DEF 14A: Definitive proxy statements

Published on April 30, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

☑ |

Filed by the Registrant |

☐ |

Filed by a party other than the Registrant |

||||||||

CHECK THE APPROPRIATE BOX: | |||||

☐ |

Preliminary Proxy Statement |

||||

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

||||

☑ |

Definitive Proxy Statement |

||||

☐ |

Definitive Additional Materials |

||||

☐ |

Soliciting Material under §240.14a-12 |

||||

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | |||||

☑ |

No fee required |

||||

☐ |

Fee paid previously with preliminary materials |

||||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

||||

Notice of Virtual Annual Meeting of Stockholders

Annual Meeting Proposals

| PROPOSALS | ||||||||||||||||||||

| 1 | ||||||||||||||||||||

Election of two Class II directors to serve until our annual meeting of stockholders to be held in 2028, or until their successors are duly elected and qualified, or until their earlier death, resignation or removal |

FOR each director nominee

|

|||||||||||||||||||

| 2 | ||||||||||||||||||||

Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2025 |

FOR

|

|||||||||||||||||||

| 3 | ||||||||||||||||||||

Approval, on an advisory basis, of the compensation of the Named Executive Officers |

FOR

|

|||||||||||||||||||

| 4 | ||||||||||||||||||||

Approval of an amendment to our 2018 Plan to increase the number of shares of our common stock reserved under our 2018 Plan by 18 million |

FOR

|

|||||||||||||||||||

We may also transact such other business as may be properly brought before the Annual Meeting or any postponements or adjournments thereof.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the Proxy Statement and submit your proxy or voting instructions as soon as possible to ensure your shares are represented. For additional instructions on attending the Annual Meeting or voting your shares, please refer to the section titled “Questions and Answers About the Annual Meeting and Voting” in the Proxy Statement. Returning the proxy does not deprive you of your right to virtually attend the Annual Meeting or to vote your shares at the Annual Meeting.

By Order of the Board of Directors:

| ||

|

Fred Thiel

Chief Executive Officer and Chairman of the Board

| ||

| LOGISTICS | |||||||||||||||||

|

Date and Time

Thursday, June 26, 2025

8:30 a.m. Pacific Time

Record Date

Monday, April 28, 2025

Virtual Meeting

You can attend the Annual Meeting online, submit your questions and vote your shares by visiting web.lumiconnect.com/266814323 (password: mara2025)

Proxy Materials

Approximate Date of Mailing of Notice of Internet Availability of Proxy Materials: May 7, 2025

| |||||||||||||||||

| HOW TO VOTE | |||||||||||||||||

|

By Internet

www.voteproxy.com

By Telephone

1-800-776-9437 in the United States or 1-201-299-4446 from foreign countries

By Mail

Mark, sign and date your proxy card and return it promptly in the postage-paid envelope provided

Beneficial Owners

If you own shares of our common stock registered in the name of a broker, bank or other nominee, please follow the instructions they provide on how to vote your shares

| |||||||||||||||||

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 26, 2025

This Notice of Meeting, Proxy Statement and our 2024 Annual Report are available on the Internet at www.astproxyportal.com/ast/29360. The materials are also available in the Investor Relations section of our website at ir.mara.com.

| ||

References to websites in this Proxy Statement are provided for convenience only. Our website is for informational purposes only and the contents of our website or information connected thereto are not a part of this Proxy Statement and are not deemed incorporated by reference into this Proxy Statement or any other public filing made with the U.S. Securities and Exchange Commission.

Table of Contents

|

||||||||

|

||||||||

|

||||||||

|

||||||||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains forward-looking statements. All statements contained in this Proxy Statement other than statements of historical fact, including statements relating to trends in or expectations relating to the expected effects of our initiatives, strategies and plans, are forward-looking statements. The words “can,” “believe,” “may,” “will,” “continue,” “anticipate,” “intend,” “plan,” “expect,” “seek” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the risks detailed in our filings with the SEC, including the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2024. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Proxy Statement may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results. We assume no obligation to update any of these forward-looking statements after the date of this Proxy Statement, except as required by law.

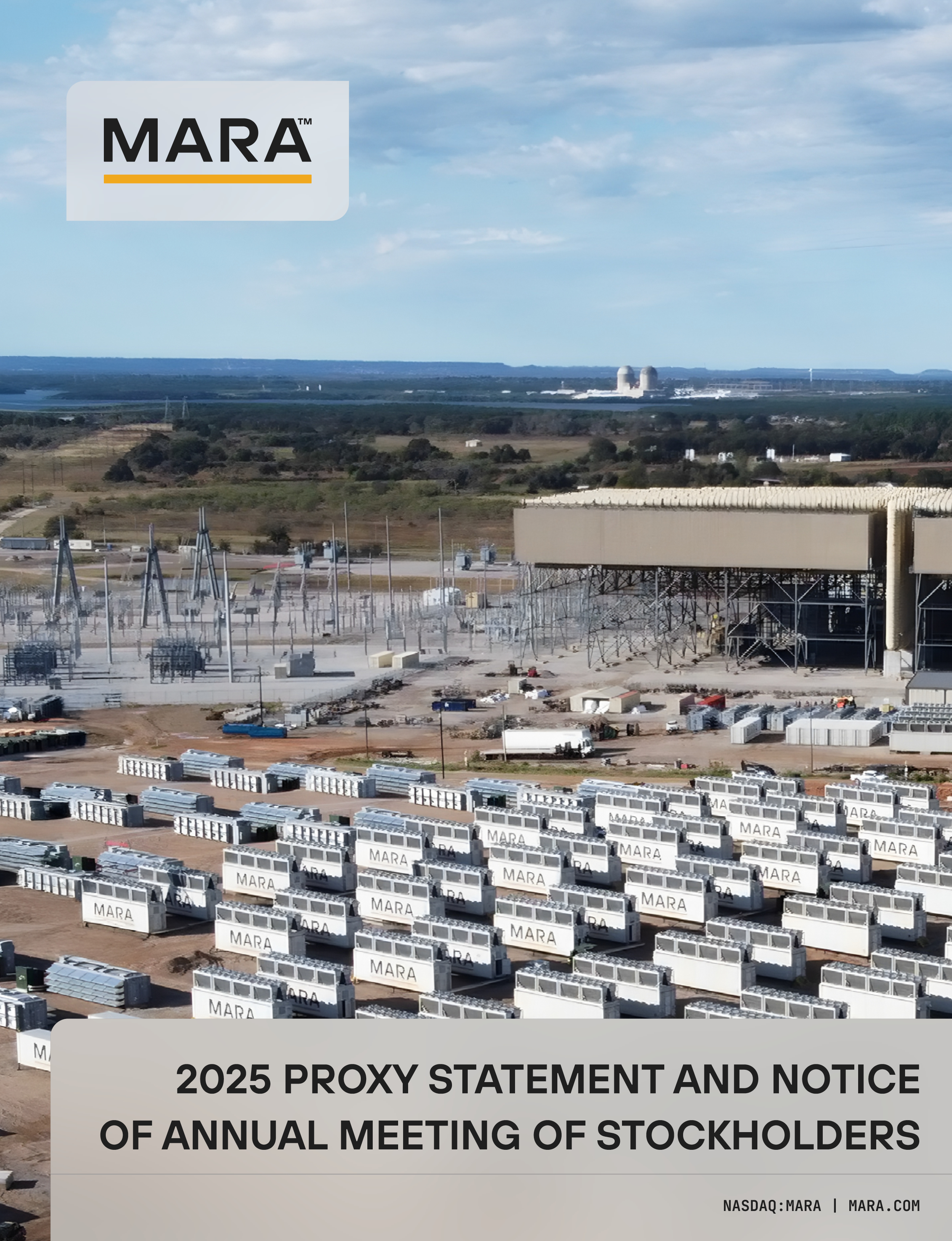

About MARA

MARA Holdings, Inc. (“MARA”) is a vertically integrated digital energy and infrastructure company that leverages high-intensity compute, such as Bitcoin mining, to monetize underutilized energy assets and optimize power management.

As of December 31, 2024, our total energy portfolio consisted of approximately 1.7 gigawatts of capacity with 16 data centers deployed across North America, the Middle East, Europe and Latin America. We believe we are the world’s largest and most efficient publicly traded Bitcoin mining company, with most of our production in the United States.

