indebtedness and other liabilities, including trade payables, and (to the extent the Company is not a holder thereof) preferred equity, if any, of the Company’s subsidiaries.

| 9 |

The Notes will accrue interest at a rate of 1.00% per annum, payable semi-annually in arrears on June 1 and December 1 of each year, beginning on June 1, 2022. The Notes will mature on December 1, 2026, unless earlier repurchased, redeemed or converted. Before the close of business on the business day immediately before June 1, 2026, noteholders will have the right to convert their Notes only upon the occurrence of certain events. From and after June 1, 2026, noteholders may convert their Notes at any time at their election until the close of business on the second scheduled trading day immediately before the maturity date. The Company will settle conversions by paying or delivering, as applicable, cash, shares of its common stock or a combination of cash and shares of its common stock, at the Company’s election. The initial conversion rate is 13.1277 shares of common stock per $1,000 principal amount of Notes, which represents an initial conversion price of approximately $76.17 per share of common stock. The conversion rate and conversion price will be subject to customary adjustments upon the occurrence of certain events. In addition, if certain corporate events that constitute a “Make-Whole Fundamental Change” (as defined in the Indenture) occur, then the conversion rate will, in certain circumstances, be increased for a specified period of time.

The Notes will be redeemable, in whole or in part (subject to certain limitations described below), at the Company’s option at any time, and from time to time, on or after December 6, 2024 and on or before the 21st scheduled trading day immediately before the maturity date, at a cash redemption price equal to the principal amount of the Notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date, but only if the last reported sale price per share of the Company’s common stock exceeds 130% of the conversion price on (1) each of at least 20 trading days, whether or not consecutive, during the 30 consecutive trading days ending on, and including, the trading day immediately before the date the Company sends the related redemption notice; and (2) the trading day immediately before the date the Company sends such notice. However, the Company may not redeem less than all of the outstanding Notes unless at least $100.0 million aggregate principal amount of Notes are outstanding and not called for redemption as of the time the Company sends the related redemption notice. In addition, calling any Note for redemption will constitute a Make-Whole Fundamental Change with respect to that Note, in which case the conversion rate applicable to the conversion of that Note will be increased in certain circumstances if it is converted during the related redemption conversion period.

If certain corporate events that constitute a “Fundamental Change” (as defined in the Indenture) occur, then, subject to a limited exception for certain cash mergers, noteholders may require the Company to repurchase their Notes at a cash repurchase price equal to the principal amount of the Notes to be repurchased, plus accrued and unpaid interest, if any, to, but excluding, the fundamental change repurchase date. The definition of Fundamental Change includes certain business combination transactions involving the Company and certain de-listing events with respect to the Company’s common stock.

The Notes will have customary provisions relating to the occurrence of “Events of Default” (as defined in the Indenture), which include the following: (i) certain payment defaults on the Notes (which, in the case of a default in the payment of interest on the Notes, will be subject to a 30-day cure period); (ii) the Company’s failure to send certain notices under the Indenture within specified periods of time; (iii) the Company’s failure to comply with certain covenants in the Indenture relating to the Company’s ability to consolidate with or merge with or into, or sell, lease or otherwise transfer, in one transaction or a series of transactions, all or substantially all of the assets of the Company and its subsidiaries, taken as a whole, to another person; (iv) a default by the Company in its other obligations or agreements under the Indenture or the Notes if such default is not cured or waived within 60 days after notice is given in accordance with the Indenture; (v) certain defaults by the Company or any of its subsidiaries with respect to indebtedness for borrowed money of at least $50,000,000; and (vi) certain events of bankruptcy, insolvency and reorganization involving the Company or any of its significant subsidiaries.

If an Event of Default involving bankruptcy, insolvency or reorganization events with respect to the Company (and not solely with respect to a significant subsidiary of the Company) occurs, then the principal amount of, and all accrued and unpaid interest on, all of the Notes then outstanding will immediately become due and payable without any further action or notice by any person. If any other Event of Default occurs and is continuing, then, the Trustee, by notice to the Company, or noteholders of at least 25% of the aggregate principal amount of Notes then outstanding, by notice to the Company and the Trustee, may declare the principal amount of, and all accrued and unpaid interest on, all of the Notes then outstanding to become due and payable immediately. However, notwithstanding the foregoing, the Company may elect, at its option, that the sole remedy for an Event of Default relating to certain failures by the Company to comply with certain reporting covenants in the Indenture consists exclusively of the right of the noteholders to receive special interest on the Notes for up to 270 days at a specified rate per annum not exceeding 0.50% on the principal amount of the Notes.

| 10 |

On November 23, 2021, Marathon Digital Holdings, Inc. (the “Company”) issued $97,500,000 aggregate principal amount of the Company’s 1.00% Convertible Senior Notes due 2026 (the “Option Notes”) to Jefferies LLC, as representative of the several initial purchasers (collectively, the “Initial Purchasers”) in connection with the exercise of the Initial Purchasers’ option to purchase additional notes. The Option Notes, together with the $650,0000,000 aggregate principal amount of the Company’s 1.00% Convertible Senior Notes due 2026 that were previously issued, were issued in connection with a private offering to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended, and were issued pursuant to the Indenture dated as of November 18, 2021 by and between the Company and U.S. Bank National Association, as trustee.

