8-K: Current report filing

Published on June 15, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

____________________________________________________________

Date of Report (Date of earliest event reported): June 11, 2012

AMERICAN STRATEGIC MINERALS CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Nevada

|

333-171214

|

01-0949984

|

||

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

||

|

c/o National Corporate Research, Ltd.

202 South Minnesota Street

Carson City, NV

|

89703

|

|||

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code:

31161 Hwy. 90

Nucla, CO 81424

(Former name or former address, if changed since last report)

Copies to:

Harvey J. Kesner, Esq.

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry Into Material Definitive Agreement

On June 11, 2012, American Strategic Minerals Corporation (the “Company”) terminated leases (the “Leases”) related to the following uranium mining claims (the “Claims”): Cutler King Property (3 unpatented mining claims); “Centennial-Sun Cup” (42 unpatented mining claims); “Bull Canyon” (2 unpatented mining claims); “Martin Mesa” (51 unpatented mining claims); “Avalanche/Ajax” (8 unpatented mining claims) and “Home Mesa” (9 unpatented mining claims). The Company had acquired the Claims through the acquisition of American Strategic Minerals Corporation, a privately held Colorado corporation, (“Amicor Colorado”) on January 26, 2012. A full description of the transactions related to the acquisition of the Claims and business of Amicor Colorado is included in the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on January 31, 2012, as amended on March 14, 2012 and April 10, 2012, and the exhibits thereto (the “Share Exchange 8-K”). The decision by the Company to terminate the Leases followed a review by the Board of Directors of the timing and costs that would be involved in seeking to exploit the Claims, as well as the Company’s current capital and ability to secure additional financing, while also considering such additional factors as commodity prices and the availability of needed technology for cost effective mining of the Claims. The Company’s resources to be focused on its remaining claims which include (1) the Dunn Property, which is comprised of two separate mining leases, one of which covers 7 unpatened mining claims on BLM land and the other lease encompassing 1,520 acres of land owned by J. H. Ranch, Inc. and (2) the Pitchfork Claims as well as the claims acquired on June 11, 2012 from Pershing Gold Corporation (“Pershing”), which include the Coso, Artillery Peak, Blythe and Carnotite properties (the “Pershing Claims”) (as further described herein)) are currently being evaluated and no assurance can be given that the Pershing Claims will be utilized and not disposed of upon review of the economic feasibility and alternatives available in order to further relieve the Company of exploration and development costs and expenditures expected to be required for the Pershing Claims. The Company has and may, from time to time, re-evaluate its business plan relative to its capital position and ongoing expenditure obligations and may consider further dispositions in the ordinary course as well as new business ventures unrelated to uranium or mining but has no understandings, agreements or contracts presently related to any business or venture.

On June 11, 2012, the Company entered into an agreement (the “Agreement”) with Amicor Colorado, George Glasier, Kathleen Glasier, Mike Thompson, Kyle Kimmerle, Dave Kimmerle, Charles Kimmerle, Sara Kimmerle, B-Mining Company, Carla Rosas Zepeda, and Andrews Mining LLC, each a shareholder of the Company (each a “Shareholder” and collectively, the “Shareholders”). Each of the Shareholders was a former shareholder of Amicor that received shares of the Company’s Common Stock (the “Common Stock”) and, in certain cases, warrants to purchase shares of the Company’s Common Stock (collectively, the Shareholder Securities”) pursuant to that certain Share Exchange Agreement dated as January 26, 2012 (the “Share Exchange Agreement”) through which the Company acquired Amicor Colarado (and its properties and Claims). Pursuant to the terms of the Agreement, each of the Shareholders, with the exception of Mike Thompson, agreed to return the Shareholder Securities to the Company for cancellation and to enter into joint mutual releases with the Company. Furthermore, pursuant to the terms of the Agreement, George Glasier resigned from his position as President, Chief Executive Officer and Chairman of the Company; Kathleen Glasier resigned from her position as Secretary of the Company, Michael Moore resigned from his position as Chief Operating Officer and Vice President of the Company and each of David Andrews and Kyle Kimmerle resigned from his position as a director of the Company. As a result of the foregoing, the Company effectively unwound the acquisition of Amicor Colorado and 9,806,667 shares of common stock and 4,800,000 warrants have been cancelled.

