8-K/A: Current report filing

Published on December 26, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM

8-K /A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

____________________________________________________________

Date of Report (Date of earliest event reported): November 14, 2012

AMERICAN STRATEGIC MINERALS CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Nevada

|

000-54652

|

01-0949984

|

||

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

||

|

2331 Mill Road

Suite 100

Alexandria, VA

|

22314

|

|||

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: 703-626-4984

|

C/o National Corporate Research Ltd.

202 South Minnesota Street

Carson City, NV 89703

|

|

(Former name or former address, if changed since last report)

|

Copies to:

Harvey J. Kesner, Esq.

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory

Note

This

amendment on Form 8-K/A (the "Amendment") amends the Current Report for American Strategic Minerals Corporation (the "Company")

on Form 8-K, as initially filed with the Securities and Exchange Commission (the "SEC") on November 20, 2012 (the "Original Report").

The purpose of this Amendment is to address the comments of the Staff of the SEC as set forth in its letter dated December 18,

2012. This Amendment is an amendment and restatement of the Original Report in its entirety in order to provide a complete presentation.

Forward-Looking Statements

This Current Report on Form 8-K and other written and oral statements made from time to time by us may contain so-called “forward-looking statements,” all of which are subject to risks and uncertainties. Forward-looking statements can be identified by the use of words such as “expects,” “plans,” “will,” “forecasts,” “projects,” “intends,” “estimates,” and other words of similar meaning. One can identify them by the fact that they do not relate strictly to historical or current facts. These statements are likely to address our growth strategy, financial results and product and development programs. One must carefully consider any such statement and should understand that many factors could cause actual results to differ from our forward looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward looking statement can be guaranteed and actual future results may vary materially.

Information

regarding market and industry statistics contained in this Current Report on Form 8-K is included based on information available

to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes

of securities offerings or economic analysis. We have not reviewed or included data from all sources, and cannot assure investors

of the accuracy or completeness of such data related to market and industry statistics based on third party publications included in this Current Report. Forecasts and other forward-looking information obtained from these sources are subject to the same

qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance

of products and services. We do not assume any obligation to update any forward-looking statement. As a result, investors should

not place undue reliance on these forward-looking statements.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The Share Exchange

On

November 14, 2012, American Strategic Minerals Corporation, a Nevada corporation ("we" or the "Company") entered into a Share

Exchange Agreement (the "Exchange Agreement") with Sampo IP LLC, a Virginia limited liability company ("Sampo"), a company

that holds certain intellectual property rights, and the members of Sampo (the "Sampo Members"). Upon closing of the

transaction contemplated under the Exchange Agreement (the "Share Exchange"), on November 14, 2012, the Sampo Members (6

members) transferred all of the issued and outstanding membership interests of Sampo to the Company in exchange for an

aggregate of 9,250,000 shares of the common stock of the Company. Additionally, the Company made a cash payment to Sampo of

$500,000 pursuant to the terms of the Exchange Agreement. The 9,250,000 shares of common stock were valued at par value or

$925. In accordance with Accounting Standards Codification ("ASC") 805-50-30 "Business Combinations," the Company determined

that if the consideration paid is not in the form of cash, the measurement may be based on either (i) the cost which is

measured based on the fair value of the consideration given or (ii) the fair value of the assets (or net assets) acquired,

whichever is more clearly evident and thus more reliably measurable. The Company determined that the fair value of the net

assets acquired was a better indicator and thus more reliably measurable than the fair value of the common stock issued.

Therefore we have determined, in accordance with ASC 805-50-30, that the value of the net assets acquired is equivalent to

$500,925 which represents the cash consideration paid of $500,000 and the par value of 9,250,000 shares of the Company

($925). No independent valuation was done on the net assets or patents acquired. The Company deemed that the fair

value of the net asset of Sampo IP amounting to $500,925 is more clearly evident and more reliable measurement

basis.

Pursuant to the terms and conditions of the Share Exchange:

|

|

·

|

At the closing of the Share Exchange, each membership interest of Sampo issued and outstanding immediately prior to the closing of the Share Exchange was exchanged for the right to receive shares of our common stock. Accordingly, an aggregate of 9,250,000 shares of our common stock were issued to the Sampo Members.

|

2

|

|

·

|

Upon the closing of the Share Exchange, Mark Groussman resigned as the Company’s Chief Executive Officer and John Stetson resigned as the Company’s President and Chief Operating Officer and simultaneously with the effectiveness of the Share Exchange, Doug Croxall was appointed as the Company’s Chief Executive Officer and Chairman and John Stetson was appointed as the Company’s Chief Financial Officer and Secretary. LVL Patent Group LLC, of which Mr. Croxall is the Chief Executive Officer, and John Stetson were former members of Sampo and received 4,000,000 and 500,000 shares of the Company’s common stock, respectively, in connection with the Share Exchange

|

The foregoing description of the Share Exchange and related transactions does not purport to be complete and is qualified in its entirety by reference to the complete text of the Exchange Agreement, which is filed as Exhibit 10.1 hereto and which is incorporated herein by reference.