Effective November 30, 2021, Marathon Digital Holdings, Inc. (the “Company”) entered into an amended five year hosting agreement with Compute North, LLC (“Compute North”) to host 73,000 S19 miners to be deployed during the first two quarters of 2022 at a hosting fee of $0.044 per kilowatt hour with substantially the same terms as the Company’s prior hosting agreements with Compute North. On that same date, the Company also entered into a joint venture with Compute North to form Marathon Compute North 1 LLC (the “LLC”) of which the equity is owned 82% by Marathon and 18% by Compute North, the business purpose of which is to jointly host bitcoin miners. The LLC entered into a hosting agreement with Compute North to host an additional 30,000 S19 miners along substantially similar terms to the hosting agreement between the Company and Compute North also at $0.044 per kilowatt hour.

On December 15, 2021, Marathon Digital Holdings, Inc. (the “Company”) entered into a Severance and Release Agreement (“Agreement”) with Merrick Okamoto, its Executive Chairman (“Okamoto”). Pursuant to the Agreement, Okamoto is retiring effective December 31, 2021. He is providing a standard release to the Company in exchange for payment of 83,333 restricted stock units of the Company, which shall vest immediately upon grant. The shares underlying the RSUs are being issued pursuant to the Company’s registration statement on Form S-8 (file no. 333-258928), filed with the SEC on August 19, 2021. Additionally on December 31, 2021, the Company shall pay Okamoto the following: (i) accrued wages of $30,942.92, his annual 2021 bonus in the amount of $371,315 and any remaining approved and unpaid Company expenses incurred by him, if any. He is also entitled to medical insurance reimbursement as currently maintained through December 31, 2022, and thereafter is entitled to COBRA at his own expense, to the extent available by law.

On December 17, 2021, a putative class action complaint was filed in the United States District Court for the District Court of Nevada, against the company and present and former senior management. The Complaint alleges securities fraud related to the disclosures of an SEC investigation previously made by the Company on November 15, 2021. Plaintiff Tad Schaltre served the Complaint on the Company on March 1, 2022.

On December 21, 2021, Marathon Digital Holdings, Inc. (the “Company”) executed a contract with Bitmain to purchase an additional 78,000 next generation Antminer S-19 XP Miners, with 13,000 units being delivered in each of July 2022, August 2022, September 2022, October 2022, November 2022 and December 2022. The purchase price is $879,060,000. The purchase price for the miners shall be paid as follows: 35% of the total amount within two days of execution of the purchase contract, 35% of each single shipment price at least six months prior to each such shipment, and the remaining 30% of each single shipment price at least one month prior to each such shipment.

Effective December 27, 2021, Marathon Digital Holdings, Inc. (the “Company”) appointed Ashu Swami as its Chief Technology Officer and entered into an Executive Employment Agreement (“Agreement”) with Mr. Swami.

Mr. Swami joins Marathon Digital Holdings from Core Scientific where he served as the CPO since Feb 2021, leading the company’s foray into DeFi and heading the mining hardware and software optimization tech. Prior to that, from Jan 2019 to Feb 2021, he was the CTO of Apifiny, a hybrid CEX and DEX crypto exchange. Previously, from Jan 2016 to Dec 2018, Mr. Swami headed a SPV of Quadeye Securities which pioneered and traded Mining Swaps, operated cloud mining data centers, and served as the Chief Advisor to Fortune 50 companies including Intel Corp on Blockchain initiatives. From May 2013 to Dec 2015, he founded LocalPad, a p2p marketplace and payments plugin that provided ebay-in-a-box like functionality to large blogs to monetize their user base. Prior to that, from May 2007 to Apr 2013, Mr. Swami was a Portfolio Manager and led the high frequency market-making business at Morgan Stanley Program Trading to become a top 5 market maker in US ETFs. Previously, since May 2002, Mr. Swami spent over 4 years as a Sr Component Designer and then Tech Lead in Intel’s Enterprise Platforms Group. Mr. Swami holds a BTech in CSE from IIT Bombay, and M.B.A. from Duke University.