Under the terms of the Agreement, the Company’s employment agreement with Mr. Glasier was terminated and Mr. Glasier acknowledged that all options, warrants and rights to acquire any shares of the Company’s common stock, whether vested or unvested, were terminated as of the date of the Agreement. Additionally, under the terms of the Agreement, the Company’s lease for certain office space, dated as of January 26, 2012 with Silver Hawk Ltd., an entity owned and controlled by George Glasier and Kathleen Glasier, was terminated.

The Pershing Option Exercise

On January 26, 2012, the Company and Pershing entered into an option agreement (the “Option”) whereby the Company acquired the option to purchase certain uranium properties and claims from Pershing for a purchase price of $10.00 (the “Exercise Price”) in consideration for the issuance of (i) 10,000,000 shares of the Company’s Common Stock and (ii) a six month promissory note in the aggregate principal amount of $1,000,000 (the “Pershing Note”). The Company and Pershing amended the Option on April 24, 2012 and May 3, 2012 in order to extend the termination date of the Option. As of June 11, 2012, the Company had repaid $930,000 of the original principal amount of the Pershing Note.

On June 11, 2012, the Company exercised the Option (the terms of which are described more fully in the Share Exchange 8-K and the exhibits thereto), through the assignment of Pershing’s wholly owned subsidiary, Continental Resources Acquisition Sub, Inc., a Florida corporation (the “Uranium Sub”), which is the owner of 100% of the issued and outstanding common stock of each of Green Energy Fields, Inc., a Nevada corporation (“Green Energy”) (which is the owner of 100% of the issued and outstanding common stock of CPX Uranium, Inc. (“CPX Uranium”)) and ND Energy, Inc., a Delaware corporation (“ND Energy”). Additionally, ND Energy and Green Energy hold a majority of the outstanding membership interests of Secure Energy LLC. (“Secure Energy” and along with Green Energy, ND Energy and CPX Uranium, the “Uranium Holding Companies”). Through the Company’s acquisition of the Uranium Sub and the Uranium Holding Properties, the Company acquired the following claims and properties:

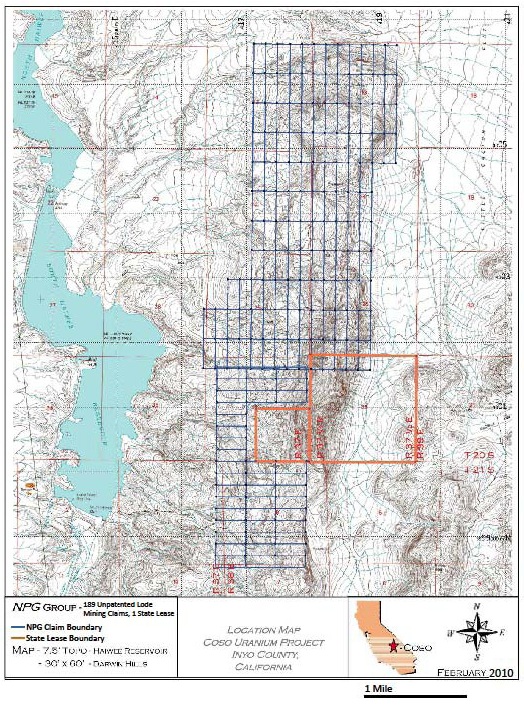

COSO

The Coso property is located in Inyo County, California on the western margin of the Coso Mountains, 32 miles (51 km) south by road of Lone Pine in Inyo County, California, 150 miles (241 km) northeast by road to Bakersfield, CA, 187 miles (300 km) north by road of Los Angeles, CA, and 283 miles (455 km) west by road of Las Vegas, Nevada. The Coso Project is accessible from U.S. highway 395 by taking the Cactus Flat road, an unimproved road for about 3 to 4 miles east of the highway, and climbing approximately 500 to 1200 feet above the floor of Owens Valley. Green Energy acquired the project on November 30, 2009 from NPX Metals, Inc., a Nevada Corporation. The 97% net revenue interest is the result of the Agreement of Conveyance, Transfer and Assignment of Assets and Assumption of Obligations, dated as of November 30, 2009. Under the terms of the agreement, NPX Metals, Inc. retained a 3% net smelter return royalty interest in the Coso Property, leaving a 97% net revenue interest to Green Energy.