On

November 14, 2012, we entered into an employment agreement with Doug Croxall (the “Croxall Employment Agreement”),

whereby Mr. Croxall agreed to serve as our Chief Executive Officer for a period of two years, subject to renewal, in consideration

for an annual salary of $350,000 and an Indemnification Agreement (such Croxall Employment Agreement and the Form of Indemnification

Agreement are filed as Exhibit 10.2 and 10.4 hereto, which are incorporated herein by reference ) . Additionally,

under the terms of the Croxall Employment Agreement, Mr. Croxall shall be eligible for an annual bonus if the Company meets certain

criteria, as established by the Board of Directors. As further consideration for his services, Mr. Croxall received

a ten year option award to purchase an aggregate of Two Million (2,000,000) shares of the Company’s common stock with an

exercise price of $0.50 per share, subject to adjustment, which shall vest in twenty-four (24) equal monthly installments on each

monthly anniversary of the date of the Croxall Employment Agreement.

On November 14, 2012, we entered into a consulting agreement with C&H Capital, Inc. (“C&H”) whereby C&H agreed to provide certain consulting and investor relations services in consideration for an aggregate of One Million (1,000,000) shares of our common stock (the “Consulting Shares”).

In connection with the Share Exchange and the changes to our Board of Directors and Executive Officers (as further described below), Mark Groussman agreed to forfeit to the Company for cancellation, an unvested restricted stock grant equal to 1,000,000 shares of common stock and a fully vested option grant to purchase an aggregate of 1,500,000 shares of common stock. Additionally, John Stetson agreed to forfeit to the Company for cancellation, an unvested restricted stock grant equal to 2,000,000 shares of common stock and a fully vested option grant to purchase an aggregate of 1,500,000 shares of common stock, which were issued in connection with their previously executed employment agreements. Mr. Stetson intends to enter into a new employment agreement with the Company and negotiate new compensation in connection with his appointment as the Company’s Chief Financial Officer.

Following (i) the closing of the Share Exchange (ii) the execution of the Consulting Agreement and (iii) the execution of the Croxall Employment Agreement, there were approximately 44,368,127 shares of common stock issued and outstanding.

The shares of our Common Stock issued to the Sampo Members in connection with the Share Exchange, the options issued to Mr. Croxall under the Croxall Employment Agreement and the Consulting Shares were not registered under the Securities Act, and were issued in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Regulation D promulgated thereunder Certificates representing these shares will contain a legend stating the restrictions applicable to such shares.

Changes to the Board of Directors and Executive Officers. On November 14, 2012, effective upon the closing of the Share Exchange, Mark Groussman resigned as our Chief Executive Officer and John Stetson resigned as our President and Chief Operating Officer. Pursuant to the terms of the Exchange Agreement, Doug Croxall was appointed as our Chief Executive Officer and Chairman and John Stetson was appointed as our Chief Financial Officer and Secretary. John Stetson remains a member of our Board of Directors.

From 2003 to 2008, Mr. Croxall served as the Chief Executive Officer and Chairman of FirePond, a software company that licensed configuration pricing and quotation software to Fortune 1000 companies. Since 2009, Mr. Croxall has served as the Chief Executive Officer and Founder of LVL Patent Group LLC, a privately owned patent licensing company. Mr. Croxall earned a Bachelor of Arts degree in Political Science from Purdue University in 1991 and a Master of Business Administration from Pepperdine University in 1995. Mr. Croxall was chosen as a director of the Company based on his knowledge of and relationships in the patent acquisition and monetization business.

LVL Patent Group LLC, of which Mr. Croxall is Chief Executive Officer, and John Stetson were former members of Sampo and received 4,000,000 and 500,000 shares of the Company’s common stock, respectively, in connection with the Share Exchange.

Changes

to the Business. Through our wholly owned subsidiary, Sampo, as the owner of certain intellectual

property rights, we intend to carry on the business of engaging in the acquisition, development and monetization of

intellectual property through both the prosecution and licensing of our own patent portfolio, the acquisition of additional

intellectual property or partnering with others to defend and enforce our patent rights along with our current real estate

business, although we are exploring alternatives for our real estate business including possible sale or disposition. Upon

the closing of the Share Exchange, we relocated our executive offices to 2331 Mill Road, Suite 100, Alexandria, VA

22314.

3

Accounting Treatment. The Share Exchange is being accounted for as an acquisition of assets rather than a business pursuant to Financial Accounting Standards Board Accounting Standards Codification 805-50-30 “Business Combinations”. Accordingly, assets acquired through a transaction that is not a business combination shall be measured based on the cash consideration paid plus either the fair value of the non-cash consideration given or the fair value of the assets acquired, whichever is more clearly evident.

Tax Treatment; Small Business Issuer. The Share Exchange is intended to constitute a reorganization within the meaning of the Internal Revenue Code of 1986, as amended (the “Code”), or such other tax free reorganization exemptions that may be available under the Code. No private letter ruling or tax opinion has been obtained in connection with the Share Exchange and there can be no assurance that the tax free treatment intended will be honored by the IRS.

Following the Share Exchange, we will continue to be a “smaller reporting company,” as defined in Item 10(f)(1) of Regulation S-K, as promulgated by the SEC.