| 11 |

Pursuant to the terms of the Agreement, Mr. Swami is employed as CTO for a one year term which shall automatically renew unless either he or the Company notifies the other at least 90 days before the end of the initial or any renewal term of the intent to terminate the Agreement. Mr. Swami’s base salary is $275,000 per year with a cash bonus of up to $137,500 per year. Mr. Swami shall also be granted 80,000 restricted stock units, of which 20,000 shall vest on the one year anniversary of the effective date of the Agreement, and then 5000 RSUs shall vest on each subsequent three month anniversary with the last 5000 RSUs vesting on the four year anniversary of the effective date of the Agreement. Upon certain not for cause termination events under the Agreement, Mr. Swami would be entitled to vesting of all unvested RSUs and a severance payment of six months of salary in addition to all accrued and unpaid salary and vacation and the like. The Agreement contains other commercially standard terms for events of termination and the like.

On December 21, 2021, the Company executed a contract with Bitmain to purchase an additional 78,000 next generation Antminer S-19 XP Miners, with 13,000 units being delivered in each of July 2022, August 2022, September 2022, October 2022, November 2022 and December 2022. The purchase price is $879,060,000. The purchase price for the miners shall be paid as follows: 35% of the total amount within two days of execution of the purchase contract, 35% of each single shipment price at least six months prior to each such shipment, and the remaining 30% of each single shipment price at least one month prior to each such shipment. As of December 31, 2021, the Company has paid $307,671,000 of the purchase price.

On February 11, 2022, we entered into an At The Market Offering Agreement, or sales agreement, with H.C. Wainwright & Co., LLC, or Wainwright, relating to shares of our common stock offered by this prospectus supplement. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $750,000,000 from time to time through Wainwright acting as our sales agent.

On February 18, 2022, a shareholder derivative complaint was filed in the United States District Court for the District of Nevada, against current and former members of the Company’s board of directors and senior management. The complaint is based on allegations substantially similar to the allegations in the December 2021 putative securities class action complaint, related to the Company’s disclosure of an SEC investigation previously made by the Company on November 15, 2021. On March 4, 2022, the Complaint was served on the Company.

Blockchain and Cryptocurrencies Generally

Bitcoin is a digital asset that is issued by and transmitted through an open source protocol collectively maintained by a peer-to-peer network of decentralized user nodes. This network hosts a public transaction ledger, known as the bitcoin blockchain, on which bitcoin holdings and transactions in bitcoin are recorded. Balances of bitcoin are stored in individual “wallet” functions, which associate network public addresses with a “private key” that controls the transfer of bitcoin. The bitcoin blockchain can be updated without any single entity owning or operating the network. New bitcoin is created and allocated by the protocol that governs bitcoin through a “mining” process that rewards users that verify transactions in the bitcoin blockchain. The bitcoin protocol limits the total issuance of bitcoin over time to 21 million.

Bitcoin can be used to pay for goods and services, or it can be converted to fiat currencies, such as the U.S. dollar, at rates of exchange determined by market forces on bitcoin trading platforms, which operate 24-hours-a-day, 7-days-a-week and are not regulated in as comprehensive a manner as traditional securities exchanges. As a result, trading on these markets is likely more subject to manipulation than on securities markets regulated by the SEC, and pricing on these markets is likely affected by such manipulative activity. In addition to these platforms, over-the-counter markets and derivatives markets for bitcoin also exist; however, these markets are still maturing and many are unregulated.

Bitcoin exists entirely in electronic form, as virtually irreversible public transaction ledger entries on the blockchain, and transactions in bitcoin are recorded and authenticated not by a central repository, but by a decentralized peer-to-peer network. This decentralization avoids certain threats common to centralized computer networks, such as denial of service attacks, and reduces the dependency of the bitcoin network on any single system. While the bitcoin network as a whole is decentralized, the private keys used to access bitcoin balances are not widely distributed and are held on hardware (which can be physically controlled by the holder or by a third party such as a custodian) or via software programs on third-party servers and loss of such private keys results in an inability to access, and effective loss of, the corresponding bitcoin. Consequently, bitcoin holdings are susceptible to all of the risks inherent in holding any electronic data, such as power failure, data corruption, security breach, communication failure, and user error, among others. These risks, in turn, make bitcoin subject to theft, destruction, or loss of value from hackers, corruption, or technology-specific factors such as viruses that do not affect conventional fiat currency. In addition, the bitcoin network relies on open source developers to maintain and improve the bitcoin protocol. Accordingly, bitcoin may be subject to protocol design changes, governance disputes such as “forked” protocols, competing protocols, and other open source-specific risks that do not affect conventional proprietary software.

| 12 |

Distributed blockchain technology is a decentralized and encrypted ledger that is designed to offer a secure, efficient, verifiable, and permanent way of storing records and other information without the need for intermediaries. Cryptocurrencies serve multiple purposes. They can serve as a medium of exchange, store of value or unit of account. Examples of cryptocurrencies include: bitcoin, bitcoin cash, and litecoin. Blockchain technologies are being evaluated for a multitude of industries due to the belief in their ability to have a significant impact in many areas of business, finance, information management, and governance.