The Coso property consists of 169 Federal unpatented lode mining claims on Bureau of Land Management ("BLM") land totaling 3,380 acres, and 800 State leased acres, in Inyo County, California. The unpatented mining claims overlie portions of sections 12, 13, 24, 25, 26, 35, and 36 of Township 20 South, Range 37 East (Mount Diablo Base & Meridian), sections 13, 24, and 25 of Township 20 South, Range 37 1/2 East (Mount Diablo Base & Meridian), sections 1 and 12 of Township 21 South, Range 37 East (Mount Diablo Base & Meridian), and sections 6 and 7 of Township 21 South, Range 37 1/2 East (Mount Diablo Base & Meridian). The state lease covers portions of section 6 of Township 20 South, Range 37 East (Mount Diablo Base & Meridian) and section 36 of Township 20 South, Range 37 1/2 East (Mount Diablo Base & Meridian). To maintain the Coso mining claims in good standing, we must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140.00 per claim per year, plus a recording cost of approximately $50 to Inyo County where the claims are located. With regard to the unpatented lode mining claims, future exploration drilling at the Coso Project will require us to either file a Notice of Intent or a Plan of Operations with the BLM , depending upon the amount of new surface disturbance that is planned. A Notice of Intent is for planned surface activities that anticipate less than 5.0 acres of surface disturbance, and usually can be obtained within a 30 to 60-day time period. A Plan of Operations will be required if there is greater than 5.0 acres of new surface disturbance involved with the planned exploration work. A Plan of Operations can take several months to be approved, depending on the nature of the intended work, the level of reclamation bonding required, the need for archeological surveys, and other factors as may be determined by the BLM.

The Coso property and the surrounding region is located in an arid environment in the rain shadow of the Sierra Nevada mountains. The property is located near the western margin of the Basin and Range province, a large geologic province in western North America characterized by generally north-south trending fault block mountain ranges separated by broad alluvial basins. The geology of the area includes late- Jurassic granite bedrock overlain by the Coso Formation, which consists of interfingered gravels, arkosic sandstone, and rhyolitic tuff. The Coso Formation is overlain by a series of lakebed deposits and volcanic tuffs.

Uranium mineralization at the Coso Property occurs primarily as disseminated deposits in the lower arkosic sandstone/fanglomerate member of the Coso Formation and along silicified fractures and faults within the granite. Uranium mineralization appears to have been deposited by hydrothermal fluids moving along fractures in the granite and the overlying Coso Formation. Mineralization is often accompanied by hematite staining, silicification, and dark staining from sulfides. Autinite is the only positively identified uranium mineral in the area. The main uranium anomalies are found within the basal arkose of the lower Coso Formation and the immediately adjacent granitic rocks.

Uranium exploration has been occurring in the area since the 1950s by a number of mining companies including Coso Uranium, Inc., Ontario Minerals Company, Western Nuclear, Pioneer Nuclear, Federal Resources Corp., and Union Pacific / Rocky Mountain Energy Corp. Previous uranium exploration and prospecting on the Coso property includes geologic mapping, pitting, adits, radon cup surveys, airborne geophysics and drilling. Preliminary field observations of the geology and historical working appear to corroborate the historical literature. These historical exploration programs have identified specific exploration targets on the property. All previous work has been exploratory in nature, and no mineral extraction or processing facilities have been constructed. The exploration activities have resulted in over 400 known exploration holes, downhole gamma log data on the drill holes, chemical assay data, and airborne radiometric surveys, and metallurgical testing to determine amenability to leaching.