Corporate Information

Sampo IP LLC (“Sampo”) was formed in the state of Virginia on June 16, 2011. As used in this Current Report on Form 8-K, all references to “we”, “our” and “us” for periods prior to the closing of the Share Exchange refer to Sampo as a privately owned company, and for periods subsequent to the closings of the Share Exchange, refer to the Company and its subsidiaries (including Sampo).

Description

of Sampo

General

Sampo

is the owner of certain intellectual property rights, as further described herein. Subsequent to the consummation of the Share

Exchange, and through Sampo, as its newly owned wholly owned subsidiary, the Company will engage in the acquisition, development

and monetization of intellectual property through both the prosecution and licensing of its own patent portfolio, the acquisition

of additional intellectual property or partnering with others to defend and enforce their patent rights. Sampo owns a patent portfolio

consisting of three patents and one open application. The patents recite systems and methods for centralized communication by

storing information and pushing notifications to group participants, providing links to portions of the stored information while

restricting access to other portions of the stored information, and pushing notifications to user peripheral.

We intend to attempt to maximize the economic benefits of our intellectual property portfolio, add significant talent in technological innovation, and potentially enhance our opportunities for revenue generation through the monetization of our assets, including patents owned by Sampo.

We

intend to expand our intellectual property portfolio through both internal development and acquisition. We believe that our experience

will enable us to expand our intellectual property portfolio as well as create additional intellectually property internally.

We intend to monetize our intellectual property through licensing and, if necessary, through litigation.

We

will continue to actively seek to broaden our intellectual property portfolio. Our philosophy is to seek and acquire intellectual

property and technology. We are reviewing portfolio opportunities with a view toward acquiring those which we believe have potential

for monetization through licensing opportunities or enforcement. We will actively engage in due diligence with respect to a number

of patent and intellectual property portfolios and are in discussions as to the acquisition of several such portfolios.

We will likely need to raise additional capital to make any such acquisition. There is no assurance that we will succeed in acquiring

any such portfolios, as to the terms of any such acquisition or that we will successfully monetize any portfolio that we acquire.

Business Model and Strategy – Overview

Sampo acquires patents and patent rights from the owners of the patents. Sampo compensates the patent seller by either providing an upfront payment or by providing the patent seller participation in the revenue generated from the licensing activities, or a combination of both.

Key Elements of Business Strategy

Our intellectual property acquisition, development, licensing and enforcement business strategy includes the following key elements:

4

|

|

·

|

Identify Emerging Growth Areas where Patented Technologies will Play a Vital Role

|

Certain

technologies become core technologies in the way products and services are manufactured, sold and delivered by companies across

a wide array of industries. In conjunction with its partners, IP Navigation Group, patent attorneys, and other patent sourcing

professionals, we will identify core, patented technologies that have been or are anticipated to be widely adopted by third parties

in connection with the manufacture or sale of products and services.

|

|

·

|

Contact and Form Alliances with Owners of Core, Patented Technologies

|

Often individual inventors and small companies have limited resources and/or expertise and are unable to effectively address the unauthorized use of their patented technologies. We seek to enter into business agreements with owners of intellectual property that do not have experience or expertise in the areas of intellectual property licensing and enforcement, or that do not possess the in-house resources to devote to intellectual property licensing and enforcement activities, or that, for any number of strategic business reasons, desire to more efficiently and effectively outsource their intellectual property licensing and enforcement activities.

|

·

|

Effectively and Efficiently Evaluate Patented Technologies for Acquisition, Licensing and Enforcement

|

Subtleties

in the language of a patent, recorded interactions with the patent office, and the evaluation of prior art and literature can

make a significant difference in the potential licensing and enforcement revenue derived from a patent or patent portfolio. Our

new management, in conjunction with patent attorneys and litigators, as well as IP Navigation are trained and skilled in these

areas. It is important to identify potential problem areas, if any, and determine whether potential problem areas can be overcome,

prior to acquiring a patent portfolio or launching an effective licensing program. Mr. Croxall has experience developing processes

and procedures for identifying problem areas and evaluating the strength of a patent portfolio before the decision is made to

allocate resources to an acquisition or to launch an effective licensing and enforcement effort.

|

·

|

Purchase or Acquire the Rights to Patented Technologies

|

After evaluation, we may elect to purchase the patented technology, or acquire the exclusive right to license the patented technology in all or in specific fields of use. The original owner of the patent or patent rights will typically receive an upfront acquisition payment, or retain the right to a portion of the gross revenues generated from a patent portfolio’s licensing and enforcement program, or a combination of the two.

|

·

|

Successfully License and Enforce Patents with Significant Royalty Potential

|

As

part of the patent evaluation process, significant consideration is also given to the identification of potential infringers,

industries within which the potential infringers exist, longevity of the patented technology, and a variety of other factors that

directly impact the magnitude and potential success of a licensing and enforcement program. Our new management is trained in evaluating

potentially infringing technologies and in presenting the claims of our patents and demonstrating how they apply to companies

we believe are using our technologies in their products or services. These presentations can take place in a non-adversarial business

setting, but can also occur through the litigation process, if necessary. Ultimately, we will execute patent licensing arrangements

with users of our patented technologies through licensing negotiations, without the filing of patent infringement litigation,

or through the negotiation of license and settlement arrangements in connection with the filing of patent infringement litigation.

Intellectual Property and Patent Rights

Our intellectual property is primarily comprised of trade secrets, patented know-how, issued and pending patents, copyrights and technological innovation.