Cryptocurrencies are decentralized currencies that enable near instantaneous transfers. Transactions occur via an open source, cryptographic protocol platform which uses peer-to-peer technology to operate with no central authority. The online network hosts the public transaction ledger, known as the blockchain, and each cryptocurrency is associated with a source code that comprises the basis for the cryptographic and algorithmic protocols governing the blockchain. In a cryptocurrency network, every peer has its own copy of the blockchain, which contains records of every historical transaction - effectively containing records of all account balances. Each account is identified solely by its unique public key (making it effectively anonymous) and is secured with its associated private key (kept secret, like a password). The combination of private and public cryptographic keys constitutes a secure digital identity in the form of a digital signature, providing strong control of ownership.

No single entity owns or operates the network. The infrastructure is collectively maintained by a decentralized public user base. As the network is decentralized, it does not rely on either governmental authorities or financial institutions to create, transmit or determine the value of the currency units. Rather, the value is determined by market factors, supply and demand for the units, the prices being set in transfers by mutual agreement or barter among transacting parties, as well as the number of merchants that may accept the cryptocurrency. Since transfers do not require involvement of intermediaries or third parties, there are currently little to no transaction costs in direct peer-to-peer transactions. Units of cryptocurrency can be converted to fiat currencies, such as the US dollar, at rates determined on various exchanges, such as Cumberland, Coinsquare (in Canada), Coinbase, Bitsquare, Bitstamp, and others. Cryptocurrency prices are quoted on various exchanges and fluctuate with extreme volatility.

We believe cryptocurrencies offer many advantages over traditional, fiat currencies, although many of these factors also present potential disadvantages and may introduce additional risks, including:

| ● | acting as a fraud deterrent, as cryptocurrencies are digital and cannot be counterfeited or reversed arbitrarily by a sender; | |

| ● | immediate settlement; | |

| ● | elimination of counterparty risk; | |

| ● | no trusted intermediary required; | |

| ● | lower fees; | |

| ● | identity theft prevention; | |

| ● | accessible by everyone; | |

| ● | transactions are verified and protected through a confirmation process, which prevents the problem of double spending; | |

| ● | decentralized – no central authority (government or financial institution); and | |

| ● | recognized universally and not bound by government imposed or market exchange rates. |

However, cryptocurrencies may not provide all of the benefits they purport to offer at all or at any time.

| 13 |

Bitcoin was first introduced in 2008 and was first introduced as a means of exchange in 2009. Bitcoin is a consensus network that enables a new payment system and a completely new form of digital money. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen. From a user perspective, we believe bitcoin can be viewed as cash for the Internet. The bitcoin network shares a public ledger called the “blockchain.” This ledger contains every transaction ever processed, allowing a user’s computer to verify the validity of each transaction. The authenticity of each transaction is protected by digital signatures corresponding to the sending addresses, allowing all users to have full control over sending bitcoins currency rewards from their own bitcoin addresses. In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in bitcoins for this service. This process is often called “mining.”

As with many new and emerging technologies, there are potentially significant risks. Businesses (including the Company) which are seeking to develop, promote, adopt, transact or rely upon blockchain technologies and cryptocurrencies have a limited track record and operate within an untested new environment. These risks are not only related to the businesses the Company pursues, but the sector and industry as a whole, as well as the entirety of the concept behind blockchain and cryptocurrency as value. Factors such as access to computer processing capacity, interconnectivity, electricity cost, environmental factors (such as cooling capacity) and location play an important role in “mining,” which is the term for using the specialized computers in connection with the blockchain for the creation of new units of cryptocurrency.

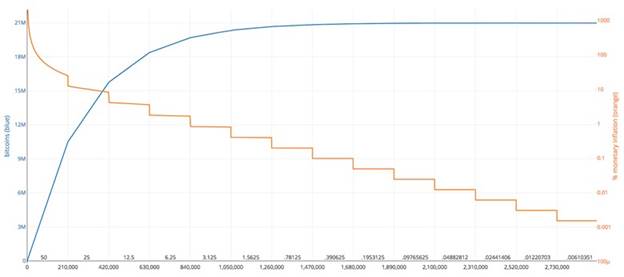

Mathematically Controlled Supply

The method for creating new bitcoins is mathematically controlled in a manner so that the supply of bitcoins grows at a limited rate pursuant to a pre-set schedule. The number of bitcoins awarded for solving a new block is automatically halved every 210,000 blocks. Thus, the current fixed reward for solving a new block is 12.5 bitcoins per block and the reward decreased by half to become 6.25 bitcoins around May 10, 2020, which is the current reward (based on estimates of the rate of block solution calculated by BitcoinClock.com). This deliberately controlled rate of bitcoin creation means that the number of bitcoins in existence will never exceed 21 million and that bitcoins cannot be devalued through excessive production unless the Bitcoin Network’s source code (and the underlying protocol for bitcoin issuance) is altered. The Company monitors the Blockchain network and, as of December 9, 2020, based on the information we collected from our network access, more than 18.45 million bitcoins have been mined.