The property is undeveloped, and there are no facilities or structures. There are a number of adits and trenches from previous exploration activities, as well as more than 400 exploration drillholes.

The last major exploration activities on the Coso Property occurred during a drilling campaign in the mid-1970s. To date, Green Energy has conducted field reconnaissance and mineral sampling on the property, but has not conducted any drilling or geophysical surveys.

Power is available from the Mono Power Company transmission lines, which parallel U.S. highway 395. To date, the water source had not yet been determined.

With regard to the state mineral prospecting permit, Green Energy is currently authorized to locate on the ground past drill holes, adits, trenches and pits, complete a scintilometer survey, and conduct a sampling program including a bulk sample of 1,000 pounds for leach test. Green Energy is not currently authorized to conduct exploration drilling on the state mineral prospecting permit. Future drilling on the state mineral prospecting permit will require the filing of environmental documentation under the California Environmental Quality Act.

The Coso Property does not currently have any reserves. All activities undertaken and currently proposed at the Coso Property are exploratory in nature.

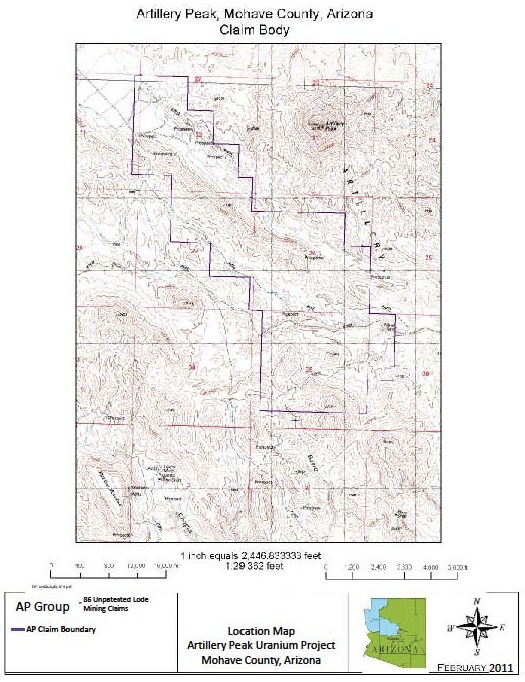

ARTILLERY PEAK

The Artillery Peak Property is located in western north-central Arizona near the southern edge of Mohave County. Green Energy’s claim group is composed of a total of 86 unpatented contiguous mining claims in Sections 22, 26, 27, 35, and 36 of Township 12 North, Range 13 West, Gila & Salt River Base & Meridian covering 1,720 acres of land managed by the BLM.

On April 26, 2010, Green Energy acquired a 100% interest (minus a 4% net smelter royalty interest) in 86 unpatented lode mining claims, located in Mohave county, Arizona for $65,000 in cash and 200,000 shares of common stock.

To maintain the Artillery Peak mining claims in good standing, Green Energy must make annual maintenance fee payments to the BLM, in lieu of annual assessment work. These claim fees are $140.00 per claim per year, plus minimal per claims cost of approximately $10 to $15 per claim recording fees to Mohave County where the claims are located.

The Artillery Peak Property is subject to an agreement to pay a net smelter return royalty interest of 4%. To date, there has been no production on the Property, and no royalties are owed. The claims are not subject to any other royalties or encumbrances.

The Artillery Peak Property lies within the Date Creek Basin, which is a region well known for significant uranium occurrence. Uranium exploration has been occurring in the Artillery Peak region since the 1950’s by a number of exploration and mining entities. Radioactivity was first discovered in the Date Creek Basin area by the U.S. Atomic Energy Commission in 1955 when a regional airborne radiometric survey was flown over the area. The Artillery Peak Property was first acquired by Jacquays Mining and first drilled in 1957. Subsequently the Property was acquired by Hecla Mining (1967), Getty Oil (1976) with a joint venture with Public Service Co of Oklahoma, Hometake Mining (1976) on adjacent properties to the south, Santa Fe Minerals (also around 1976), and Universal Uranium Limited in 2007. As of 2007, a total of 443 exploration holes were drilled into the Artillery Peak Property area.