MARA at a Glance (as of December 31, 2024)

| Incorporated | 2010 (Nevada) | ||||||||||

| Headquarters | Fort Lauderdale, Florida | ||||||||||

| Publicly Listed | MARA (NASDAQ) | ||||||||||

| Market Capitalization | $5.7 billion | ||||||||||

| Employees | 152 | ||||||||||

| Core Business |

•Converting clean, stranded or otherwise underutilized energy into economic value with the most efficient hardware available

•Developing new technologies to advance the Bitcoin mining network

|

||||||||||

| OUR STRATEGY | |||||||||||||||||

|

Vertically Integrated Technology

•Software + Hardware + Infrastructure

|

|

Bitcoin Treasury

•44,893 BTC held (including 10,374 loaned or collateralized BTC, full “HODLˮ approach

|

|

Diversified Operations

•53.2 EH/s energized combined at 16 sites across four continents

|

||||||||||||

2024 FINANCIAL AND OPERATIONAL HIGHLIGHTS

| 53.2 EH/s | 9,430 | $656M | $4.6B | ||||||||||||||||||||||||||

| Energized Hash Rate |

Bitcoin Produced |

Revenues | Unrestricted Cash, Cash Equivalents and BTC | ||||||||||||||||||||||||||

| 2025 PROXY STATEMENT | 1 |

||||

Proxy Voting Roadmap

This summary highlights select information contained elsewhere in this Proxy Statement. This summary does not contain all the information that you should consider, and you should read the entire Proxy Statement carefully before submitting your proxy and voting instructions. For more information regarding our 2024 performance, please review our 2024 Annual Report, which is being made available to stockholders together with this Proxy Statement on or about May 7, 2025.

| PROPOSAL 1 | ||||||||||||||

Election of Directors |

||||||||||||||

\  \ \

|

||||||||||||||

Our Board at a Glance

| Name and Primary Occupation |

Career Highlights | Director Since | Committees | |||||||||||||||||

| Nominees for Election as Class II Directors | ||||||||||||||||||||

|

Georges Antoun

Chief Commercial Officer of First Solar

|

•30 years of operational and technical experience at global technology companies

•Board membership at publicly traded companies

|

May 20, 2021 |

|

RAC |

|||||||||||||||

|

TSC | |||||||||||||||||||

|

Jay Leupp

Managing Partner and Senior Portfolio Manager of Terra Firma Asset Management, LLC

|

•Extensive audit and financial expertise

•Member of American Institute of Certified Public Accountants

|

May 20, 2021 |

|

RAC |

|||||||||||||||

|

NCGC | |||||||||||||||||||

| Continuing Class III Directors | ||||||||||||||||||||

|

Vicki Mealer-Burke

Former Chief Diversity Officer of QUALCOMM

|

•26 years of global executive leadership experience at QUALCOMM

•Led global organizational transformation program for human resources at QUALCOMM

|

Apr. 1, 2024 |

|

TCCC | |||||||||||||||

|

NCGC | |||||||||||||||||||

|

SRC | |||||||||||||||||||

|

Douglas Mellinger

Managing Director of Clarion Capital Partners

|

•Extensive experience building and leading public and private companies in the technology and financial industries

•Extensive finance experience

|

Mar. 31, 2022 |

|

NCGC | |||||||||||||||

|

SRC | |||||||||||||||||||

|

TSC | |||||||||||||||||||

| Continuing Class I Directors | ||||||||||||||||||||

|

Fred Thiel

Chief Executive Officer and Chairman of MARA Holdings, Inc.

|

•Extensive blockchain and cryptocurrency experience

•Deep operating and strategic expertise in the technology industry

|

Apr. 24, 2018 | |||||||||||||||||

|

Janet George

Executive Vice President of Artificial Intelligence of Mastercard

|

|

•Deep expertise in artificial intelligence, data centers and high-growth technology environments

•Strong track record of scaling businesses and executing and integrating large-scale acquisitions

|

Sept. 1, 2024 |

|

TSC | ||||||||||||||

|

RAC | |||||||||||||||||||

|

TCCC | |||||||||||||||||||

|

Barbara Humpton

President and Chief Executive Officer of Siemens USA

|

|

•Oversees a $19 billion portfolio that focuses on energy-efficient technologies, smart infrastructure and healthcare

•Experience leveraging AI and industrial data to drive continuous improvements

|

Sept. 1, 2024 |

|

SRC | ||||||||||||||

|

TCCC | |||||||||||||||||||

|

TSC | |||||||||||||||||||

NCGC - Nominating & Corporate Governance Committee |

RAC - Risk & Audit Committee |

|

Chair |

|

Member | ||||||||||||

| TCCC - Talent, Culture & Compensation Committee | SRC - Social Responsibility Committee | TSC - Technology & Strategy Committee | |||||||||||||||

2 |

|

||||

Proxy Voting Roadmap

| PROPOSAL 2 | ||||||||||||||

Ratification of the Appointment of PricewaterhouseCoopers LLP as Independent Registered Public Accounting Firm for 2025 |

||||||||||||||

|

||||||||||||||

Our board of directors (the “Board”) recommends a vote FOR ratification of the appointment of PricewaterhouseCoopers LLP (“PwC”) as the independent registered public accounting firm for 2025. The Risk and Audit Committee of our Board considered several factors in engaging PwC, including their independence controls and objectivity, industry knowledge and expertise. The Risk and Audit Committee has determined that the appointment of PwC is in the best interests of MARA and its stockholders.

| PROPOSAL 3 | ||||||||||||||

Approval, on an Advisory Basis, of Compensation Paid to Our Named Executive Officers |

||||||||||||||

|

||||||||||||||

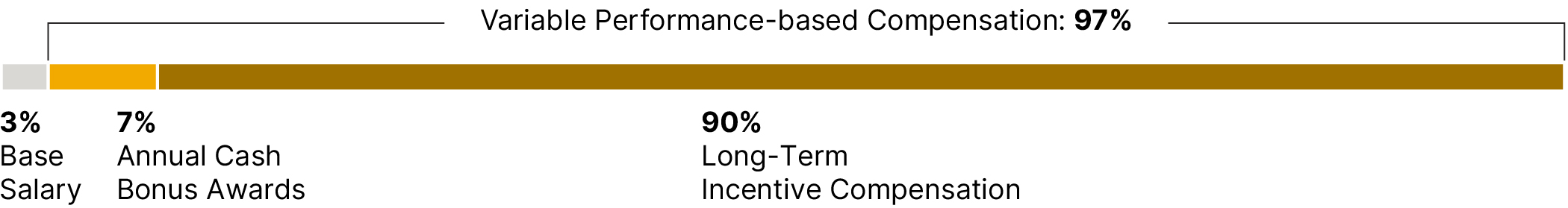

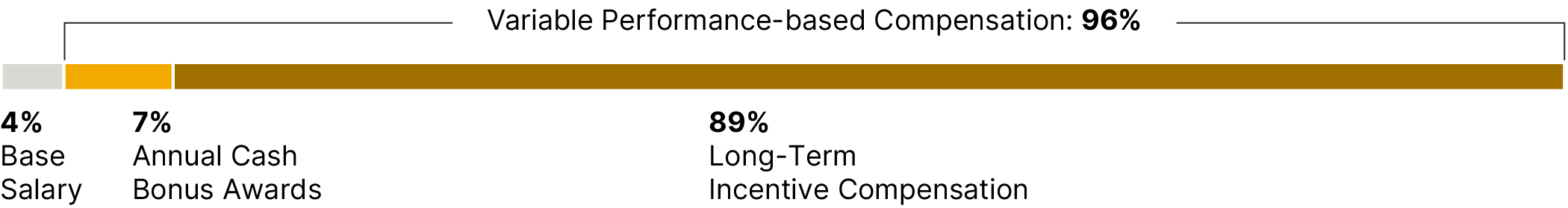

Overview of NEO Compensation

The Talent, Culture and Compensation Committee of our Board is guided by a pay-for-performance philosophy and seeks to design the executive compensation program in a manner that reflects alignment between the total compensation paid to executive officers and achievement of strategic objectives deemed critical to the growth and success of the business. To ensure the interests of executives are aligned with those of stockholders, a significant portion of the total compensation opportunity for executives is issued in the form of equity incentive compensation. The charts below represent target compensation mix for (i) the Chief Executive Officer and (ii) as an average for the other Named Executive Officers.

| Pay Element | Form | Description | ||||||||||||

| Fixed | Base Salary |

•Provide a base amount of compensation necessary to attract and retain executives

•Reviewed annually and all of the Named Executive Officers had an increase in salary in 2024

|

||||||||||||

CEO

|

Other NEOs

|

|||||||||||||

| Short-Term Incentive | Annual Cash Incentive Compensation |

•Based on achievement of objectives deemed important by the Talent, Culture and Compensation Committee to be important for driving long-term stockholder value