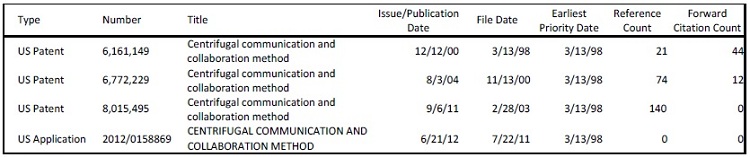

We have a portfolio comprised of three (3) patents in the United States and one open pending U.S. patent application.

We

have included a list of our U.S. patents below. Each patent below is publicly accessible on the Internet website of

the U.S. Patent and Trademark Office at www.uspto.gov.

5

The

life of the patent rights shall be based on the expiration dates of the patent rights as follows:

US

Patent 6,161,149 expires March 13, 2018;

US

Patent 6,772,229 expires Dec 1, 2019; and

US

Patent 8,015,495 expires Nov 16, 2023.

Competition

We expect to encounter significant competition from others seeking to acquire interests in intellectual property assets and monetize such assets. Most of our competitors have much longer operating histories, and significantly greater financial and human resources, than it has. Entities such as Document Security Systems, Inc. (NYSE MKT:DSS), Vringo, Inc (NYSE MKT:VRNG), VirnetX Holding Corp (NYSE MKT:VHC), Acacia Research Corporation (NASDAQ:ACTG), Allied Security Trust, Altitude Capital Partners, Augme Technologies Inc. (OTCBB:AUGT) Intellectual Ventures, Ocean Tomo, RPX Corporation (NASDAQ:RPXC), Rembrandt IP Management and others presently market themselves as being in the business of creating, acquiring, licensing or leveraging the value of intellectual property assets. We expect others to enter the market as the true value of intellectual property is increasingly recognized and validated. In addition, competitors may seek to acquire the same or similar patents and technologies that it may seek to acquire, making it more difficult for us to realize the value of its assets.

Patent Enforcement Litigation

We

may often be required to engage in litigation to enforce our patents and patent rights. Sampo is or may become a party

to ongoing patent enforcement related litigation, alleging infringement by third parties of certain of the patented technologies

owned or controlled by Sampo.

Research and Development

We have not expended funds for research and development costs since inception.

Properties.

The Company does not own or lease any real property.

Employees

As of November 14, 2012, we had 2 full-time employee and no part-time employees. We believe our employee relations to be good.

Risk Factors Relating to Sampo

An investment in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks discussed under the section captioned “Risk Factors” contained in our most recent annual report on Form 10-K, as revised or supplemented by our subsequent quarterly reports on Form 10-Q and our current reports on Form 8-K on file with the SEC, all of which are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC.

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

6

The Company intends to change the focus of its business to acquiring, developing and monetizing patents through licensing and enforcement. The Company may not be able to successfully monetize the patents, which it acquires and thus it may fail to realize all of the anticipated benefits of such acquisition.

There is no assurance that the Company will be able to successfully acquire, develop or monetize the patent portfolio that it acquired from Sampo. The acquisition of the patents could fail to produce anticipated benefits, or could have other adverse effects that the Company does not currently foresee. Failure to successfully monetize these patent assets may have a material adverse effect on the Company’s business, financial condition and results of operations.

In addition, the acquisition of the patent portfolio is subject to a number of risks, including, but not limited to the following:

• There is a significant time lag between acquiring a patent portfolio and recognizing revenue from those patent assets. During that time lag, material costs are likely to be incurred that would have a negative effect on the Company’s results of operations, cash flows and financial position; and

• The integration of a patent portfolio will be a time consuming and expensive process that may disrupt the Company’s operations. If its integration efforts are not successful, the Company’s results of operations could be harmed. In addition, the Company may not achieve anticipated synergies or other benefits from such acquisition.

Therefore, there is no assurance that the monetization of the patent portfolios to be acquired will generate enough revenue to recoup the Company’s investment.

The Company’s limited operating history makes it difficult to evaluate its current business and future prospects.

The

Company is a development stage company and has generated no revenue to date and has only incurred expenses related to its patents .

The Company has, prior to the acquisition of Sampo, been involved in unrelated businesses. To date, the Company’s business

has consisted entirely of mining and mineral exploration as a junior exploration company and real estate investments. The Company’s

efforts to license existing patents and develop new patents are still in development. Therefore, the Company not only has no operating

history in executing its business model which includes, among other things, creating, prosecuting, licensing, litigating or otherwise

monetizing its patent assets. The Company’s lack of operating history makes it difficult to evaluate its current business

model and future prospects.

In light of the costs, uncertainties, delays and difficulties frequently encountered by companies in the early stages of development with no operating history, there is a significant risk that the Company will not be able to:

• implement or execute its current business plan, or demonstrate that its business plan is sound; and/or

• raise sufficient funds in the capital markets to effectuate its business plan.

If the Company cannot execute any one of the foregoing or similar matters relating to its operations, its business may fail.

The Company is presently reliant exclusively on the patent assets it acquired from Sampo. If the Company is unable to license or otherwise monetize such assets and generate revenue and profit through those assets or by other means, there is a significant risk that the Company’s business would fail.