Digital Asset Mining

We intend to power and secure blockchains by verifying blockchain transactions using custom hardware and software. We are currently using our hardware to mine bitcoin (“BTC”) and expect to mine BTC, and potentially other cryptocurrencies. Bitcoin relies on different technologies based on the blockchain. Wherein bitcoin is a digital currency, we will be compensated in BTC based on the mining transactions we perform, which is how we will earn revenue.

Blockchains are decentralized digital ledgers that record and enable secure peer-to-peer transactions without third party intermediaries. Blockchains enable the existence of digital assets by allowing participants to confirm transactions without the need for a central certifying authority. When a participant requests a transaction, a peer-to-peer network consisting of computers, known as nodes, validate the transaction and the user’s status using known algorithms. After the transaction is verified, it is combined with other transactions to create a new block of data for the ledger. The new block is added to the existing blockchain in a way that is permanent and unalterable, and the transaction is complete.

Digital assets (also known as cryptocurrency) are a medium of exchange that uses encryption techniques to control the creation of monetary units and to verify the transfer of funds. Many consumers use digital assets because it offers cheaper and faster peer-to-peer payment options without the need to provide personal details. Every single transaction and the ownership of every single digital asset in circulation is recorded in the blockchain. Miners use powerful computers that tally the transactions to run the blockchain. These miners update each time a transaction is made and ensure the authenticity of information. The miners receive a transaction fee for their service in the form of a portion of the new digital “coins” that are issued.

| 14 |

Performance Metrics – Hashing

We operate mining hardware which performs computational operations in support of the blockchain measured in “hash rate” or “hashes per second.” A “hash” is the computation run by mining hardware in support of the blockchain; therefore, a miner’s “hash rate” refers to the rate at which it is capable of solving such computations. The original equipment used for mining bitcoin utilized the Central Processing Unit (CPU) of a computer to mine various forms of cryptocurrency. Due to performance limitations, CPU mining was rapidly replaced by the Graphics Processing Unit (GPU), which offers significant performance advantages over CPUs. General purpose chipsets like CPUs and GPUs have since been replaced in the mining industry by Application Specific Integrated Circuits (ASIC) chips. These ASIC chips are designed specifically to maximize the rate of hashing operations.

We measure our mining performance and competitive position based on overall hash rate being produced in our mining sites. The latest equipment utilized in our mining operation performs in the range of approximately 86 – 110 terahash per second (TH/s) per unit. This mining hardware is on the cutting edge of available mining equipment and we believe our acquisition of our units places us among leaders of publicly-traded cryptocurrency miners; however, advances and improvements to the technology are ongoing and may be available in quantities to the market in the near future which may affect our perceived position. We believe that our current inventory of miners establishes us among the top public companies in the United States mining cryptocurrency.

Our Strategy: Marathon Digital Holdings’ primary focus is to support the adoption, security, and evolution of Bitcoin by building one of the largest, most agile, and most sustainably operated Bitcoin mining operations in the world. Our strategy is to purchase hardware (“miners”) that are specially designed to solve complex cryptographic problems set forth by the Bitcoin protocol and to partner with third-party hosting providers to deploy this hardware, predominantly at renewable power sources, with the ultimate aim of adding blocks to the Bitcoin blockchain and earning bitcoin.

In the second quarter of 2021, we determined that the most effective strategy for expanding and improving the efficiency of our mining operations is to invest in mining hardware rather than the construction and maintenance of the infrastructure that supports Bitcoin mining, including but not limited to hosting centers and power facilities. As a result, we now employ an “asset light” business model, opting to outsource the deployment and hosting of our machines to third party hosting providers, including Compute North, who deploy our miners at locations with low costs of electricity and access to clean and/or renewable energy sources. We believe this strategy provides a superior return on assets, increases our optionality, and reduces risks to our business.

Along with our hosting partners, we focus on deploying our miners predominantly “behind the meter” at renewable power stations to reduce our costs, to optimize for sustainably generated power, to incentivize the construction of new renewable power stations in the United States, and to help improve the stability of power grids by operating as a flexible, base load customer.