•For 2024, annual cash incentive opportunities for our Named Executive Officers were based on a combination of MARA’s achievement of an exahash target and individual performance goals

•For 2024 performance, the Named Executive Officers were awarded cash bonuses of 140% to 210% of their base salary

|

||||||||||||

CEO

|

Other NEOs

|

|||||||||||||

| Long-Term Incentives | Performance-based Restricted Stock Units |

•Entitles recipient to receive shares of common stock upon vesting and settlement

•All long-term incentive awards for 2024 performance vest solely based on the achievement of relative total stockholder return (“TSR”) performance as measured against a designated peer group

|

||||||||||||

CEO

|

Other NEOs

|

|||||||||||||

| 2025 PROXY STATEMENT | 3 |

||||

Proxy Voting Roadmap

| PROPOSAL 4 | ||||||||||||||

Proposal 4: Approval of Amendment to Our 2018 Plan |

||||||||||||||

|

||||||||||||||

Our Board recommends a vote FOR approval of an amendment to our Amended and Restated 2018 Equity Incentive Plan (the “2018 Plan”) to increase the number of shares reserved under the 2018 Plan by 18 million shares. The amendment is intended to support our ability to attract and retain directors, officers, employees and other service providers by ensuring sufficient shares remain available for future equity awards. The 2018 Plan was used to grant equity awards to approximately 80% of our employees in 2024 and we believe reflects good governance practices.

4 |

|

||||

Board and Governance Matters

| PROPOSAL 1 | ||||||||||||||

| Election of Class II Directors | ||||||||||||||

|

Our Board unanimously recommends a vote “FOR” each Class II Director Nominee

|

|||||||||||||

Board Structure and Membership

We currently have seven directors serving and no vacant directorships on our Board. Our Amended and Restated Bylaws (our “Bylaws”) provide that our Board is divided into three classes with staggered three-year terms. Only one class of directors will be elected at each annual meeting of stockholders, with the other two classes continuing to serve for the remainder of their respective three-year terms. Because approximately one-third of our directors will be elected at each annual meeting of stockholders, consecutive annual meetings could be required for our stockholders to change a majority of our Board. This classification of our Board may have the effect of delaying or preventing changes of control of MARA.

Our three classes of directors are currently divided as follows:

•The Class II directors are Georges Antoun and Jay Leupp, whose terms will expire at the annual meeting to which this Proxy Statement relates (the “Annual Meeting”) unless they are re-elected;

•The Class III directors are Vicki Mealer-Burke and Douglas Mellinger, whose terms will expire at the annual meeting of stockholders to be held in 2026; and

•The Class I directors are Fred Thiel, Janet George and Barbara Humpton, whose terms will expire at the annual meeting of stockholders to be held in 2027.

Any additional directorships resulting from an increase in the number of directors or a vacancy may be filled by the vote of a majority of the remaining directors then in office, although less than a quorum, or by the sole remaining director. A director elected by our Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, will serve for the remainder of the full term of that class, or until the director’s successor is duly elected and qualified, or until such director’s earlier death, resignation or removal. The size of our Board may be reduced or increased by resolution adopted by our stockholders or directors.

Classified Board Structure

The Board believes that a classified board structure offers several advantages to MARA and its stockholders, such as promoting board continuity and stability, encouraging long-term perspectives in pursuing our strategic initiatives, ensuring that a majority of the directors will always have a deep knowledge of MARA and a firm understanding of its goals and providing protection against certain abusive takeover tactics. A classified Board remains accountable to MARA’s stockholders as directors continue to have fiduciary responsibilities. We have a successful history of refreshing our Board and efficiently allocating board roles appropriately. We currently have six independent directors, each of whom contributes valuable skills and backgrounds to our Board and enhances the Board’s oversight in areas critical to our business strategy.

Director Nominees

Our Board has nominated Georges Antoun and Jay Leupp for re-election to our Board as Class II directors. If elected at the Annual Meeting, Messrs. Antoun and Leupp would serve until our annual meeting of stockholders to be held in 2028, or until their respective successors are duly elected and qualified, or until such director’s earlier death, resignation or removal.

| 2025 PROXY STATEMENT | 5 |

||||

Board and Governance Matters

Required Vote

The election of each of our director nominees requires a plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. This means that the two nominees receiving the highest number of votes at the Annual Meeting will be elected, even if those votes do not constitute a majority of the votes cast. Stockholders may vote “FOR” each director or “WITHHOLD” their vote for any director with respect to this Proposal No. 1. A “WITHHOLD” vote with respect to a director nominee will not count as a vote cast for that or any other nominee, and thus will have no effect on the outcome of the vote on this proposal.

This proposal is considered a non-routine matter. A broker, bank or other nominee may not vote without instructions on this matter, so there may be broker non-votes in connection with this proposal. Broker non-votes will have no effect on the outcome of the vote on this proposal. If no contrary indication is made, returned proxies will be voted “FOR” each of the Class II director nominees.

Our 2025 Directors and Nominees

Board Qualifications

Our directors and nominees have a wide range of skills, experiences and leadership to oversee MARA’s execution of its strategy.

| Skill / Experience / Expertise | ||||||||||||||||||||||||||||||||||||||

| Director |  |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

| Antoun | l | l | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||

| Humpton | l | l | l | l | l | l | l | l | l | l | l | |||||||||||||||||||||||||||

| George | l | l | l | l | l | l | l | l | l | |||||||||||||||||||||||||||||

| Leupp | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||||

| Mealer-Burke | l | l | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||

| Mellinger | l | l | l | l | l | l | l | l | l | l | ||||||||||||||||||||||||||||

| Thiel | l | l | l | l | l | l | l | l | l | l | l | |||||||||||||||||||||||||||

|

Executive Leadership |  |

Sales/Marketing |  |

Cybersecurity | ||||||||||||

|

Technology/Industry |  |

Human Capital Management |  |

Public Policy/Legal/Regulatory | ||||||||||||

|

International Operations |  |

Risk Management |  |

Business Transformation/Strategy | ||||||||||||

|

Financial Expertise/Literacy |  |

Corporate Governance |  |

Energy/Sustainability | ||||||||||||

6 |

|

||||

Board and Governance Matters

Director Biographies

Director Nominees

Our Board has nominated the two directors set forth in the table below for reelection as Class II directors at the Annual Meeting.

The information below includes certain biographical information about each director nominee, as well as selected information about the specific qualifications, attributes, skills and experience that led our Board to conclude that each director nominee is qualified to serve on our Board.

Independent: Yes

Board Committees: Risk and Audit; Technology and Strategy

Prior Public Company Directorships: Ruckus Wireless, Inc.; Violin Memory, Inc.

Other Directorships and Memberships: Chairman of the University of Louisiana’s College of Engineering Dean’s Advisory Council board

|

Georges Antoun

Chief Commercial Officer of First Solar

|

Age: 62

Director Since: May 20, 2021

|

||||||||||||||||||||||||

Professional Experience |

||||||||||||||||||||||||||

|

•Chief Commercial Officer, First Solar, Inc. Appointed in July 2016 after serving as Chief Operating Officer and later as President, U.S.; instrumental in shaping commercial strategy for one of the world’s leading solar companies.

•Venture Partner, Technology Crossover Ventures (TCV). Provided operational expertise to a top-tier technology-focused private equity and venture capital firm.

•Executive Leadership at Ericsson and Redback Networks. Led global IP and broadband networks at Ericsson; previously served as senior vice president of worldwide sales and operations of Redback Networks and then as chief executive officer of the Redback Networks subsidiary following its acquisition by Ericsson.

|

•Senior Leadership at Cisco Systems. Held several key executive roles, including Vice President of Worldwide Systems Engineering, Optical Operations, and Carrier Sales.

•Early Career at NYNEX (now Verizon). Began his career as a member of the technical staff in the Science and Technology Division, developing foundational expertise in communications infrastructure.

•Energy Advisory Council. Serves on the Federal Reserve Bank of Atlanta’s Energy Advisory Council, providing strategic guidance on energy policy.