At the Company’s commencement of its current line of business in 2012, it acquired a portfolio of patent assets from Sampo, a company affiliated with our Chief Executive Officer Douglas Croxall, that it plans to license or otherwise monetize. If the Company’s efforts to generate revenue from such assets fail, the Company will have incurred significant losses and may be unable to acquire additional assets. If this occurs, the Company’s business would likely fail. The Company did not obtain any independent valuation with respect to the portfolio acquired from Sampo.

The Company may commence legal proceedings against certain companies, and the Company expects such litigation to be time-consuming and costly, which may adversely affect its financial condition and its ability to operate its business.

To license or otherwise monetize its patent assets, the Company may commence legal proceedings against certain companies, pursuant to which the Company may allege that such companies infringe on one or more of the Company’s patents. The Company’s viability could be highly dependent on the outcome of this litigation, and there is a risk that the Company may be unable to achieve the results it desires from such litigation, which failure would harm the Company’s business to a great degree. In addition, the defendants in this litigation are likely to be much larger than the Company and have substantially more resources than the Company does, which could make the Company’s litigation efforts more difficult.

7

The Company anticipates that these legal proceedings may continue for several years and may require significant expenditures for legal fees and other expenses. Disputes regarding the assertion of patents and other intellectual property rights are highly complex and technical. Once initiated, the Company may be forced to litigate against others to enforce or defend its intellectual property rights or to determine the validity and scope of other parties’ proprietary rights. The defendants or other third parties involved in the lawsuits in which the Company is involved may allege defenses and/or file counterclaims in an effort to avoid or limit liability and damages for patent infringement. If such defenses or counterclaims are successful, they may preclude the Company’s ability to derive licensing revenue from the patents. A negative outcome of any such litigation, or one or more claims contained within any such litigation, could materially and adversely impact the Company’s business. Additionally, the Company anticipates that its legal fees and other expenses will be material and will negatively impact the Company’s financial condition and results of operations and may result in its inability to continue its business.

The Company may seek to internally develop additional new inventions and intellectual property, which would take time and be costly. Moreover, the failure to obtain or maintain intellectual property rights for such inventions would lead to the loss of the Company’s investments in such activities.

Part of the Company’s business may include the internal development of new inventions or intellectual property that the Company will seek to monetize. However, this aspect of the Company’s business would likely require significant capital and would take time to achieve. Such activities could also distract our management team from its present business initiatives, which could have a material and adverse effect on the Company’s business. There is also the risk that the Company’s initiatives in this regard would not yield any viable new inventions or technology, which would lead to a loss of the Company’s investments in time and resources in such activities.

In addition, even if the Company is able to internally develop new inventions, in order for those inventions to be viable and to compete effectively, the Company would need to develop and maintain, and it would heavily rely on, a proprietary position with respect to such inventions and intellectual property. However, there are significant risks associated with any such intellectual property the Company may develop principally including the following:

• patent applications the Company may file may not result in issued patents or may take longer than the Company expects to result in issued patents;

• the Company may be subject to interference proceedings;

• the Company may be subject to opposition proceedings in the U.S. or foreign countries;

• any patents that are issued to the Company may not provide meaningful protection;

• the Company may not be able to develop additional proprietary technologies that are patentable;

• other companies may challenge patents issued to the Company;

• other companies may have independently developed and/or patented (or may in the future independently develop and patent) similar or alternative technologies, or duplicate the Company’s technologies;

• other companies may design around technologies the Company has developed; and

• enforcement of the Company’s patents would be complex, uncertain and very expensive.

The Company cannot be certain that patents will be issued as a result of any future applications, or that any of the Company’s patents, once issued, will provide the Company with adequate protection from competing products. For example, issued patents may be circumvented or challenged, declared invalid or unenforceable, or narrowed in scope. In addition, since publication of discoveries in scientific or patent literature often lags behind actual discoveries, the Company cannot be certain that it will be the first to make its additional new inventions or to file patent applications covering those inventions. It is also possible that others may have or may obtain issued patents that could prevent the Company from commercializing the Company’s products or require the Company to obtain licenses requiring the payment of significant fees or royalties in order to enable the Company to conduct its business. As to those patents that the Company may license or otherwise monetize, the Company’s rights will depend on maintaining its obligations to the licensor under the applicable license agreement, and the Company may be unable to do so. The Company’s failure to obtain or maintain intellectual property rights for the Company’s inventions would lead to the loss the Company’s investments in such activities, which would have a material and adverse effect on the Company’s company.

Moreover, patent application delays could cause delays in recognizing revenue from the Company’s internally generated patents and could cause the Company to miss opportunities to license patents before other competing technologies are developed or introduced into the market.

8

New legislation, regulations or court rulings related to enforcing patents could harm the Company’s business and operating results.

If Congress, the United States Patent and Trademark Office or courts implement new legislation, regulations or rulings that impact the patent enforcement process or the rights of patent holders, these changes could negatively affect the Company’s business model. For example, limitations on the ability to bring patent enforcement claims, limitations on potential liability for patent infringement, lower evidentiary standards for invalidating patents, increases in the cost to resolve patent disputes and other similar developments could negatively affect the Company’s ability to assert its patent or other intellectual property rights.