Our Mining Operations: In 2020, we began rapidly expanding our Bitcoin mining operations by purchasing large numbers of state-of-the-art Bitcoin miners from Bitmain, one of the leading Bitcoin mining hardware manufacturers. By expanding our mining operations and increasing our “hash rate” (computing power) relative to the rest of the network, we can improve the probability of successfully adding a block to Bitcoin’s blockchain and therefore earning bitcoin.

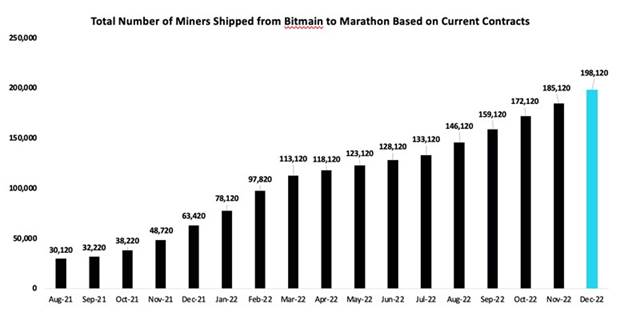

| ● | Our Bitcoin Miners: In the second half of 2020, we began purchasing large quantities of new Bitcoin miners from Bitmain to expand and upgrade our Bitcoin mining operations. Our major orders to date are as follows: |

| ○ | August 2020: 10,500 Antminer S19 Pros (110 TH/s) | |

| ○ | October 2020: 10,000 Antminer S19 Pros (110 TH/s) | |

| ○ | December 2020: 10,000 Antminer S19j Pros (100 TH/s) | |

| ○ | December 2020: 70,000 Antminer S19s (90-110 TH/s) | |

| ○ | July 2021: 30,000 Antminer S19j Pros (110 TH/s) | |

| ○ | December 2021: 78,000 Antminer S19 XPs (140 TH/s) |

| 15 |

We have paid an average price of $6,054 per machine, or $52 per Terahash, for these miners, which we believe are among the most powerful and most efficient currently available. Shipment schedules by month are as follows:

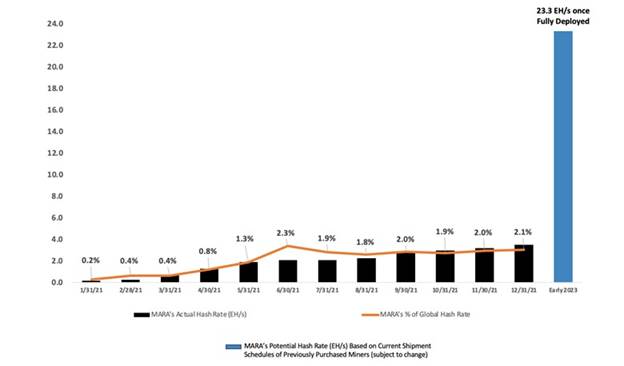

As of January 2021, we had 2,060 miners deployed, generating approximately 0.2 Exahash per second (“EH/s”). Once deployments and upgrades are complete, we expect our total fleet to consist of approximately 199,000 state of the art Bitcoin miners, capable of producing 23.3 EH/s. Based on current construction and deployment schedules, we currently believe all machines may be deployed by early 2023.

| 16 |

| ● | Our Mining Facilities: We deploy miners in various locations across the United States, including South Dakota, Nebraska, Montana, and Texas. Our blended costs for electricity and hosting across our entire fleet is $0.0426 per kilowatt hour (“kWh”). Our objective is for our mining operations to be 100% carbon neutral and predominantly powered by renewable power sources (solar, wind, etc.) by the end of fiscal year 2022. |

| ○ | Hardin, MT Data Center: In October 2020, we entered into a series of agreements to construct a Bitcoin mining facility adjacent to a stranded power station in Hardin, MT. We house approximately 30,000 Bitcoin miners at this facility, half of which reside in air cooled containers, while the other half reside in an air cooled building. Our miners at this location derive all of their power from the previously dormant power station, which is owned by Beowulf Energy and can produce up to 100 megawatt (MW) of power. Both the power station and our mining facility reside on land owned by the Crow Nation. The construction of our mining facility in Hardin, MT was completed in December 2021. | |

| ○ | Compute North Hosting Arrangements: Since 2017, we have been hosting Bitcoin miners with Compute North at their mining facilities in North Dakota and Nebraska. In May 2021, we announced that we had entered into a binding letter of intent with Compute North to host 73,000 of our Bitcoin miners at a new 300 MW data center in Texas. In December 2021, we announced that we were expanding our agreement to include up to 100,000 of our Bitcoin miners. | |

| Our arrangements with Compute North provide us with reliable hosting, access to renewable power, and low costs of operations. We pay a fixed rate for electricity and hosting to Compute North, who develops and operates the facilities while managing the deployment of our miners. Through these arrangements, we are deploying miners at multiple locations in Texas and elsewhere, the majority of which are behind the meter at wind and solar farms operated by one of the largest renewable energy power providers in North America. | ||

| Construction of new facilities is currently underway and continuing throughout 2022. Once completed, we expect our mining operations to be 100% carbon neutral. |