•Academic Background. B.S. in Engineering from the University of Louisiana at Lafayette and an M.S. in Information Systems Engineering from the Polytechnic Institute of New York University.

|

|||||||||||||||||||||||||

|

Skills and Experience Supporting Nomination

Our Board believes Mr. Antoun is qualified to serve as a member of our Board due to his more than 30 years of leadership across the global technology sector. He has held senior executive roles at industry-leading companies and brings deep expertise in scaling operations, driving innovation and navigating complex global markets. His prior board service and experience overseeing strategic growth initiatives further enhance his ability to contribute meaningfully to the Board’s oversight and decision-making.

|

||||||||||||||||||||||||||

| 2025 PROXY STATEMENT | 7 |

||||

Board and Governance Matters

Independent: Yes

Board Committees: Risk and Audit (Chair); Nominating and Corporate Governance

Current Public Company Directorships: Healthcare Realty Trust Incorporated; Apartment Investment and Management Company

Other Directorships and Memberships: G.W. Williams Company; Certified Public Accountant (inactive status)

|

Jay Leupp

Managing Partner and Senior Portfolio Manager of Terra Firma Asset Management

|

Age: 61

Director Since: May 20, 2021

|

||||||||||||||||||||||||

| Professional Experience | ||||||||||||||||||||||||||

|

•Managing Partner, Terra Firma Asset Management, LLC. Leads investment strategy and portfolio management for real estate securities, bringing decades of financial, real estate and asset management expertise.

•Managing Director, Lazard Asset Management. Led Lazard’s global real estate securities practice, a business that was created with the sale of Grubb & Ellis Alesco Global Advisors to Lazard in 2011.

•Founder, President and Chief Executive Officer, Grubb & Ellis Alesco Global Advisors. Established and led a real estate securities mutual fund platform, serving as Senior Portfolio Manager until the firm’s acquisition by Lazard.

|

•Managing Director, Real Estate Equity Research. Directed real estate equity research at RBC Capital Markets, an investment banking division of the Royal Bank of Canada, as well as Robertson Stephens & Company, formerly an investment banking firm.

•Early Career in Real Estate and Accounting. Gained foundational experience at Staubach Company, specializing in the leasing, acquisition and financing of commercial real estate; Trammell Crow Company, a leading commercial real estate development and investment firm; and KPMG Peat Marwick.

•Academic Background. B.S. in Business Administration from Santa Clara University and an MBA from Harvard Business School.

|

|||||||||||||||||||||||||

|

Skills and Experience Supporting Nomination

Our Board believes Mr. Leupp is qualified to serve as a member of our Board because of his extensive audit and finance expertise, as well as his long-standing experience in investment management and capital markets. As a senior executive at multiple global financial institutions and member of publicly traded company boards, Mr. Leupp brings deep knowledge of financial reporting, risk oversight and corporate governance, which are critical to the Board’s oversight responsibilities.

|

||||||||||||||||||||||||||

8 |

|

||||

Board and Governance Matters

Continuing Directors

The table below sets forth our Class I and Class III directors, whose terms will expire at our annual meetings to be held in 2027 and 2026, respectively.

Independent: Yes

Board Committees: Technology and Strategy (Chair); Risk and Audit; Talent, Culture and Compensation

Prior Public Company Directorships: NanoString Technologies, Inc.

Other Directorships and Memberships: Gandeeva Therapeutics

|

Janet George

Executive Vice President of Artificial Intelligence of Mastercard

|

Age: 58

Director Since: September 1, 2024

|

||||||||||||||||||||||||

Professional Experience |

||||||||||||||||||||||||||

|

•Executive Vice President of Artificial Intelligence, Mastercard Incorporated. Joined Mastercard in 2025 and leads AI strategy and innovation with a focus on enhancing, protecting and personalizing payments through cutting-edge AI technology.

•Corporate Vice President and General Manager, Data Center and AI, Intel Corporation. Oversaw a multi-billion dollar business unit focused on AI and machine learning SaaS growth, operational performance and large-scale technology integration from 2022 to 2024.

•M&A and Scaling Expertise. Successfully led execution and integration of major acquisitions, including Intel’s $650 million acquisition of a cloud AI-based workload optimization company.

|

•Group Vice President, Oracle Corporation. Built a $1 billion AI business on Oracle Cloud Infrastructure, leading major industry deals and driving Oracle’s growth in the cloud market from 2019 to 2021.

•Senior Technology Leadership. Held executive roles at Western Digital, Accenture, Yahoo, eBay and Apple, consistently delivering growth, operational efficiencies and innovative technology solutions.

•Academic Background. Master’s degree in computer applications from Kerela University and a bachelor’s degree in computer science, mathematics and physics from Pune University.

|

|||||||||||||||||||||||||

|

Skills and Experience Supporting Board Membership

Our Board believes Ms. George is qualified to serve as a member of our Board due to her deep expertise in artificial intelligence, cloud infrastructure and high-growth technology environments. Her experience driving innovation, executing complex acquisitions and delivering operational efficiency across global enterprises makes her a valuable contributor to the Board’s oversight of MARA’s technology strategy and growth.

|

||||||||||||||||||||||||||

| 2025 PROXY STATEMENT | 9 |

||||

Board and Governance Matters

Independent: Yes

Board Committees: Social Responsibility Committee (Chair); Talent, Culture and Compensation Committee; Technology and Strategy Committee

Current Public Company Directorships: Triumph Group, Inc.; Fluence Energy, Inc.

Other Directorships and Memberships: Federal Reserve Bank of Richmond

|

Barbara Humpton

President and Chief Executive Officer of Siemens USA

|

Age: 64

Director Since: September 1, 2024

|

||||||||||||||||||||||||

Professional Experience |

||||||||||||||||||||||||||

|

•President and Chief Executive Officer, Siemens USA. Joined in 2018 and leads a $19 billion portfolio spanning energy-efficient technologies, smart infrastructure and healthcare, with a focus on innovation, digitalization and sustainability.

•Technology and Operational Leadership. Oversees the integration of AI and industrial data to drive continuous improvement and efficiency across Siemens USA’s operations.

•Senior Executive, Booz Allen Hamilton and Lockheed Martin. Held key leadership roles contributing to national security, defense and advanced technology development.

|

•Public-Private Leadership. Served on advisory boards for both the Trump and Biden administrations, recognized for her leadership in driving impactful public-private sector collaboration.

•Board Service. Currently serves on the boards of Fluence Energy, Triumph Group and the Federal Reserve Bank of Richmond, bringing a broad perspective on energy and industrial innovation and economic policy.

•Academic Background. B.A in mathematics from Wake Forest University.

|

|||||||||||||||||||||||||

|

Skills and Experience Supporting Board Membership

Our Board believes Ms. Humpton is qualified to serve as a member of our Board due to her extensive leadership experience in the energy, technology and infrastructure sectors. As President and Chief Executive Officer of Siemens USA, she has overseen large-scale innovation and digital transformation across a $19 billion portfolio. Her expertise in applying advanced technologies to complex industrial systems brings valuable insight to the Board as MARA continues to scale its infrastructure and energy operations. In addition to her executive leadership, Ms. Humpton brings valuable governance expertise through her service on the boards of public companies and major institutions.

|

||||||||||||||||||||||||||

10 |

|

||||

Board and Governance Matters

Independent: No

Board Committees: None

Other Directorships and Memberships: Auradine, Inc.; Oden Technologies

|

Fred Thiel

Chairman and Chief Executive Officer of MARA Holdings, Inc.

|

Age: 64

Director Since: April 24, 2018

|

||||||||||||||||||||||||

Professional Experience |

||||||||||||||||||||||||||

|

•Chairman and Chief Executive Officer, MARA. Leads the premier Bitcoin mining company, having grown its market capitalization from under $30 million to over $5 billion and its global footprint to span four continents.

•Chairman, Thiel Advisors. Provided deep technology sector operating expertise and strategic advisory services to private equity and venture capital firms, as well as public and private company boards, prior to leading MARA in 2021.

•Chief Executive Officer, Local Corporation and Lantronix, Inc. Held top leadership roles at publicly traded technology companies.

|

•Over 35 Years’ Experience in the Technology Sector. Brings deep expertise across digital assets, artificial intelligence, semiconductors and enterprise software, with a track record of leading innovation and driving strategic growth.

•Leadership in Young Presidents’ Organization (YPO). Actively involved in global business leadership networks, having led initiatives within YPO’s FinTech and Technology Networks.