In

addition, on September 16, 2011, the Leahy-Smith America Invents Act (the “Leahy-Smith

Act”), was signed into law. The Leahy-Smith Act includes a number of significant changes to United States patent

law. These changes include provisions that affect the way patent applications will be prosecuted and may also affect patent litigation.

The U.S. Patent Office is currently developing regulations and procedures to govern administration of the Leahy-Smith Act, and

many of the substantive changes to patent law associated with the Leahy-Smith Act will not become effective until one year or

18 months after its enactment. Accordingly, it is too early to tell what, if any, impact the Leahy-Smith Act will have on the

operation of the Company’s new business. However, the Leahy-Smith Act and its implementation could increase the uncertainties

and costs surrounding the prosecution of patent applications and the enforcement or defense of the Company’s issued patents,

all of which could have a material adverse effect on the Company’s business and financial condition.

Further, and in general, it is impossible to determine the extent of the impact of any new laws, regulations or initiatives that may be proposed, or whether any of the proposals will become enacted as laws. Compliance with any new or existing laws or regulations could be difficult and expensive, affect the manner in which the Company conducts its business and negatively impact the Company’s business, prospects, financial condition and results of operations.

The Company’s acquisitions of patent assets may be time consuming, complex and costly, which could adversely affect the Company’s operating results.

Acquisitions of patent or other intellectual property assets, which are and will be critical to the Company’s business plan, are often time consuming, complex and costly to consummate. The Company may utilize many different transaction structures in its acquisitions and the terms of such acquisition agreements tend to be heavily negotiated. As a result, the Company expects to incur significant operating expenses and will likely be required to raise capital during the negotiations even if the acquisition is ultimately not consummated. Even if the Company is able to acquire particular patent assets, there is no guarantee that the Company will generate sufficient revenue related to those patent assets to offset the acquisition costs. While the Company will seek to conduct confirmatory due diligence on the patent assets the Company is considering for acquisition, the Company may acquire patent assets from a seller who does not have proper title to those assets. In those cases, the Company may be required to spend significant resources to defend the Company’s interest in the patent assets and, if the Company is not successful, its acquisition may be invalid, in which case the Company could lose part or all of its investment in the assets.

The Company may also identify patent or other intellectual property assets that cost more than the Company is prepared to spend with its own capital resources. The Company may incur significant costs to organize and negotiate a structured acquisition that does not ultimately result in an acquisition of any patent assets or, if consummated, proves to be unprofitable for the Company. These higher costs could adversely affect the Company’s operating results, and if the Company incurs losses, the value of its securities will decline.

In addition, the Company may acquire patents and technologies that are in the early stages of adoption in the commercial, industrial and consumer markets. Demand for some of these technologies will likely be untested and may be subject to fluctuation based upon the rate at which the Company’s licensees will adopt its patents and technologies in their products and services. As a result, there can be no assurance as to whether technologies the Company acquires or develops will have value that it can monetize.

In certain acquisitions of patent assets, the Company may seek to defer payment or finance a portion of the acquisition price. This approach may put the Company at a competitive disadvantage and could result in harm to the Company’s business.

The Company has limited capital and may seek to negotiate acquisitions of patent or other intellectual property assets where the Company can defer payments or finance a portion of the acquisition price. These types of debt financing or deferred payment arrangements may not be as attractive to sellers of patent assets as receiving the full purchase price for those assets in cash at the closing of the acquisition. As a result, the Company might not compete effectively against other companies in the market for acquiring patent assets, many of whom have greater cash resources than the Company has. In addition, any failure to satisfy the Company’s debt repayment obligations may result in adverse consequences to its operating results.

9

Any failure to maintain or protect the Company’s patent assets or other intellectual property rights could significantly impair its return on investment from such assets and harm the Company’s brand, its business and its operating results.

The Company’s ability to operate its business and compete in the intellectual property market largely depends on the superiority, uniqueness and value of the Company’s acquired patent assets and other intellectual property. To protect the Company’s proprietary rights, the Company relies on and will rely on a combination of patent, trademark, copyright and trade secret laws, confidentiality agreements with its employees and third parties, and protective contractual provisions. No assurances can be given that any of the measures the Company undertakes to protect and maintain its assets will have any measure of success.

Following the acquisition of patent assets, the Company will likely be required to spend significant time and resources to maintain the effectiveness of those assets by paying maintenance fees and making filings with the United States Patent and Trademark Office. The Company may acquire patent assets, including patent applications, which require the Company to spend resources to prosecute the applications with the United States Patent and Trademark Office. Further, there is a material risk that patent related claims (such as, for example, infringement claims (and/or claims for indemnification resulting therefrom), unenforceability claims, or invalidity claims) will be asserted or prosecuted against the Company, and such assertions or prosecutions could materially and adversely affect the Company’s business. Regardless of whether any such claims are valid or can be successfully asserted, defending such claims could cause the Company to incur significant costs and could divert resources away from the Company’s other activities.

Despite the Company’s efforts to protect its intellectual property rights, any of the following or similar occurrences may reduce the value of the Company’s intellectual property:

• the Company’s applications for patents, trademarks and copyrights may not be granted and, if granted, may be challenged or invalidated;

• issued trademarks, copyrights, or patents may not provide the Company with any competitive advantages when compared to potentially infringing other properties;

• the Company’s efforts to protect its intellectual property rights may not be effective in preventing misappropriation of the Company’s technology; or

• the Company’s efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those the Company acquires and/or prosecutes.