The Artillery Peak uranium occurrences lie in the northwest part of the Miocene-age Date Creek Basin, which extends from the east to the west in a west-southwest direction, and includes the Anderson Uranium Mine. The uranium anomalies are found primarily within a lacustrine rock unit known as the Artillery Peak Formation. The uranium bearing sediments are typically greenish in color and are thin-bedded to laminated, well-sorted, sandstone, siltstone and limestone.

A technical report was compiled on October 12, 2010 formatted according to Canadian National Instrument 43-101 standards prepared by Dr. Karen Wenrich, an expert on uranium mineralization in the southwestern United States, and Allen Wells, who performed a mineral resource estimate (as defined by the Canadian Institute of Mining, Metallurgy and Petroleum) based on historical data and the recent 2007 data.

Access to the property is either southeast from Kingman or northwest from Wickenburg along U.S. Highway 93, then following the Signal Mountain Road (dirt) for 30 miles toward Artillery Peak. Road access within the claim block is on unimproved dirt roads that currently are in good condition. The property is undeveloped, and there are no facilities or structures.

A power line runs northeast to southwest approximately 2 miles to the northwest of the Artillery Peak Property, and power for the Property will be tied to the national power grid. Other than that, no utilities exist on or near the Artillery Peak Project area. The transmission power line runs northwest to southeast along U.S. Highway 93, approximately 30 miles to the east. The water supply may be provided by drilling in the thick alluvial fill and located only 2-7 miles from the perennial Big Sandy River.

The Artillery Peak Property does not currently have any reserves. All activities undertaken and currently proposed at the Artillery Peak Property are exploratory in nature.

BLYTHE

The Blythe project is located in the southern McCoy Mountains in Riverside County, California approximately 15 miles west of the community of Blythe. It consists of 66 unpatented lode mining claims (the NPG Claims) covering 1,320 acres of BLM land.

On November 30, 2009, Green Energy acquired a 100% interest (minus a 3% Net Smelter Return Royalty) in the Blythe Property.

The Blythe Property is located in an arid environment within the Basin and Range Province. The southern McCoy Mountains are composed of Precambrian metasediments, including meta-conglomerates, grits, quartzites and minor interbedded shales.

Uranium mineralization occurs along fractures, in meta-conglomerates and in breccia zones. Secondary uranium minerals occur on fracture surfaces and foliation planes adjacent to fine veinlets of pitchblende. Uranium minerals include uraninite (pitchblende), uranophane, gummite and boltwoodite. It has been reported that the uranium mineralization tends to occur in areas where finely disseminated hematite is present.

Although there are no known intrusive bodies near the property, it is believed that the uranium mineralization could be hydrothermal in origin and genetically related to an intrusive source. If such a deep-seated intrusive body underlies the property it is possible that larger concentrations of primary uranium ore may exist at depth.

A number of companies have worked on the Blythe uranium property during the 1950s through the 1980s. Several shipments of ore were reportedly shipped from the property.

The Blythe Property does not currently have any reserves. All activities undertaken and currently proposed at the Coso Property are exploratory in nature.

UINTA COUNTY (CARNOTITE) URANIUM PROSPECT

The “Uinta County (Carnotite) Uranium Prospect” located on Bureau of Land Management land in Uinta County Wyoming was acquired from Absaroka Stone LLC in May 2011. Absaroka retains a 1% gross royalty on any revenues derived from the sale of all uranium-vanadium, gold, silver, copper and rare earth ores or concentrates produced from the Claim Body, up to an aggregate of $1,000,000. Green Energy has the option to eliminate the obligation of the Royalty Payment by paying Absaroka an aggregate payment of $1,000,000.