•Academic Background. Attended classes at the Stockholm School of Economics and Harvard Business School.

|

|||||||||||||||||||||||||

|

Skills and Experience Supporting Board Membership

Our Board believes Mr. Thiel is qualified to serve as a member of our Board due to his extensive leadership experience, deep knowledge of MARA’s operations and strategy and expertise in blockchain and digital asset technologies. As its Chairman and Chief Executive Officer, Mr. Thiel has been instrumental in driving MARA’s growth and operational scale, and his comprehensive understanding of MARA’s business and industry positions him to provide valuable insight and effective oversight as a member of the Board.

|

||||||||||||||||||||||||||

| 2025 PROXY STATEMENT | 11 |

||||

Board and Governance Matters

Independent: Yes

Board Committees: Talent, Culture and Compensation (Chair); Nominating and Corporate Governance; Social Responsibility

Other Directorships and Memberships: Make-A-Wish Foundation of San Diego (former director); LEAD San Diego (former director)

|

Vicki Mealer-Burke

Former Chief Diversity Officer of QUALCOMM

|

Age: 63

Director Since: April 1, 2024

|

||||||||||||||||||||||||

Professional Experience |

||||||||||||||||||||||||||

|

•Former Executive, QUALCOMM Incorporated. Held a range of senior leadership roles during 26-year tenure at one of the world’s leading wireless technology companies, including Chief Diversity Officer, Vice President of Human Resources, Vice President and General Manager of QUALCOMM Education and Senior Director of Product Management, overseeing functions spanning global business development, product management, operations and human resources.

•Operational and Strategic Leadership. Contributed to QUALCOMM’s global growth, helping the company scale from $2 billion in annual revenue and 6,000 employees to over $36 billion in revenue and 50,000 employees.

|

•First Chief Diversity Officer. Championed inclusive leadership and cultural transformation, establishing initiatives to build a more diverse and purpose-driven global workforce as QUALCOMM’s inaugural Chief Diversity Officer.

•Advisory Board Membership. Served as a member on MARA’s advisory board from September 2022 to April 2024.

•Academic Background. B.B.A. in Management Information Systems from Iowa State University’s Ivy College of Business and an M.A. in Administration from The Ohio State University.

|

|||||||||||||||||||||||||

|

Skills and Experience Supporting Board Membership

Our Board believes Ms. Mealer-Burke is qualified to serve as a member of our Board due to her extensive leadership experience in the technology industry, including over two decades in senior roles at a global Fortune 500 company. Her proven ability to navigate complex and rapidly evolving business environments, coupled with her expertise across operations, product management and human capital strategy, brings valuable perspective to the Board. In addition, her prior service as a member of our advisory board provides her with a deep understanding of our business, culture and strategic priorities.

|

||||||||||||||||||||||||||

12 |

|

||||

Board and Governance Matters

Lead Independent Director

Independent: Yes

Board Committees: Nominating and Corporate Governance (Chair); Social Responsibility; Technology and Strategy

Other Directorships and Memberships: IEC; Campden IPI

|

Douglas Mellinger

Managing Director of Clarion Capital Partners

|

Age: 60

Director Since: March 31, 2022

|

|||||||||||||||||||||

Professional Experience |

|||||||||||||||||||||||

|

•Managing Director, Clarion Capital Partners. Plays a key leadership role at a lower middle market private equity and structured credit asset management firm, which he joined in 2013, and focuses on driving value creation across portfolio companies.

•Co-founder, Foundation Source. Helped launch Foundation Source, the leading provider of outsourced services and technology for private foundations.

•Founder, Chairman and Chief Executive Officer, enherent Corp. Built a global software development and services firm that twice earned recognition on the Inc. 500 list and Deloitte’s Technology Fast 500 and Fast 50 rankings.

|

•Investment Leadership. Held senior positions at Palm Ventures and Zeno Ventures, bringing strategic and operational expertise to high-growth businesses.

•Extensive Board and Advisory Experience. Served on the boards of numerous private and public companies, as well as advisory boards to government agencies, universities, and nonprofit organizations.

•Entrepreneurial and Industry Leadership. Active member and past leader within Young Entrepreneurs’ Organization and Young Presidents’ Organization, contributing to entrepreneurial ecosystems globally.

•Academic Background. B.S. in Entrepreneurial Science from Syracuse University.

|

||||||||||||||||||||||

|

Skills and Experience Supporting Board Membership

Our Board believes Mr. Mellinger is qualified to serve as a member of our Board due to his extensive finance and investment experience, as well as his track record of building, leading and advising public and private companies across the technology and financial sectors. As a managing director at a private equity and structured credit firm and a founder of multiple successful ventures, Mr. Mellinger brings deep expertise in capital markets, governance and strategic growth. His broad board experience across corporate, nonprofit and government organizations further enhances his ability to provide valuable oversight and strategic perspective to MARA.

|

|||||||||||||||||||||||

| 2025 PROXY STATEMENT | 13 |

||||

Board and Governance Matters

Director Nomination and Succession Process

The Board is committed to maintaining strong, effective governance through thoughtful director succession planning and a rigorous nomination process, as described below.

Step 1 |

Annual Evaluation of Composition | ||||||||||

| Our Nominating and Corporate Governance Committee regularly assesses the appropriate size, composition and needs of our Board and its committees, and the qualification of candidates considering these needs. The Nominating and Corporate Governance Committee developed minimum selection criteria that may be weighted differently depending on the individual being considered or the needs of our Board at the time. Each director should possess attributes, characteristics, experiences, qualifications and skills which enhance his or her ability to perform duties on our behalf (both individually and in combination with the other directors). In addition to the factors described below, the Nominating and Corporate Committee may also consider such other factors as it determines would reasonably be expected to contribute to the overall effectiveness and diversity of our Board. | |||||||||||

|

|||||||||||

Step 2 |

Identify Candidates | ||||||||||

|

The Nominating and Corporate Governance Committee uses a variety of methods for identifying director nominees, including search firms and recommendations from executive officers, directors or stockholders. The Nominating and Corporate Governance Committee will also seek appropriate input from our Chief Executive Officer, from time to time, in assessing the needs of our Board for relevant background, experience, diversity and skills of its members.

The Nominating and Corporate Governance Committee considers director candidates recommended by our stockholders entitled to vote in the election of directors, so long as such candidates (i) have been nominated in accordance with applicable procedures and (ii) meet the minimum selection criteria for director nominees.

To submit a director candidate, a stockholder must submit the candidate’s name, contact information and detailed background information to: MARA Holdings, Inc., 101 NE Third Avenue, Suite 1200, Fort Lauderdale, Florida 33301, Attention: Corporate Secretary. Our Corporate Secretary will forward such information to the Nominating and Corporate Governance Committee for its consideration.

|

|||||||||||

|

|||||||||||

Step 3 |

Review Pool of Candidates | ||||||||||

|

The minimum selection criteria established by the Nominating and Corporate Governance Committee includes, without limitation:

•the ability and willingness to devote the necessary time and effort to diligently perform the duties and responsibilities of Board membership,

•a high level of integrity, personal and professional ethics and sound business judgment,

•commitment to enhancing long-term stockholder value and understanding that such director’s primary goal is to serve the best interest of our stockholders and

•freedom from conflicts of interests that would violate applicable laws, rules, regulations or listing standards, conflict with any of our corporate governance policies or procedures or interfere with the proper performance of such director’s responsibilities.

In making its assessment, the Nominating and Corporate Governance Committee will consider such factors as (i) personal qualities, skills and characteristics, (ii) expertise in specific business areas, including strategy, finance or corporate governance, (iii) professional experience in our industry (or similar industries) and (iv) ability to qualify as an “independent director” under applicable Nasdaq rules and to otherwise exercise independent judgment as a director. Director nominees must be able to offer guidance to our Chief Executive Officer based on past experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. They must also have sufficient time available to perform all Board and committee responsibilities.

|

|||||||||||

|

|||||||||||

Step 4 |

Committee Recommendation to Board and Nomination | ||||||||||

| The Nominating and Corporate Governance Committee reviews a candidate’s independence, time commitments and the qualifications criteria as outlined above and recommends potential director nominees to the Board for approval. The Board reviews the recommendation of the Nominating and Corporate Governance Committee and approves either the candidate’s appointment to the Board or the candidate as a director nominee, as applicable. | |||||||||||

14 |

|

||||

Board and Governance Matters

Director Independence

Nasdaq requires that our Board be comprised of a majority of directors who satisfy the criteria for independence set forth in the Nasdaq rules. Based on the director independence requirements set forth in the applicable Nasdaq rules, our Board has determined that Messrs. Antoun, Leupp and Mellinger and Mses. George, Humpton and Mealer-Burke are “independent” directors. The Board has also determined that Sarita James, whose Board service ended upon the expiration of her term at the 2024 annual meeting of stockholders on June 27, 2024, and Kevin DeNuccio and Said Ouissal, who resigned from the Board effective September 1, 2024, were “independent” directors during their Board service. In addition, all members of our Risk and Audit Committee, Talent, Culture and Compensation Committee and Nominating and Corporate Governance Committee meet the independence standards set forth in applicable Nasdaq rules. Furthermore, all members of our Risk and Audit Committee and Compensation Committee meet the heightened independence standards set forth under applicable SEC rules. For information regarding committee composition as of the date of this Proxy Statement, please refer to the section below titled “Committees of Our Board.”