Moreover, the Company may not be able to effectively protect its intellectual property rights in certain foreign countries where the Company may do business in the future or from which competitors may operate. If the Company fails to maintain, defend or prosecute its patent assets properly, the value of those assets would be reduced or eliminated, and the Company’s business would be harmed.

Weak global economic conditions may cause infringing parties to delay entering into licensing agreements, which could prolong the Company’s litigation and adversely affect its financial condition and operating results.

The Company’s business plan depends significantly on worldwide economic conditions, and the United States and world economies have recently experienced weak economic conditions. Uncertainty about global economic conditions poses a risk as businesses may postpone spending in response to tighter credit, negative financial news and declines in income or asset values. This response could have a material negative effect on the willingness of parties infringing on the Company’s assets to enter into licensing or other revenue generating agreements voluntarily. Entering into such agreements is critical to the Company’s business plan, and the Company’s failure to do so could cause material harm to its business.

The Company is a development stage company with no historically significant income and there is a significant doubt about the Company’s ability to continue its activities as a going concern.

The Company is still a development stage company. The Company’s operations are subject to all of the risks inherent in development stage companies that do not have significant revenues or operating income. The Company’s potential for success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with a new business. The Company cannot provide any assurance that its business objectives will be accomplished. All of the Company’s audited consolidated financial statements, since inception, have contained a statement by the Company’s management that raises significant doubt about the Company being able to continue as a going concern unless the Company is able to raise additional capital. The Company’s financial statements do not include any adjustment relating to the recovery and classification of recorded asset amounts or the amount and classification of liabilities that might be necessary should the Company’s operations cease.

10

If the Company is unable to adequately protect its intellectual property, the Company may not be able to compete effectively.

The

Company’s ability to compete depends in part upon the strength of the Company’s proprietary rights that it owns or

may hereafter acquire in its technologies, brands and content. The Company relies on a combination of U.S. and foreign patents,

copyrights, trademark, trade secret laws and license agreements to establish and protect its intellectual property and proprietary

rights. The efforts the Company takes to protect its intellectual property and proprietary rights may not be sufficient

or effective at stopping unauthorized use of its intellectual property and proprietary rights. In addition, effective trademark,

patent, copyright and trade secret protection may not be available or cost-effective in every country in which the Company’s

services are made available. There may be instances where the Company is not able to fully protect or utilize its intellectual

property in a manner that maximizes competitive advantage. If the Company is unable to protect its intellectual property and proprietary

rights from unauthorized use, the value of the Company’s products may be reduced, which could negatively impact the Company’s

business. The Company’s inability to obtain appropriate protections for its intellectual property may also allow competitors

to enter the Company’s markets and produce or sell the same or similar products. In addition, protecting the Company’s

intellectual property and other proprietary rights is expensive and diverts critical managerial resources. If any of the foregoing

were to occur, or if the Company is otherwise unable to protect its intellectual property and proprietary rights, the Company’s

business and financial results could be adversely affected.

If the Company is forced to resort to legal proceedings to enforce its intellectual property rights, the proceedings could be burdensome and expensive. In addition, the Company’s proprietary rights could be at risk if the Company is unsuccessful in, or cannot afford to pursue, those proceedings. The Company also relies on trade secrets and contract law to protect some of its proprietary technology. The Company will enter into confidentiality and invention agreements with its employees and consultants. Nevertheless, these agreements may not be honored and they may not effectively protect the Company’s right to its un-patented trade secrets and know-how. Moreover, others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to the Company’s trade secrets and know-how.

The following tables set forth certain information as of November 14, 2012 regarding the beneficial ownership of our common stock, based on 44,368,127 shares of Common Stock issued and outstanding, taking into account the consummation of the Share Exchange by (i) each person or entity who, to our knowledge, owns more than 5% of our common stock; (ii) each executive officer and director; and (iii) all of our executive officers and directors as a group. Unless otherwise indicated in the footnotes to the following table, each person named in the table has sole voting and investment power and that person’s address is c/o American Strategic Minerals Corporation, 2331 Mill Road, Suite 100, Alexandria, VA 22314. Shares of common stock subject to options, warrants, or other rights currently exercisable or exercisable within 60 days of November 14, 2012, are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the stockholder holding such options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other stockholder.

|

Name of Beneficial Owner

|

Number of Shares Beneficially Owned

|

Percentage

Beneficially Owned

|

||

|

Doug Croxall (1)

|

4,166,666

|

9.6%

|

||

|

John Stetson (2) (3)

|

812,500

|

1.8%

|

||

|

Joshua Bleak (3) (4)

|

0

|

0

|

||

|

Stuart Smith (3) (5)

|

500,000

|

1.1%

|

||

|

David Rector (3) (6)

|

100,000

|

*

|

||

|

Pershing Gold Corporation (7)

|

4,173,333

|

9.4%

|

||

|

Barry Honig (8)

|

3,041,111

|

6.9%

|

||

|

Mark Groussman (9)

|

2,965,631

|

6.7%

|

||

|

All executive officers and directors as a group (5 persons)

|

5,579,166

|

12.5%

|

||

|

*

|

Less than one percent.