Our Bitcoin Holdings: While we may sell bitcoin in future periods as needed to generate cash for treasury management and other general corporate purposes, Marathon Digital Holdings views its bitcoin holdings as long-term holdings. We last sold bitcoin on October 21, 2020 and have since been accumulating and holding (“hodling”) all the bitcoin we produce. As of December 31, 2021, we held approximately 8,115 bitcoin, including the 4,794 bitcoin held in the investment fund. A total of 4,812.66 bitcoin was purchased and placed into an investment fund in January 2021 for an average price of $31,168 per bitcoin. During 2021, 18 bitcoin were liquidated as needed by the investment manager in order to pay the management fee and other operating expenses of the fund pursuant to the management agreement.

We believe that bitcoin is attractive because it can serve as a store of value and a hedge against inflation as it is supported by a robust and public open source architecture that is untethered to sovereign monetary policy. We also believe that bitcoin, due to its limited supply, has the potential to further appreciate in value as adoption increases.

Halving/Halvening Events: Bitcoin miners receive a reward in the form of bitcoin for each block they successfully process and add to Bitcoin’s blockchain. This reward, frequently referred to as a “block reward”, is the foundation of Bitcoin’s supply algorithm. It is the process by which new bitcoin enter the marketplace.

Bitcoin’s supply is finite, and the rate at which new bitcoin enter the marketplace is designed to decrease over time, reducing the rate of inflation. Every 210,000 blocks, the block reward is cut in half (i.e., decreased by 50%). This event is commonly referred to as a “halving” or “halvening.” On average, blocks are added to Bitcoin’s blockchain every 10 minutes. As a result, a halving/halvening event occurs approximately every four years.

| 17 |

(Source)

For the first four years of Bitcoin’s life, the block reward was 50 bitcoin per block. In 2012, the block reward decreased to 25 bitcoin per block. In 2016, the block reward was reduced to 12.5 bitcoin per block. The last halving occurred on May 12, 2020 when the block reward was cut to 6.25 bitcoin per block. The next halving is expected to occur in 2024, at which time, the block reward will be reduced to 3.125 bitcoin per block. Halving events will continue until all 21,000,000 bitcoin have been mined, which is expected to occur in approximately 2140.

While not guaranteed, historically, halving events have been correlated with increases Bitcoin’s price. (Source)

MaraPool: Marathon Digital Holdings operates its own bitcoin mining pool, MaraPool. The pool functions as a strategic differentiator for Marathon, as it provides us with improved insight into the performance of our mining operations, the potential to further optimize our performance, and the ability to vote on proposed upgrades and changes to the Bitcoin network.

| 18 |

Cybersecurity. To the Company’s knowledge there has been no security breach or incident, unauthorized access or disclosure, or other compromise of or relating to the Company or its subsidiaries information technology and computer systems, networks, hardware, software, data and databases, equipment or technology. The Company has not been notified of, and has no knowledge of any event or condition that could result in, any security breach or incident, unauthorized access or disclosure or other compromise to their IT Systems and Data, and the Company has implemented appropriate controls, policies, procedures, and technological safeguards to maintain and protect the integrity, continuous operation, redundancy and security of their IT Systems and Data reasonably consistent with industry standards and practices, or as required by applicable regulatory standards. The Company is presently in material compliance with all applicable laws or statutes and all judgments, orders, rules and regulations of any court or arbitrator or governmental or regulatory authority, internal policies and contractual obligations relating to the privacy and security of IT Systems and Data and to the protection of such IT Systems and Data from unauthorized use, access, misappropriation or modification.

Research & Development:

We have recently made several R&D forays.

Marathon’s Research Lab

Marathon operates a proof-of-work research initiative focused on accelerating the development and deployment of the best new mining practices. This initiative focuses on the proprietary testing and experimentation of proof-of-work related matters such as miners, firmware, immersion technologies, power supply units, miner software, and pools. The initiative is also focused on researching and publishing thought pieces related to the future of mining, impact on the electrical grid, impact on local economies, security, performance issues, as well as general education. Research is performed both within Marathon, as well as via partnerships with complimentary corporations, startups, non-profits, and universities. This initiative’s purview extends beyond just Bitcoin to include investigation and experimentation of all proof-of-work cryptocurrencies, as well as examining optimal participation with proof-of-stake cryptocurrencies at the infrastructure layer.