The prospect is located in Wyoming’s overthrust belt in a series of vertically-thrust rocks in which uranium and vanadium minerals have been historically reported. Preliminary observations indicate that the uranium minerals may be the result of hydrothermal deposition in vertical fractures, with ore being found in sandstone, conglomerate, and limestone channels within vertical beds. Similar characteristics appear to continue over a 20 mile trend that will be the subject of further study.

The Absaroka Property does not currently have any reserves. All activities undertaken and currently proposed at the Absaroka Property are exploratory in nature.

SECURE ENERGY LLC

Green Energy and ND Energy own an approximate 75% membership interest in Secure Energy LLC. Secure Energy’s current assets include the following:

|

1.

|

Data package including historical exploration data including drill logs, surface samples, maps, reports and other information on various uranium prospects in North Dakota.

|

|

2.

|

Uranium Lease Agreement with Robert Petri, Jr. and Michelle Petri dated June 28, 2007. Location: Township 134 North, Range 100 West of the Fifth Principal Meridian. Sec. 30: Lots 1 (37.99), 2 (38.13), 3 (38.27), 4 (38.41) and E1/2 W1/2 and SE 1/4.

|

|

3.

|

Uranium Lease Agreement with Robert W. Petri and Dorothy Petri dated June 28, 2007. Location: Township 134 North, Range 100 West of the Fifth Principal Meridian. Sec. 30: Lots 1 (37.99), 2 (38.13), 3 (38.27), 4 (38.41) and E1/2 W1/2 and SE 1/4.

|

|

4.

|

Uranium Lease Agreement with Mark E. Schmidt dated November 23, 2007. Location: Township 134 North, Range 100 West of the Fifth Principal Meridian. Sec. 31: Lots 1 (38.50), 2 (38.54), 3 (38.58), 4 (38.62) and E1/2 W1/2, W1/2NE1/4, SE 1/4.

|

The uranium lease agreements include the rights to conduct exploration for and mine uranium, thorium, vanadium, other fissionable source materials, and all other mineral substances contained on or under the leased premises. The leased premises consist of a total of 1,027 acres located in Slope County, North Dakota.

Drill logs from the uranium leases show uranium mineralized roll fronts in sandstone, with uranium mineralization occurring within 350 feet of the surface. Additional layers of sandstone exist at deeper intervals but have not been cored or logged.

The Prospect Uranium Property does not currently have any reserves. All activities undertaken and currently proposed at the Prospect Uranium Property are exploratory in nature.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On June 11, 2012, George Glasier resigned from his position as President, Chief Executive Officer and Chairman of the Company; Kathleen Glasier resigned from her position as Secretary of the Company, Michael Moore resigned from his position as Chief Operating Officer and Vice President of the Company and each of David Andrews and Kyle Kimmerle resigned from his position as a director of the Company

On June 11, 2012, Mark Groussman was appointed as the Chief Executive Officer of the Company. Mr. Groussman has been a consultant and investor in both private and public companies for the past eleven years. Mr. Groussman has been the managing member of Bull Hunter LLC since 2001 and the president of Melechdavid, Inc. (“Melechdavid”) since 2001. Mr. Groussman received his B.A. from George Washington University in 1995 and received a M.S. in Real Estate Finance from New York University in 1999.

The Company and Melechdavid are a party to that certain consulting agreement dated as of January 26, 2012 pursuant to which Melechdavid provides certain consulting services to the Company in consideration for which the Company sold to Melechdavid a warrant to purchase 1,700,000 shares of the Company’s common stock at an exercise price of $0.50 per share for an aggregate purchase price of $175.00. In addition, Melechdavid purchased 680,000 shares and 600,000 warrants from Mike Thompson. Mark Groussman is the President of Melechdavid.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

|

Exhibit No.

|

Description

|

|

10.1

|

Rescission Agreement dated as of June 11, 2012

|

|

10.2

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: June 15, 2012

|

AMERICAN STRATEGIC MINERALS CORPORATION

|

||

|

By:

|

/s/ Mark Groussman

|

|

|

Name: Mark Groussman

|

||

|

Title: Chief Executive Officer

|

||