|

|

(1)

|

Chief Executive Officer and Chairman of the Company. Includes 4,000,000 shares of Common Stock held by LVL Patent Group LLC, over which Mr. Croxall holds voting and dispositive power. Includes options to purchase an aggregate of 166,666 shares of common stock that shall vest and are exercisable within 60 days. Excludes options to purchase 1,833,334 shares of common stock that do not vest and are not exercisable within 60 days.

|

|

(2)

|

Chief Financial Officer and Secretary of the Company. Represents 500,000 shares of common stock held by Mr. Stetson individually, 75,000 shares of Common Stock held by HS Contrarian Investments LLC and 237,500 shares of Common Stock held by Stetson Capital Investments, Inc. Mr. Stetson is the managing member of HS Contrarian Investments LLC and the President of Stetson Capital Investments, Inc. and in such capacities is deemed to have voting and dispositive power over shares held by such entities.

|

|

(3)

|

Director of the Company.

|

|

(4)

|

Excludes warrants to purchase 700,000 shares of Common Stock which are not exercisable within 60 days.

|

|

(5)

|

Excludes warrants to purchase 250,000 shares of Common Stock which are not exercisable within 60 days.

|

11

|

(6)

|

Excludes warrants to purchase 250,000 shares of Common Stock which are not exercisable within 60 days. Mr. Rector also serves as Director of Pershing Gold Corporation. Excludes shares held by Pershing Gold Corporation.

|

|

(7)

|

Stephen Alfers is the President and Chief Executive Officer of Pershing Gold Corporation and in such capacity is deemed to have voting and dispositive power over the shares of Common Stock held by Pershing Gold Corporation.

|

|

(8)

|

Includes 1,000,000 shares of Common Stock held by GRQ Consultants, Inc. 401(k) and 1,361,111 shares of Common Stock held by GRQ Consultants, Inc. Barry Honig is the trustee of GRQ Consultants, Inc. 401(k) and the President of GRQ Consultants, Inc. and in such capacities is deemed to have voting and dispositive power over the shares of Common Stock held by such entities. Mr. Honig also serves as Director of Pershing Gold Corporation. Excludes shares held by Pershing Gold Corporation.

|

|

(9)

|

Represents 2,662,391 shares of Common Stock held by Melechdavid, Inc. Mark Groussman is the President of Melechdavid, Inc. and in such capacity holds voting and dispositive power over shares held by such entity. Also includes 302,970 shares of Common Stock held in trust for Mr. Groussman’s minor child.

|

Item 3.02 Unregistered Sales of Equity Securities.

Share Exchange

On November 14, 2012, we entered into the Exchange Agreement with Sampo and the Sampo Members. Upon closing of the transaction contemplated under the Exchange Agreement (the “Share Exchange”), on November 14, 2012, the Sampo Members (six members) transferred all of the issued and outstanding membership interests of Sampo to the Company in exchange for an aggregate of 9,250,000 shares of the Common Stock of the Company. Such exchange caused Sampo to become a wholly-owned subsidiary of the Company.

Croxall Options

On November 14, 2012, we entered into the Croxall Employment Agreement, whereby Mr. Croxall agreed to serve as our Chief Executive Officer for a period of two years, subject to renewal, in consideration for an annual salary of $350,000. Additionally, under the terms of the Croxall Employment Agreement, Mr. Croxall shall be eligible for an annual bonus if the Company meets certain criteria, as established by the Board of Directors. As further consideration for his services, Mr. Croxall shall receive a ten year option award to purchase an aggregate of Two Million (2,000,000) shares of the Company’s common stock with an exercise price of $0.50 per share, which shall vest in twenty-four (24) equal monthly installments on each monthly anniversary of the date of the Croxall Employment Agreement.

Consulting Shares

On November 14, 2012, we entered into a consulting agreement with C&H Capital, Inc. (“C&H”) whereby C&H agreed to provide certain consulting and investor relations services in consideration for an aggregate of One Million (1,000,000) shares of our common stock.

The securities were all sold and/or issued only to “accredited investors,” as such term is defined in the Securities Act, were not registered under the Securities Act or the securities laws of any state, and were offered and sold in reliance on the exemption from registration afforded by Section 4(2) and Regulation D (Rule 506) under the Securities Act and corresponding provisions of state securities laws.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Reference is made to the disclosure set forth under Item 2.01 of this Current Report on Form 8-K, which disclosure is incorporated herein by reference.

12

(d) Exhibits.

The exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

|

Exhibit No.

|

Description

|

|

10.1

|

Share

Exchange Agreement *

|

|

10.2

10.3

10.4

|

Employment

Agreement between the Company and Doug Croxall *

Consulting

Agreement with C&H Capital, Inc. *

Form

of Indemnification Agreement between the Company and Doug Croxall *

|

*Incorporated

by reference to the Company's Current Report on Form 8-K, filed with the SEC on November 20, 2012.

13

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: December

26 , 2012

|

AMERICAN STRATEGIC MINERALS CORPORATION

|

|

By: /s/ Doug Croxall

|

|

Name: Doug Croxall

|

|

Title: Chief Executive Officer

|