Marathon’s Incubator

Marathon operates an incubator/accelerator for the Bitcoin ecosystem. The purpose of the incubator is to support the development of new technologies and businesses that seek to expand and enrich Bitcoin as a decentralized global monetary, settlement, and digital information network. These technologies may include, but are not limited to, infrastructure building blocks, and “layer 2” protocols.

Human Capital: We believe our ongoing success depends on our employees. Development and investment in our people are central to who we are and will continue to be so. We take a comprehensive approach to sourcing, hiring, onboarding, integrating, developing, engaging and rewarding employees. As of December 31, 2021, our workforce consisted of nine full time employees.

Marathon Digital Holdings, Inc. is committed to the principles of equal employment. We are committed to complying with all federal, state, and local laws providing equal employment opportunities, and all other employment laws and regulations. It is our intent to maintain a work environment that is free of harassment, discrimination, or retaliation because of age (40 and older), race, color, national origin, ancestry, religion, sex, sexual orientation (including transgender status, gender identity or expression), pregnancy (including childbirth, lactation, and related medical conditions), physical or mental disability, genetic information (including testing and characteristics), veteran status, uniformed servicemember status, or any other status protected by federal, state, or local laws. The Company is dedicated to the fulfilment of this policy in regard to all aspects of employment, including but not limited to recruiting, hiring, placement, transfer, training, promotion, rates of pay, and other compensation, termination, and all other terms, conditions, and privileges of employment.

| 19 |

Competition

In cryptocurrency mining, companies, individuals and groups generate units of cryptocurrency through mining. Miners can range from individual enthusiasts to professional mining operations with dedicated data centers. Miners may organize themselves in mining pools. The Company competes or may in the future compete with other companies that focus all or a portion of their activities on owning or operating cryptocurrency exchanges, developing programming for the blockchain, and mining activities. At present, the information concerning the activities of these enterprises is not readily available as the vast majority of the participants in this sector do not publish information publicly or the information may be unreliable. Published sources of information include “bitcoin.org” and “blockchain.info”; however, the reliability of that information and its continued availability cannot be assured.

Several public companies (traded in the U.S. and Internationally), such as the following, may be considered to compete with us, although we believe there is no company, including the following, which engages in the same scope of activities as we do.

| ● | Overstock.com Inc. | |

| ● | Bitcoin Investment Trust | |

| ● | Blockchain Industries, Inc. (formerly Omni Global Technologies, Inc.) | |

| ● | Bitfarms Technologies Ltd. (formerly Blockchain Mining Ltd) | |

| ● | DMG Blockchain Solutions Inc. | |

| ● | Digihost International, Inc. | |

| ● | Hive Blockchain Technologies Inc. |

| ● | Hut 8 Mining Corp. | |

| ● | HashChain Technology, Inc. | |

| ● | MGT Capital Investments, Inc. | |

| ● | DPW Holdings, Inc. | |

| ● | Layer1 Technologies, LLC | |

| ● | Northern Data AG | |

| ● |

Riot Blockchain Core Scientific Terawulf Mining Genesis Mining |

While there is limited available information regarding our non-public competitors, we believe that our recent acquisition and deployment of miners (as discussed further above) positions us well among the publicly traded companies involved in the cryptocurrency mining industry. The cryptocurrency industry is a highly competitive and evolving industry and new competitors and/or emerging technologies could enter the market and affect our competitiveness in the future.

| 20 |

Government Regulation

Government regulation of blockchain and cryptocurrency is being actively considered by the United States federal government via a number of agencies and regulatory bodies, as well as similar entities in other countries. State government regulations also may apply to our activities and other activities in which we participate or may participate in the future. Other regulatory bodies are governmental or semi-governmental and have shown an interest in regulating or investigating companies engaged in the blockchain or cryptocurrency business.

Businesses that are engaged in the transmission and custody of bitcoin and other digital assets, including brokers and custodians, can be subject to U.S. Treasury Department regulations as money services businesses as well as state money transmitter licensing requirements. Bitcoin and other digital assets are subject to anti-fraud regulations under federal and state commodity laws, and digital asset derivative instruments are substantively regulated by the U.S. Commodity Futures Trading Commission. Certain jurisdictions, including, among others, New York and a number of countries outside the United States, have developed regulatory requirements specifically for digital assets and companies that transact in them.

Regulations may substantially change in the future and it is presently not possible to know how regulations will apply to our businesses, or when they will be effective. As the regulatory and legal environment evolves, we may become subject to new laws, further regulation by the SEC and other agencies, which may affect our mining and other activities. For instance, various bills have also been proposed in Congress related to our business, which may be adopted and have an impact on us. For additional discussion regarding our belief about the potential risks existing and future regulation pose to our business, see the Section entitled “Risk Factors” herein.