Corporate Governance Highlights

| Independent Leadership |

Strong Lead Independent Director with robust and transparent authority and clearly defined responsibilities Strong Lead Independent Director with robust and transparent authority and clearly defined responsibilities

100% independent Board committees 100% independent Board committees

Majority independent Board (6 of 7 directors are independent) Majority independent Board (6 of 7 directors are independent)

Regular executive sessions of independent directors at Board and committee meetings Regular executive sessions of independent directors at Board and committee meetings

|

||||

Active and Engaged Oversight |

Year-round engagement program for proactive outreach to understand stockholder perspectives and numerous investor relations touchpoints with feedback regularly reported to the Board Year-round engagement program for proactive outreach to understand stockholder perspectives and numerous investor relations touchpoints with feedback regularly reported to the Board

Regular sessions of directors outside of the planned quarterly meetings Regular sessions of directors outside of the planned quarterly meetings

Access to and regular engagement with senior management in furtherance of risk oversight Access to and regular engagement with senior management in furtherance of risk oversight

|

||||

Regular Board Assessments |

Annual Board performance assessments through self-evaluations Annual Board performance assessments through self-evaluations

Regular review of committee composition Regular review of committee composition

|

||||

Other Best Practices |

Single class of common stock Single class of common stock

Prohibition on hedging and pledging Prohibition on hedging and pledging

Clawback policies applicable to cash and equity-based incentive compensation Clawback policies applicable to cash and equity-based incentive compensation

|

||||

Enhancements in 2024

|

•formed the Social Responsibility and Technology and Strategy committees

•adopted improved committee charters

•appointed a Lead Independent Director

•enhanced stockholder engagement program

|

•increased transparency with first Climate, Culture and Community report and Climate Disclosure Project report

•increased gender diversity on the Board and appointed Ms. Mealer-Burke as chair of the Talent, Culture and Compensation Committee

|

||||

| 2025 PROXY STATEMENT | 15 |

||||

Board and Governance Matters

Board Structure and Operations

Board Leadership Structure

|

Fred Thiel

Chairman and Chief Executive Officer

|

|

Douglas Mellinger

Lead Independent Director

|

|||||||||||

|

Responsibilities of the Chairman of the Board:

•Presides at meetings of the Board, and unless another person is designated, meetings of stockholders

•Establishes the schedules and agendas for Board meetings in consultation with the Lead Independent Director

•Serves as a key liaison between management and the Board, ensuring transparency and alignment

|

Responsibilities of Lead Independent Director:

•Presides at meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors

•Contributes to the development of meeting agendas

•If requested by significant stockholders, available for consultation and direct communication with such stockholders

|

|||||||||||||

Our Bylaws allow our Board to determine whether to separate or combine the roles of Chief Executive Officer and Chairman of the Board. Our Board believes it is important to maintain flexibility in our Board leadership structure to best serve our and our stockholders’ interests at any particular time. Currently, Mr. Thiel serves as our Chief Executive Officer and Chairman of the Board.

| NEW | Additionally, effective September 1, 2024, we appointed Douglas Mellinger as our Lead Independent Director. Mr. Mellinger’s long-standing commitment to MARA and his deep understanding of our business make him the ideal choice for the role. |

||||

We believe our Lead Independent Director and committee structure, combined with the independence of the majority of our Board members, ensures our Board maintains effective oversight of our business, including independent oversight of our financial statements, executive compensation, selection of director candidates and corporate governance programs. While our Board believes this current structure is appropriate at this time, it regularly assesses the advantages and disadvantages of various structures taking into account the evolving needs of our business.

Committees of Our Board

Our Board has five standing committees: the Risk and Audit Committee, the Talent, Culture and Compensation Committee, the Nominating and Corporate Governance Committee, the Social Responsibility Committee and the Technology and Strategy Committee. Each of our committees has a written charter that describes its purpose, membership, meeting structure and responsibilities. A copy of each committee’s charter is available on our website at mara.com in the Governance section of the Investors tab. These charters are reviewed annually by each committee, with any recommended changes approved by our Board.

16 |

|

||||

Board and Governance Matters

|

Jay Leupp (Chair) |

Risk and Audit Committee

Our Risk and Audit Committee is responsible for, among other things:

•serving as an independent and objective party to monitor our financial reporting process and internal control system and complaints or concerns relating thereto;

•meeting with our independent registered public accounting firm and our financial management to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof reviewing such audit, including any comments or recommendations of our independent registered public accounting firm;

•reviewing and approving the internal corporate audit staff functions, including (i) purpose, authority and organizational reporting lines; (ii) annual audit plan, budget and stalling; (iii) concurrence in the appointment, compensation and rotation of the internal audit management function; and (iv) results of internal audits;

•reviewing the financial statements contained in our annual reports and quarterly reports to stockholders with management and our independent registered public accounting firm to determine that our independent registered public accounting firm is satisfied with the disclosure and content of the financial statements to be presented to our stockholders; and

•reviewing with our management any financial information, earnings press releases and earnings guidance filed with the SEC or disseminated to the public, including any certification, report, opinion or review rendered by our independent registered public accounting firm.

|

||||||||||||||||||

| Other Members | ||||||||||||||||||||

|

|

|||||||||||||||||||

| Georges Antoun |

Janet George |

|||||||||||||||||||

|

Independent: 100%

Meetings in 2024: 4

|

||||||||||||||||||||

|

Vicki Mealer

-Burke

(Chair) |

Talent, Culture and Compensation Committee

Our Talent, Culture and Compensation Committee is responsible for, among other things:

•reviewing and approving our goals and objectives relevant to the compensation of our Chief Executive Officer, evaluating our Chief Executive Officer’s performance with respect to such goals and, subject to existing contractual obligations, set our Chief Executive Officer’s compensation level based on such evaluation;

•considering our Chief Executive Officer’s recommendations with respect to other executive officers;

•evaluating our performance both in terms of current achievements and significant initiatives with long-term implications;

•assessing the contributions of individual executives and recommending to our Board levels of salary and incentive compensation payable to our executive officers; and

•reviewing our financial, human resources and succession planning.

|

||||||||||||||||||

| Other Members | ||||||||||||||||||||

|

|

|||||||||||||||||||

| Janet George |

Barbara Humpton |

|||||||||||||||||||

|

Independent: 100%

Meetings in 2024: 3

|

||||||||||||||||||||

| 2025 PROXY STATEMENT | 17 |

||||

Board and Governance Matters

Compensation Committee Interlocks and Insider Participation

During 2024, Mses. Mealer-Burke, George and Humpton and Messrs. Antoun and Leupp each served on our Talent, Culture and Compensation Committee. Kevin DeNuccio also served on the committee prior to his resignation from the Board effective September 1, 2024. None of them (a) was an officer or employee of MARA or any of its subsidiaries, (b) was a former officer of MARA or any of its subsidiaries or (c) had any related party relationships requiring disclosure under Item 404 of Regulation S-K. During 2024, no executive officer of MARA served as a member of the board of directors or on the compensation committee of any other company whose executive officers or directors serve or served as a member of our Board or our Talent, Culture and Compensation Committee.

|

Douglas Mellinger (Chair) |

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible for, among other things:

•setting qualification standards for director nominees;

•identifying, considering and nominating candidates for membership on our Board;

•developing, recommending and evaluating corporate governance standards and a code of business conduct and ethics applicable to MARA;

•implementing and overseeing a process for evaluating our Board and Board committees and overseeing our Board’s evaluation of our Chairman and Chief Executive Officer;

•making recommendations regarding the structure and composition of our Board and Board committees;

•advising our Board on corporate governance matters and any related matters required by the federal securities laws; and

•assisting our Board in identifying individuals qualified to become Board members; recommending to our Board the director nominees for the next annual meeting of stockholders; and recommending to our Board director nominees to fill vacancies.

|

||||||||||||||||||

| Other Members | ||||||||||||||||||||

|

|

|||||||||||||||||||

| Jay Leupp |

Vicki Mealer -Burke |

|||||||||||||||||||

|

Independent: 100%

Meetings in 2024: 4

|

||||||||||||||||||||

|

Barbara Humpton (Chair) |

Social Responsibility Committee

Our Social Responsibility Committee is responsible for, among other things:

•providing an open channel of communication with Board and management related to social responsibility and sustainability initiatives, including philanthropic and community engagement efforts;

•providing oversight of policies, strategies, programs and risks related to social responsibility and sustainability, including climate change and broader environmental and social matters;

•reviewing the annual social responsibility report and other public disclosures related to sustainability, environment and social responsibility; and

•making recommendations with respect to stockholder proposals relating to social responsibility and sustainability matters.

|

||||||||||||||||||

| Other Members | ||||||||||||||||||||

|

|

|||||||||||||||||||

| Vicki Mealer -Burke |

Douglas Mellinger |

|||||||||||||||||||

Independent: 100%

|

||||||||||||||||||||

18 |

|

||||

Board and Governance Matters

|

Janet George (Chair) |

Technology and Strategy Committee

Our Technology and Strategy Committee is responsible for, among other things:

•overseeing the development and execution of MARA’s strategic technology and product initiatives;

•assessing with management the development and modification of MARA’s technology and product;

•reviewing with management the impact of external developments and factors on MARA’s technology and product;

•evaluating MARA's execution of its strategic technology and product initiatives; and

•providing an open channel of communication with the Board and management regarding MARA's strategic technology and product initiatives.

|

||||||||||||||||||

| Other Members | ||||||||||||||||||||

|

|

|||||||||||||||||||

| Georges Antoun |

Barbara Humpton |

|||||||||||||||||||

|

||||||||||||||||||||

| Douglas Mellinger |

||||||||||||||||||||

Independent: 100%

|

||||||||||||||||||||

| 2025 PROXY STATEMENT | 19 |

||||

Board and Governance Matters

Board Engagement

Our Board is active and engaged in performing its oversight functions throughout the year.

| Meeting Attendance |

•Our Board held four meetings in 2024

•Each director attended at least 75% of all meetings of the Board and of any committees on which they served during the period such director was on the Board or such committee

•In addition to formal meetings, management provides the Board with monthly updates to keep directors informed on key developments and business performance

|

||||||||||

| Annual Meeting Attendance |

•Although we do not have a formal policy regarding attendance by members of our Board at our annual meetings of stockholders, we encourage, but do not require, our directors to attend

•Three of our directors who were serving as directors at the time attended our 2024 annual meeting of stockholders

|

||||||||||

| Executive Sessions |

•Independent directors meet in executive session at every regularly scheduled Board meeting

|

||||||||||

Board Evaluation Process

Our Nominating and Corporate Governance Committee leads an annual evaluation of our Board, and the Board periodically assesses whether it has the skills, processes, structure and policies necessary to effectively attain its goals and fulfill its responsibilities. The annual evaluation requires each director to complete a detailed questionnaire covering, among other topics, Board and committee composition, including size and mix of skills; allocation of responsibilities among Board committees and their respective fulfillment of those responsibilities; Board and committee meeting procedures; and assessment of supporting resources, including from our management.

The responses to the questionnaires are collected and compiled into a report, highlighting key themes, strengths and areas for improvement. The compiled results are presented to the entire Board. This readout includes a summary of the findings, notable trends and any significant discrepancies in responses. Board members engage in an open and constructive discussion about the results. They analyze the feedback, share perspectives and identify specific actions to address any identified issues.

While the Nominating and Corporate Governance Committee’s formal evaluation is conducted on an annual basis, directors share their perspectives and suggestions throughout the year. The Nominating and Corporate Governance Committee uses this ongoing and annual feedback when considering Board composition, Board refreshment and other governance matters, as well as in connection with nominating directors to be elected to the Board.

20 |

|

||||

Board and Governance Matters

Board Oversight Role

Strategic Oversight

The Board has oversight responsibility for management’s establishment and execution of corporate strategy. The Board is actively engaged in overseeing our long-term strategy, including our Bitcoin mining operations and growth initiatives, development of new technologies and energy solutions, market opportunities and trends and evolving regulatory and policy developments affecting the digital asset industry and technology and energy sectors. The Board regularly discusses and engages with management on a range of topics throughout the year, including strategic and operational priorities; long-term planning and the competitive landscape for Bitcoin mining and digital infrastructure; sustainability and energy efficiency initiatives; regulatory, policy and tax developments; and capital allocation, performance against budget and financial risks in support of our strategic objectives.

Risk Oversight

Risk assessment and oversight are an integral part of our governance and management processes.

Board of Directors | |||||||||||||||||||||||||||||||||||||||||

Primarily responsible for overseeing MARA’s risk management processes. Receives and reviews periodic reports from management, auditors, legal counsel and others, as considered appropriate regarding the assessment of risks. Focuses on the most significant risks and general risk management strategy and ensures that risks undertaken by MARA are consistent with the Board’s risk parameters. | |||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

Risk and Audit Committee

Oversees MARA’s major financial, operational and cybersecurity risk exposures, including the adequacy of MARA’s internal controls and risk management systems. Monitors the effectiveness of processes to identify, assess and manage significant risks and oversees compliance with legal and regulatory requirements.

|

Talent, Culture and Compensation Committee

Oversees risks related to executive compensation policies and practices, including whether they encourage excessive or unnecessary risk-taking. Also oversees risks associated with succession planning, workplace culture and human capital management.

|

Nominating and Corporate Governance Committee

Oversees risks associated with corporate governance practices, including Board structure and effectiveness, compliance with MARA’s Code of Business Conduct and Ethics, and broader governance risks that could impact MARA’s reputation and operations.

|

Social Responsibility Committee

Oversees risks related to environmental, social and governance matters, including sustainability practices, corporate citizenship initiatives and stakeholder engagement activities that could impact MARA’s long-term risk profile.

|

Technology and Strategy Committee

Oversees risks related to MARA’s technology initiatives, innovation strategy and emerging technology trends that may affect MARA’s business model or competitive position.

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

Management | |||||||||||||||||||||||||||||||||||||||||

Responsible for the day-to-day handling and mitigation of risks and informing the Board and its committees of changing risks on a timely basis. | |||||||||||||||||||||||||||||||||||||||||

| 2025 PROXY STATEMENT | 21 |

||||

Board and Governance Matters

Compensation Risk Considerations

The Talent, Culture and Compensation Committee, with the assistance of its compensation consultant, periodically reviews our various compensation programs and related policies and practices and believes that the mix and design of the elements of such programs do not encourage our employees, including our executive officers, to take, or reward our employees for taking, inappropriate or excessive risks and accordingly are not reasonably likely to have a material adverse effect on us. In particular, in conducting our review, we consider compensation program attributes that help to mitigate risk, including:

|

•the mix of cash and equity compensation

•the balance of short-term and long-term performance focus

•the oversight of an independent Talent, Culture and Compensation Committee

|

•our Insider Trading Policy, which prohibits the hedging of the economic interest in our securities

•our annual bonus plans being subject to the achievement of performance metrics and offering upside leverage that is within reasonable market norms and provide for uncapped payouts

|

||||||||||

Sustainability/Environmental, Social and Governance (ESG)

Sustainability and ESG considerations are important elements of MARA’s long-term strategy and risk management framework. The Board and Social Responsibility Committee oversee MARA’s initiatives and performance related to environmental stewardship, social responsibility and governance practices. The Social Responsibility Committee meets regularly with members of management to review ESG-related priorities, monitor progress against goals and discuss emerging trends and stakeholder expectations. Management provides the Social Responsibility Committee with periodic reports on key ESG initiatives, including energy sourcing strategies, efforts to improve mining efficiency and reduce carbon intensity, community and workforce engagement activities and broader sustainability risks and opportunities.

In connection with these reviews, the Board and its committees consider how ESG factors, particularly those related to energy consumption, regulatory developments and stakeholder expectations, may impact MARA’s business strategy and long-term value creation. This oversight structure ensures that sustainability topics are integrated into our strategic and operational planning and that our ESG efforts align with MARA’s broader business objectives.

Human Capital Management

Our highly competitive business requires skilled and motivated employees and leaders with the necessary expertise to execute our innovation, transformation and growth strategies. Developing and retaining top talent is a priority. The Board and Talent, Culture and Compensation Committee regularly discuss with management MARA’s continuous efforts to attract and retain the caliber of employee with the type of knowledge and skills necessary to realize our goals. Both our directors and management set a “tone at the top” through regularly meeting with our most senior human resources executive to discuss culture, talent strategy and leadership development and staying ahead of market trends by identifying early the skills needed for our future; developing compensation programs that incentivize employees to pursue goals that align with our strategies and operational imperatives; designing strategies to attract a comprehensive range of skills and perspectives; and designing strategies to bridge any gaps in our succession plans by cultivating our in-house talent or engaging third parties.

22 |

|

||||

Board and Governance Matters

2024 Stockholder Engagement and Director Communications

We are committed to regular stockholder engagement and solicited our stockholders’ views on financial performance, governance, compensation and other matters in 2024.

| Outreach |

•Throughout 2024, we participated in numerous investor conferences, non-deal roadshows and over 100 meetings by phone or video conference with stockholders.

•We engaged with top stockholders representing 65% of shares outstanding as of year end.

|

||||||||||

| What We Discussed |

•Our Chief Executive Officer, Chief Financial Officer, General Counsel, Vice President of Investor Relations and other members of our management team and Board participated in one-on-one and group discussions, sharing their views on MARA’s strategy and our strategic positioning, operational priorities, governance structure and executive compensation.

|

||||||||||

| What We Did in Response |

•We held regular quarterly earnings conference calls open to all investors, which included Q&A sessions. These calls were announced to the public in advance, and we provided an opportunity for investors to participate via audio or webcast. A recording of each earnings call webcast and Q&A was made available following the call.

•We began issuing a stockholder letter in place of a traditional earnings release, providing stockholders with a more comprehensive and direct overview of our financial performance, operational developments, strategic priorities and outlook. We believe this approach promotes greater transparency and enables a clearer understanding of our long-term value creation strategy.

•We periodically published and distributed additional materials for our investors, leveraging our social media publications.

•In addition, we published press releases regarding our accomplishments and strategic initiatives.

|

||||||||||

Stockholders who wish to communicate with our Board may do so by e-mail by using the following email address: ir@mara.com, or by submitting a comment via our website at mara.com in the Contact section of the Investors tab. Communications sent in accordance with this process will be transmitted to the appropriate Board members.

Other Governance Policies and Practices

Availability of Corporate Governance Documents

Our key corporate governance documents, including our written code of business conduct and ethics (our “Code of Ethics”), Insider Trading Policy and the charters of our Board committees, are available on our website at mara.com in the Governance section of the Investors tab.

Code of Business Conduct and Ethics

Our Board has adopted the Code of Ethics, which applies to our directors, executive officers and employees, including our principal executive officer, principal financial officer and principal accounting officer, or controller, or persons performing similar functions. Our Code of Ethics is available on our website at mara.com in the Governance section of the Investors tab.

| 2025 PROXY STATEMENT | 23 |

||||

Board and Governance Matters

We intend to disclose future amendments to our Code of Ethics, or any waivers of its requirements, applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, or our directors, on our website identified above.

Our Board has adopted an insider trading policy (our “Insider Trading Policy”) governing the purchase, sale and other dispositions of our securities by our directors, officers, employees and contractors. Our Insider Trading Policy prohibits our directors, officers and employees from hedging the economic interest in our securities, and from pledging our securities. Our Insider Trading Policy is available on our website at mara.com in the Governance section of the Investors tab, as well as filed as Exhibit 19.1 to our Annual Report on Form 10-K for the year ended December 31, 2024.

Related Person Transactions

Since January 1, 2024, other than as disclosed below, we have not entered into any transactions, nor are there any currently proposed transactions, between us and any of our directors, director nominees, executive officers or persons who own more than five percent of a registered class of our securities, and each of their respective immediate family members (each, a “related person”), where the amount involved exceeds, or is reasonably expected to exceed, $120,000 in a single fiscal year, and in which the related person has or will have a direct or indirect material interest (each, a “related person transaction”).

Auradine

In September 2023, MARA entered into an agreement with Auradine, Inc. (“Auradine”) to secure certain rights to future purchases by MARA from Auradine for which MARA paid $15.0 million. During the third quarter of 2024, MARA purchased additional shares of Auradine preferred stock with a purchase price of $0.8 million, bringing the Company’s total investment holdings in Auradine to $50.7 million based upon previous purchases of additional preferred stock and a Simple Agreements for Future Equity instrument. In addition, during the year ended December 31, 2024, MARA made advances of $84.5 million for future purchases. As of December 31, 2024 total advances to Auradine, net of property and equipment placed into service, was $40.7 million. MARA holds one seat on Auradine’s board of directors, which currently is filled by Mr. Thiel, our Chief Executive Officer and Chairman.

Policies and Procedures for Related Person Transactions

Our Risk and Audit Committee has the primary responsibility for reviewing and approving or disapproving “related person transactions.” In approving or disapproving any such transaction, our Risk and Audit Committee is to consider the relevant facts and circumstances available and deemed relevant to our Risk and Audit Committee, including, but not limited to, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances, whether such transaction would impair the independence of an outside director, whether such transaction would present an improper conflict of interest for any of our directors or executive officers, whether the transaction is part of the ordinary course of business and the extent of the related person’s interest in the transaction. Any member of our Risk and Audit Committee who has an interest in a potential related person transaction under discussion will abstain from voting on the approval of such transaction. If a related person transaction will be ongoing, our Risk and Audit Committee may establish guidelines for us to follow in our ongoing dealings with the related person.

Family Relationships

There are no family relationships between any of our director nominees, continuing directors or executive officers.

Agreements with Directors or Executive Officers

None of our director nominees, continuing directors or executive officers were selected pursuant to any arrangement or understanding.

24 |

|

||||

Board and Governance Matters

Legal Proceedings with Directors

There are no legal proceedings related to any of our director nominees, continuing directors or executive officers which are required to be disclosed pursuant to applicable SEC rules.

| 2025 PROXY STATEMENT | 25 |

||||

Director Compensation

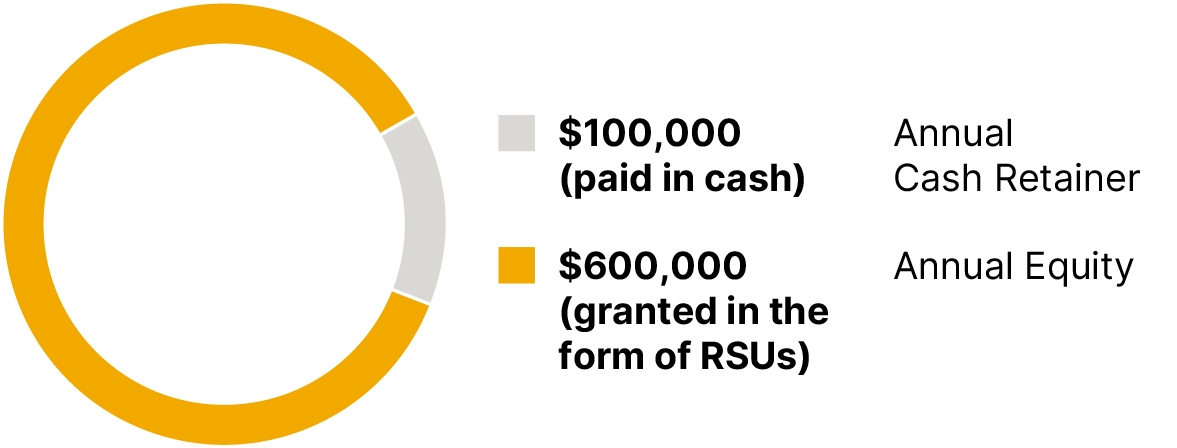

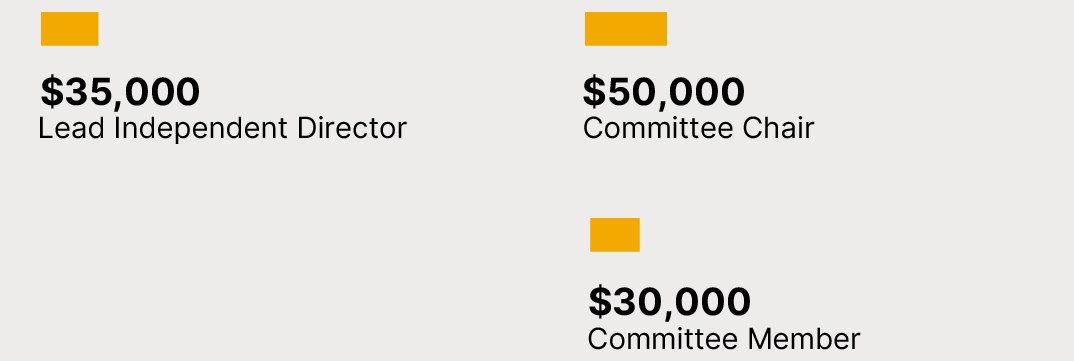

Director Compensation Program